Last month, Australian Listed REIT Lifestyles Investment Communities (ASX: LIC), a company that specialised in providing affordable accommodation for the aging population, lost a case in the Supreme Court of Victoria making certain agreements of Deferred Management Fees (DMF) unenforceable. Upon the news, the stock fell significantly.

Deferred management fees are usually levied on residents upon leaving (selling) a property where the manager /operator received some percentage of the sales value.

The wider investment theme around LIC is seductive: an aging population moving from existing residential accommodation will have new needs in the future. And properties that can cater for these new needs (retirement, assisted living etc) in an affordable manner are set to benefit as the wave of older Australians seek new accommodation and potentially new services.

But the LIC legal case highlights the problem with all types of ‘theme investments’ – the details matter, and in the case of LIC, the DMF structure is complicated. In our view the court found certain contracts void likely due to the complicated structure that resulted in an unknown end cost to the resident.

To be clear, the concept of a DMF is still valid – there just needs to be some certainty of the cost (as we understand), and so the structure is likely to stay, albeit in a modified form. But we believe this masks a wider hurdle. The DMF structure is still somewhat complicated which strikes us as a ‘hard sell’ to children (at times the decision markers) who stand to lose 15, 20, 30% of their parent’s assets upon exit of a facility.

Fortunately, there are opportunities outside Australia where investors can arguably better benefit from the aging population. Moreover, we find the business models easier to understand and therefore values easier to calculate.

North America – Senior Housing

Senior housing is well-established in North America (US & Canada). In addition, there are several listed REITs that own senior housing real estate that (we believe) are well positioned to benefit from the secular growth.

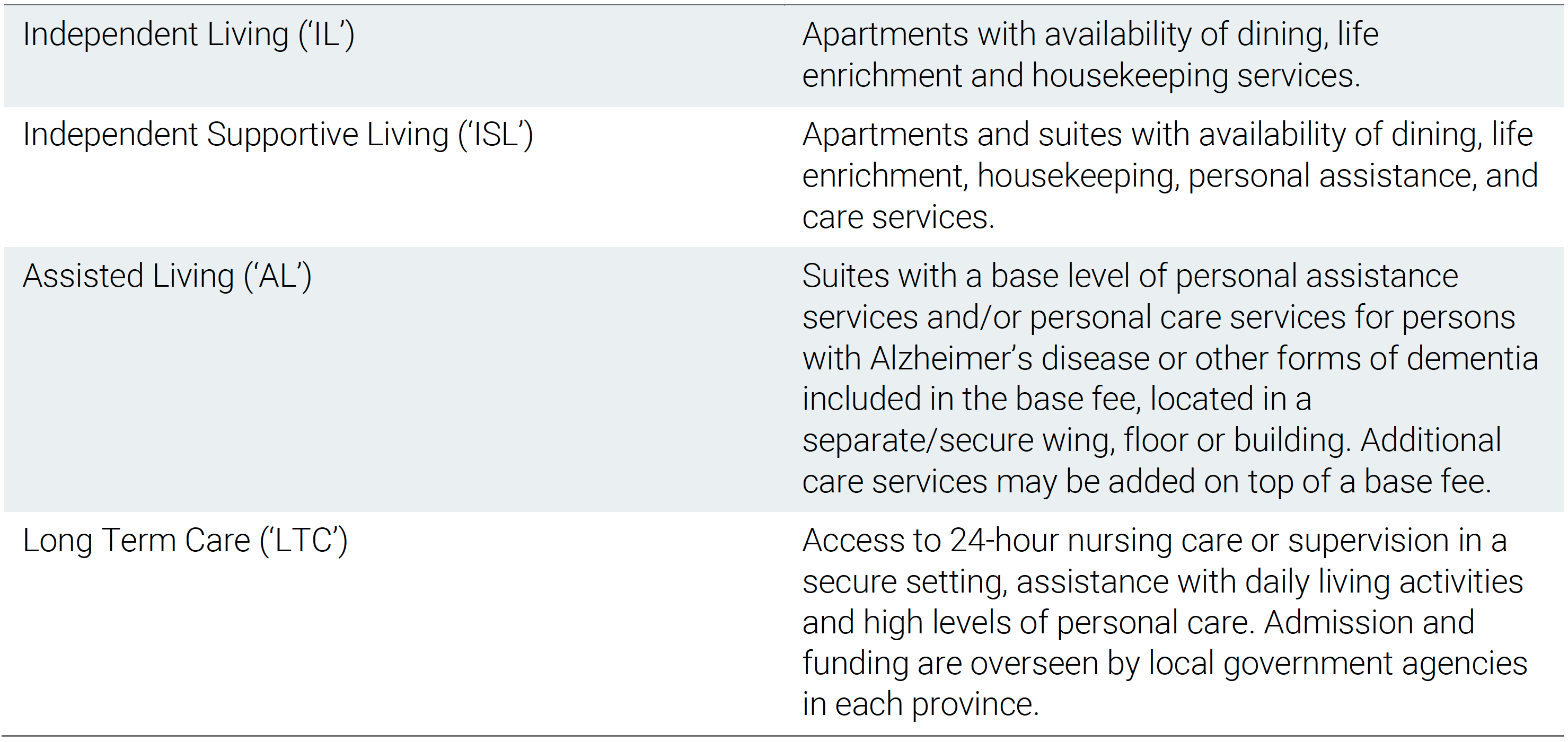

In these markets, senior housing can be defined broadly into the following buckets.

