In light of these recent events, we believed it was worth updating our investors on what this latest news means for real estate, and the Quay Global Real Estate Fund’s exposure.

US presidential election

At the time of writing, it appears Joe Biden will win the US presidency and the Democrats will retain a majority in the House of Representatives. At this stage, the Senate count is in favour of the Republicans 50-48; however, there is a run-off election in Georgia for the remaining 2 seats. If the Democrats win both seats, they will control the Senate (with Vice President Harris acting in the case of any Senate tied vote).

In the unlikely event the Senate does fall to the Democrats, the fine margin will almost certainly mean that new and sweeping agendas will be unrealistic. Compromise will likely be needed.

At the margin, the outcome of the election is a small net positive for US real estate for the following reasons.

Pre-election, Biden hinted at the removal or change to the 1031 exchanges (which allow the sale of real estate to occur while deferring capital gains tax). While this would not have cost listed REITs too much, it was still a potential negative. That risk now appears significantly diminished.

- The election included certain propositions across a number of states, including rent control in California (Proposition 21), and increased commercial real estate taxes (Proposition 15). Both were defeated, and are a net positive for Californian real estate.

- A Biden administration will push for more environmentally friendly policies – but this will not impact the sector, as many listed REITs are already very proactive in the area of sustainable energy use.

- Democrats are more supportive of providing fiscal stimulus directly to the states. If successful, this will ease / reduce the risk on state finances, and therefore reduce the risk of higher local property taxes which have been increasing at an alarming rate under the Trump administration.

The biggest negative from a ‘split congress’ is the risk to the likelihood of new and large stimulus. The wider equity market also shares this risk.

At the time of writing, Senate Majority Leader McConnell has opened the door for more spending talks, which is a positive. However, given the new hawkish stance on federal government spending by Senate Republicans, the size of any new stimulus may disappoint the market’s short-term expectations.

