Summary

- At Quay, we pride ourselves on our long-term, low turnover approach to listed real estate investing.

- Part of this is to acknowledge the importance of responsible investing and ESG in achieving our fiduciary duty of generating long-term sustainable returns.

- In this, we’re assisted by the fact the global real estate industry has embraced the challenge in meeting ESG investor requirements.

- Global real estate screens well on ESG scores versus global equities, especially after excluding real estate developers.

- The Quay Global Real Estate Fund screens well compared to the global real estate sector, reflecting our commitment to long-term sustainable investing.

Environmental, social and governance (ESG) matters in real estate

The improvement in ESG initiatives is particularly noticeable in the US, which has historically not been as strong in ESG disclosure as other main investment geographies such as Europe, Australia and Hong Kong.

Following is a compilation of various ESG metrics published by NAREIT (National Association of Real Estate Investment Trusts) across the top 100 US REITs by market capitalisation. Evident is the drastic improvements in ESG disclosure the entities have made across the ESG spectrum compared to only a few years ago, in 2017.

|

ESG metrics, % of top 100 US REITs by market cap |

2017 |

2018 |

2019 |

2020 |

|

Reported ESG publicly |

60% |

66% |

84% |

98% |

|

Issued stand-alone sustainability reports |

28% |

43% |

49% |

66% |

|

Publicly disclosed carbon targets |

N/A |

30% |

44% |

46% |

|

Publicly disclosed sustainability goals |

N/A |

33% |

39% |

55% |

|

Dedicated ESG staff |

22% |

31% |

36% |

41% |

|

Carbon emissions disclosure |

38% |

41% |

51% |

66% |

|

Energy usage disclosure |

33% |

42% |

51% |

66% |

|

Water usage disclosure |

30% |

35% |

47% |

58% |

|

Waste management disclosure |

27% |

32% |

39% |

43% |

|

Tenant engagement initiatives |

29% |

30% |

42% |

80% |

|

Community development initiatives |

60% |

62% |

72% |

92% |

|

Health and wellness programs |

N/A |

54% |

69% |

74% |

|

Workforce development programs |

N/A |

55% |

68% |

85% |

|

Supplier screening policies |

N/A |

22% |

58% |

69% |

|

Diversity, equity and inclusion policies |

N/A |

49% |

62% |

89% |

|

Health and safety policies |

N/A |

49% |

64% |

73% |

|

Total female Board members |

144 |

182 |

202 |

230 |

|

Percentage of Board that is female |

18% |

21% |

23% |

26% |

Source: NAREIT ESG REIT Dashboard 2020

Almost all the top 100 US REITs now report ESG publicly, and two-thirds issue an annual stand-alone sustainability report. Focus on tenant engagement and employee wellbeing has also improved significantly. An area that needs further improvement among REITs – not just in the US, but globally – is the tracking and disclosure of carbon targets/emissions, energy and water usage, and waste management data. We expect this reporting to continue to improve in the future as investors place increasing attention on ESG, particularly the ‘E’ and ‘S’ as part of responsible investment.

How do real estate ESG risks compare to other industries?

Perhaps intuitively, real estate as a sector is likely to have a lower environmental risk than say, the oil and gas sector, or the mining sector. But how does it fare against other industries? What about when the ‘S’ and the ‘G’ is factored in too?

To answer this question, we analysed the data provided by third-party ESG research provider Sustainalytics (a Morningstar company).

According to Sustainalytics research, real estate – which includes REITs, real estate operating companies and property developers – has a lower ESG risk profile on average than other industries. More than 60% of real estate entities under Sustainalytics’ coverage are rated as either having negligible ESG risk or low ESG risk, compared to ~30% when other industries are included.

Source: Sustainalytics

Additionally, real estate has one of the lowest ‘event rates’ of all industries, referring to events or controversies that can negatively impact stakeholders, a company’s operations or the environment.