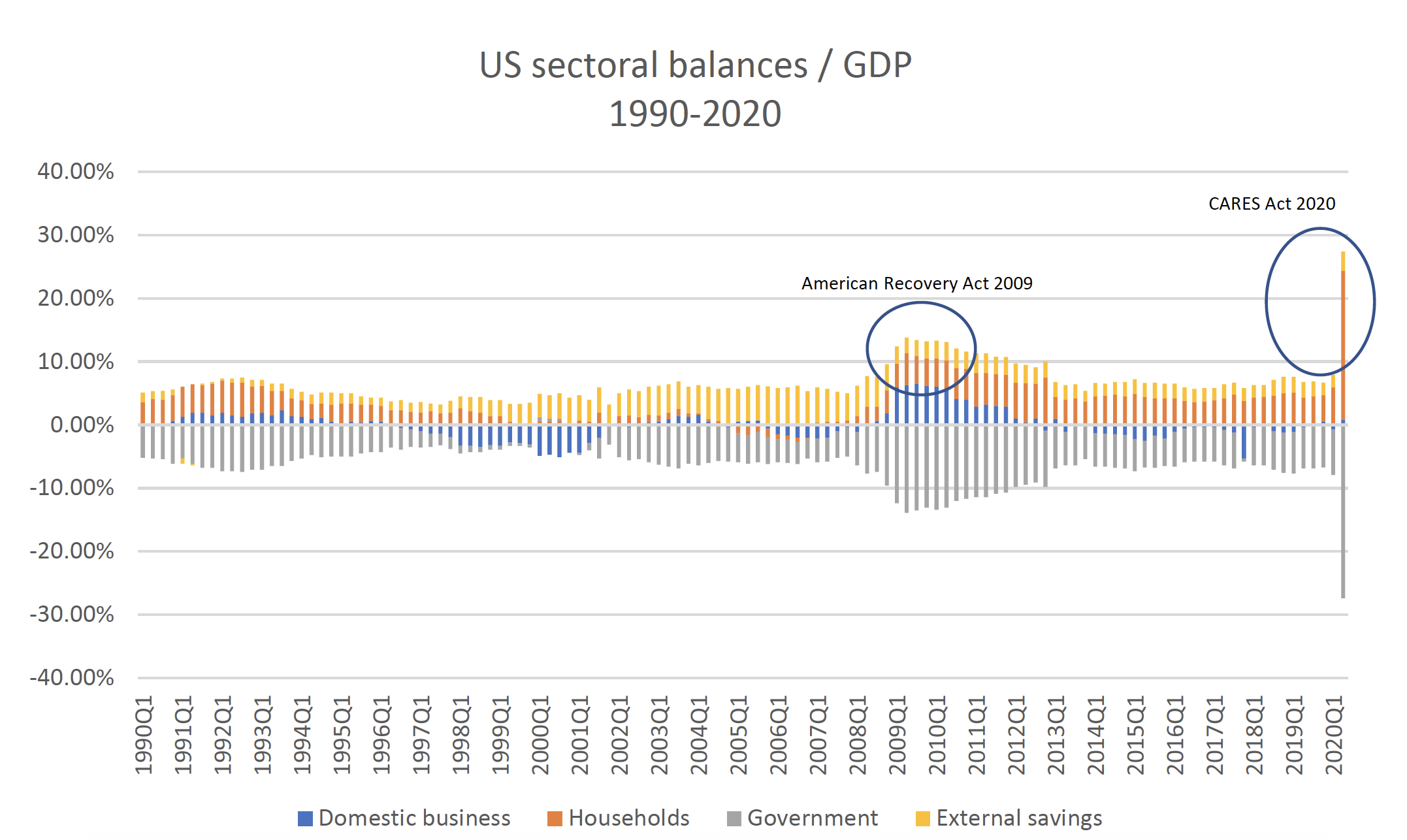

While additional stimulus spending would be helpful, the latest US flow of funds report reminds us of the massive scale of the CARES Act (stimulus) in April compared to the 2009 America Recovery Act post GFC, and the enormous long-term balance sheet benefits this will deliver to the private sector generally, and households specifically.

Source: St Louis Federal Reserve, Quay Global Investors

Pfizer’s vaccine announcement

On Monday 9 November, Pfizer announced its experimental coronavirus vaccine was found to help prevent COVID-19 in more than 90% of controlled cases.

The headline led to significant relative and absolute price movements globally across listed real estate. Some sectors benefited more than others – for example, on the day of the announcement Manhattan office REITs jumped as much as 40%. Many US mall REITs jumped as much as 30% and even in Australia, Scentre Group rose by 14%.

The net impact across the industry is seen as a positive. Unlike most industries, real estate landlords have been asked by various levels of government to shoulder the cost of the virus and associated shutdowns. This has included providing rent waivers for commercial tenants and legislating against evictions for tenants who are unable (and sometimes unwilling) to pay.

A successful vaccine and a return to normal will eliminate this legislative cost borne by the industry, and therefore it has been no surprise to see listed real estate prices recover so aggressively.

While recent vaccine news is positive, some caution should be exercised at this stage. Much of the data from Pfizer’s trial has yet to be released, and any approval will mean it could be many months before the vaccine is widely available. Meanwhile the spread of the virus across the northern hemisphere is accelerating at an alarming rate at the worst possible time – winter.

Impact on our portfolio

A successful vaccine will be most beneficial for those REIT sectors that suffered most during the downturn. That includes healthcare (senior housing), retail, urban office and urban / coastal apartments. Fortunately, our Fund is well-positioned across these sectors (with the exception of office) and we have therefore managed to capture much of the upside in the recent rally, while still maintaining a relatively defensive position across sectors including self-storage, life science office, German housing and data centres.

The portfolio is positioned this way not because we anticipated a vaccine, but because we see deep long-term value across many of these real estate names. As such, over the past three months we have ensured:

- The Fund has remained fully invested in line with our sector-wide conviction; and

- We have been steadily increasing our weighting to the deepest value subsectors including retail, Hong Kong, senior housing (health), and more recently New York office. These increases have come at the expense of recent ‘winners’ including industrial, German residential, single family housing and data centres.

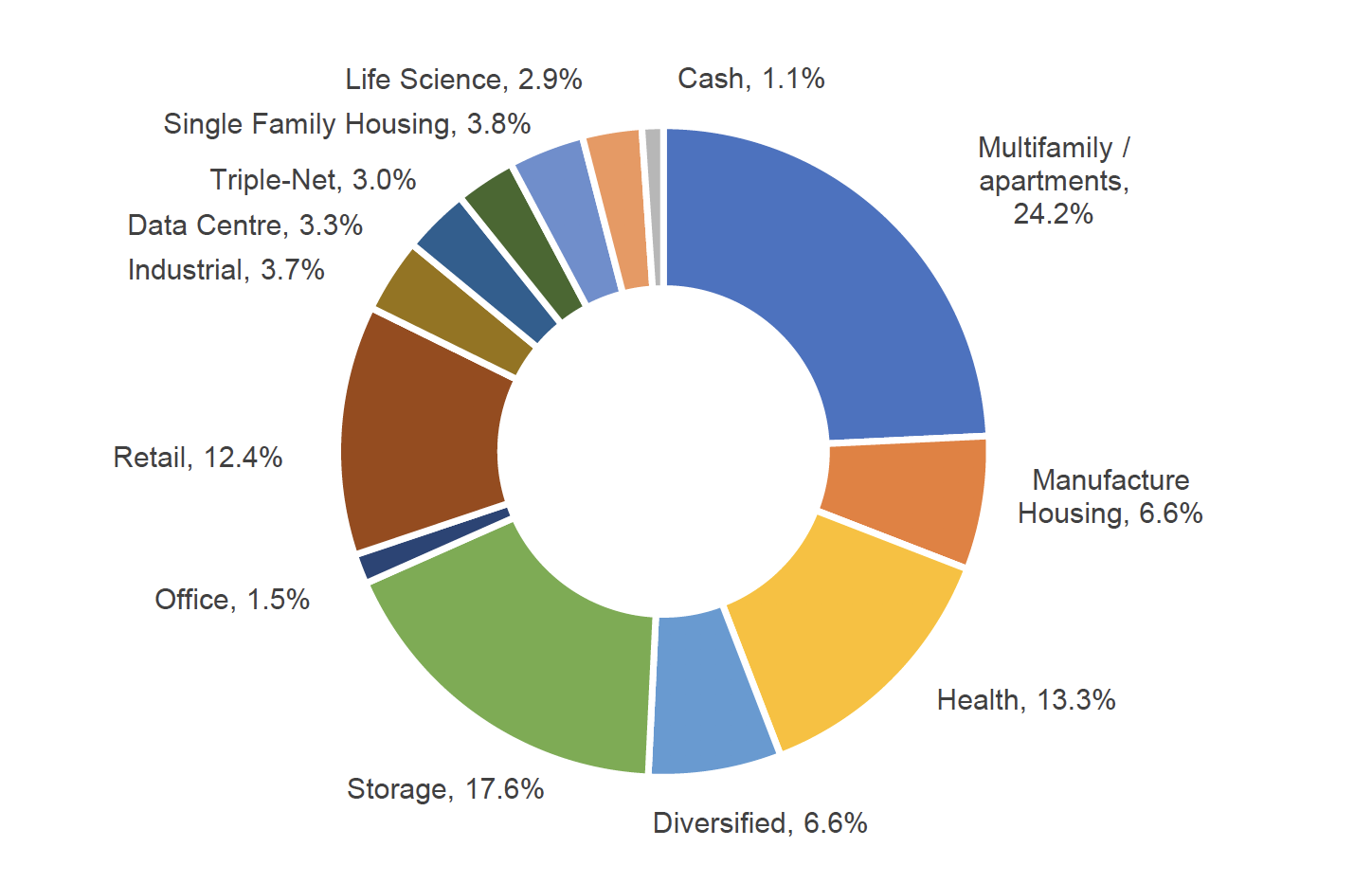

As at 11 November, the Fund’s exposure by real estate sub-sector is as per the following chart.

Source: Quay Global Investors