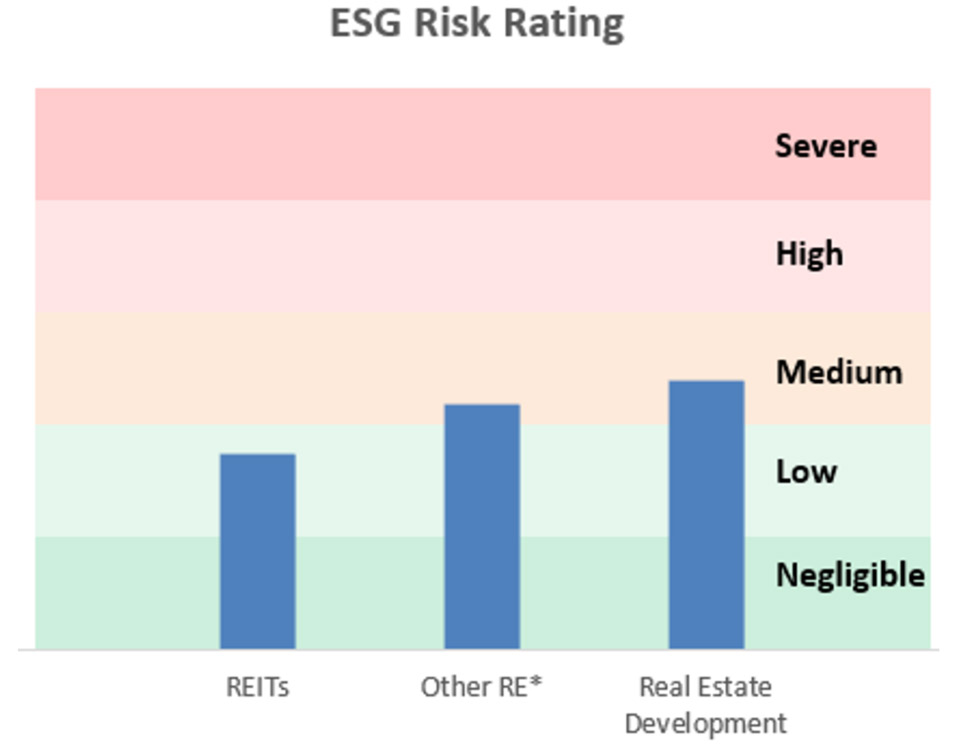

Digging deeper, within the real estate sector itself, REITs have the best average ESG risk rating (‘low risk’), while developers fare the worst.

Source: Sustainalytics *Includes REOCs, mortgage REITs and RE management companies

ESG issues in focus: carbon footprint

According to the World Green Building Council, buildings are currently responsible for 39% of global carbon emissions. Not surprisingly, one of the main ESG challenges facing the real estate sector is the reduction of the carbon impact of their portfolio through the whole life cycle of a building.

As illustrated in the diagram below, the carbon emissions lifecycle of a building can be classified into three main stages – upfront, operational and end of life carbon.

Source: World Green Building Council based on European Standards EN 15978

For the real estate industry, much of the focus has been placed on reducing operational carbon emissions by reducing energy usage. Like-for-like energy reduction is a key metric tracked by ESG rating providers, and some companies have set organisational targets for medium to long-term energy reduction. It is a relatively low-hanging fruit, and most ‘noticeable’ compared to the other stages in the lifecycle because upfront carbon emissions on existing buildings have already been released before the building has even begun to be used. Reducing use stage embodied carbon – relating to the carbon footprint of such items as maintenance, repair and refurbishment – requires a fundamental change in the approach to building design and waste reduction. Existing buildings have less ability to improve their embodied carbon footprint and thereby emissions released throughout the supply chain.

One of the issues more pertinent for property developers than REITs is upfront carbon, which is emitted in the materials production and construction phases of a building. According to estimates[1], more than half of total carbon emissions released during the whole lifecycle of buildings constructed between 2020 and 2050 will be due to upfront carbon. The production of steel and cement for building construction is very carbon intensive, because those materials require very high temperatures and the chemical reactions release carbon dioxide directly. It is estimated that cement manufacture is responsible for ~7% of global carbon emissions[2] and steel production is responsible for ~7-9% of global carbon emissions[3].

As part of our investment process at Quay, we limit our exposure to upfront carbon emissions because we screen out property developers and other entities who rely on property development as a significant source of revenue. By avoiding investment in these types of companies and entities, we can actively reduce the overall carbon footprint of our investment portfolio.

ESG at Quay

At Quay, we regard responsible investing as important in achieving our fiduciary duty of generating long-term sustainable returns. Consideration of ESG factors is an important part of our investment process.

Our approach to responsible investing is to consider the ESG risks of our investees. This is integrated within our investment process and forms part of our overall investment stewardship responsibilities.

Our approach to ESG is reflected in the following activities.

- As a signatory to the United Nations Principles for Responsible Investment (UNPRI), we are committed to the six core principles for responsible investment. These are incorporating ESG issues in our decision making; being active owners and incorporate ESG issues into our policies; seeking appropriate ESG disclosure from our investees; promoting acceptance and implementation of ESG principles; working together to enhance our effectiveness; and reporting on our activities and progress

- Incorporating negative screens into our investment process and screening out companies with poor environmental and/or social profiles, excluding:

- geographies such as Asia Pacific emerging markets, Eastern Europe, Latin America & Caribbean and Middle East / Africa, and

- entities that rely on development to generate income

- Applying a significant weight to corporate governance in the research and analysis phase

- Participating in proxy voting, reviewing shareholder resolutions, and taking an active interest in special issues and situations, and

- Conducting our own research and utilising third-party ESG research firms to assess, monitor and identify actionable items on new and existing investees.

Portfolio review

Following are three charts illustrating how our current portfolio screens relative to the overall listed real estate sector and the overall all-sector universe, based on Sustainalytics data. On average, our portfolio has a lower overall ESG risk profile, a lower ESG risk exposure and a higher management score than both the listed real estate sector and the all-sector universe.

We believe these results are testament to our investment philosophy and investment process of seeking to invest in entities and companies that in our opinion will not only generate attractive long-term returns to our investors, but also operate in a manner that is sustainable.

Source: Sustainalytics

Responsible investment is not a new subject; yet it continues to grow, develop and broaden in many ways. As understanding of ESG issues deepens and new challenges evolve, so too does the quality of related data, transparency of information and increase in regulation. This presents both opportunities and challenges for the investment industry, including within the global listed real estate asset class and for our own investees.