Source: Chartwell Residences.

Source: Chartwell Residences.

Importantly, all of these levels of residential property and care are current-pay property (no DMFs), in the same way regular residential rents are levied – monthly and in cash.

This provides North American REITs with current cashflow (rather than deferred) to pay for residential services, funding costs and ultimately dividends to shareholders.

Another feature of the asset class for the publicly traded REITs is the vast majority of rents paid / received are privately sourced (outside of The Long-Term Care sector). That is, there is minimal requirement for government payments / subsidies, which reduces ‘stroke of pen’ risk (the risk of government funding changes).

The opportunity

We believe the senior housing sector is likely to benefit from a significant mismatch between supply and demand.

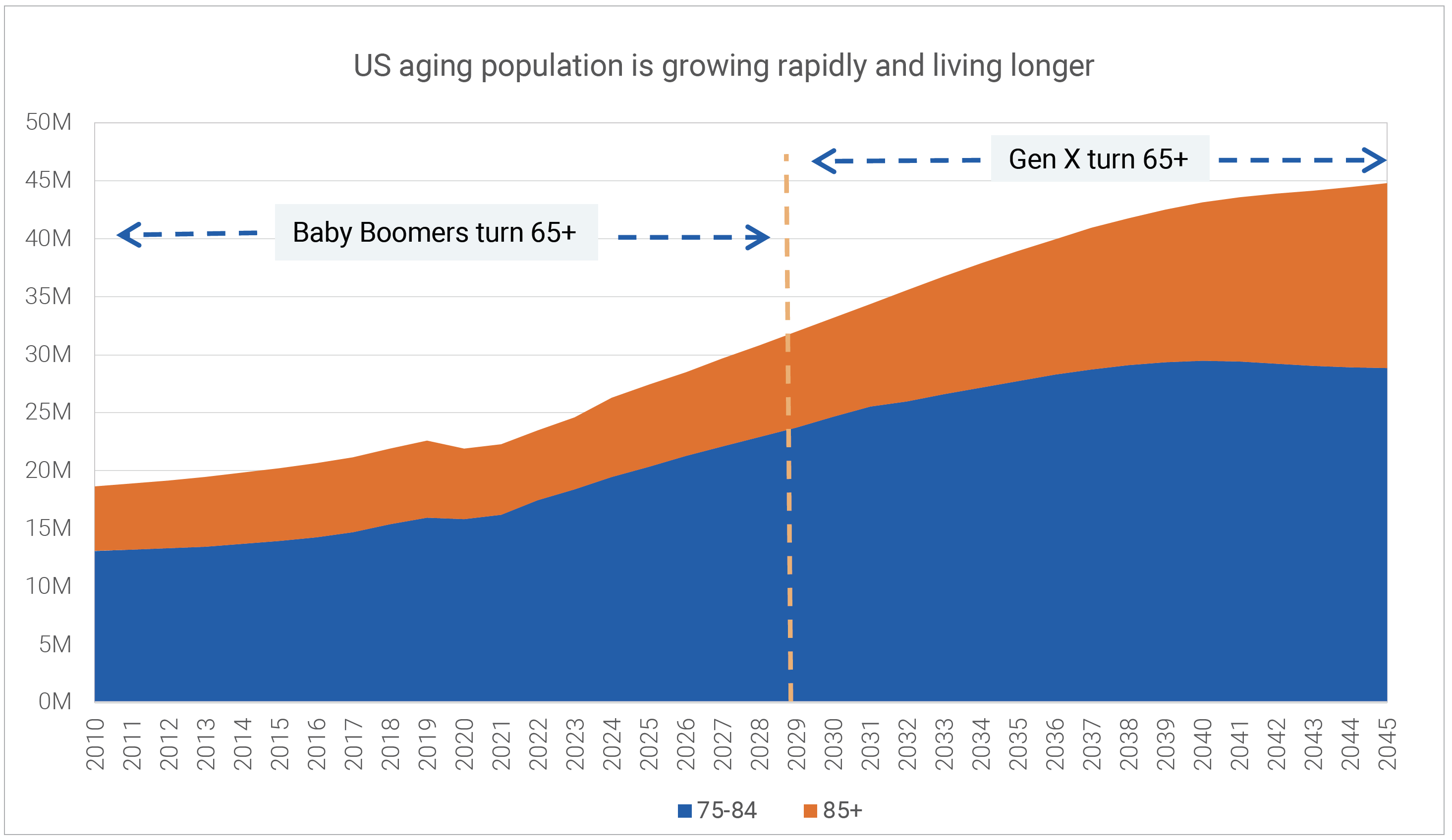

The demand side is compelling. To put some numbers around it, we start with the fact the average age of a new entrant in senior housing facilities is 75-80 years of age. As the chart below shows, in the US this cohort (+75 age group) is forecast to increase from 26m today to almost 40m by 2036, or 4% compound growth per annum. Growth continues (albeit at a slower rate) for a further ten years until 2045.

Source: US Census Bureau, Quay Global.

Source: US Census Bureau, Quay Global.

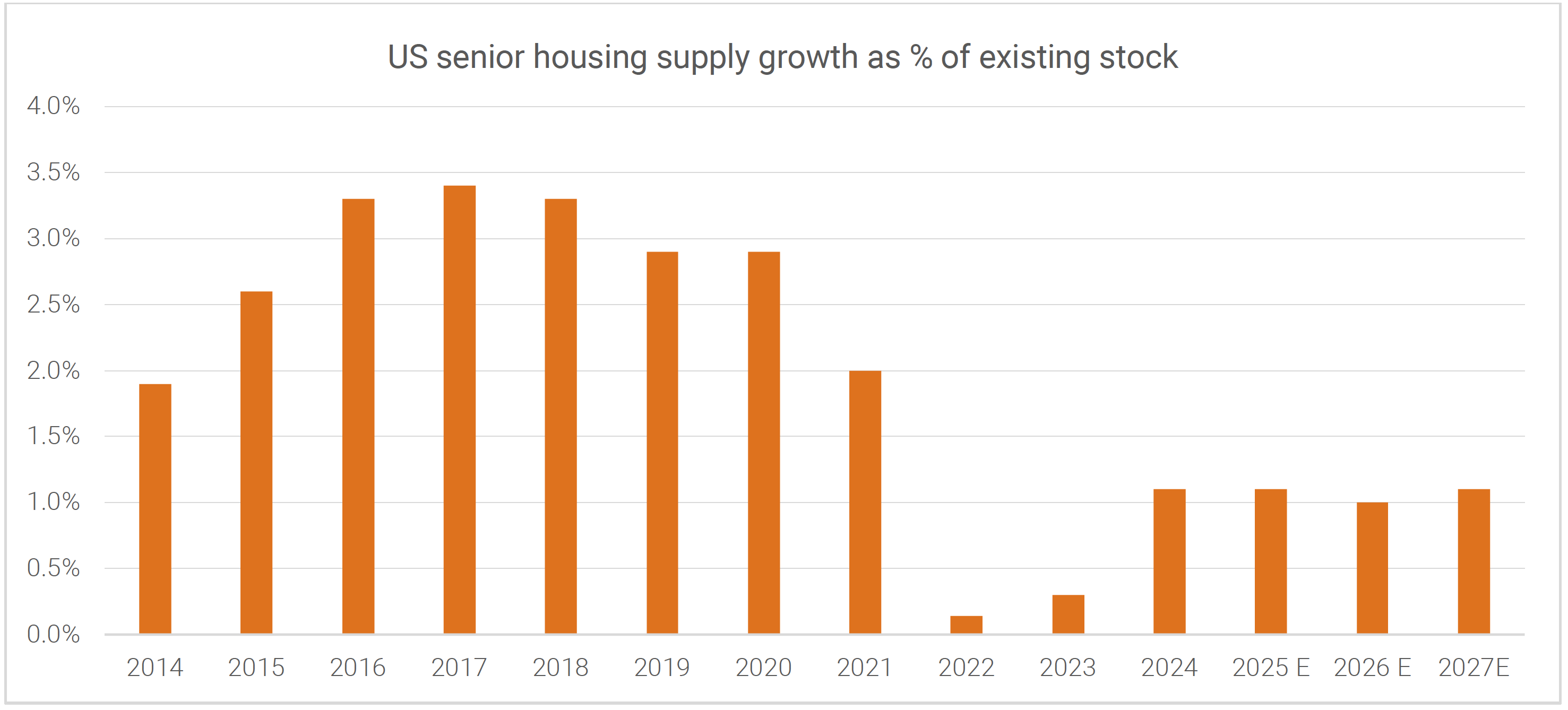

The supply side of the industry is equally compelling, with new senior housing starts tracking at near 15 year lows both in the US and Canada.

Source: NIC Map, Greenstreet, Quay Global.

Source: NIC Map, Greenstreet, Quay Global.

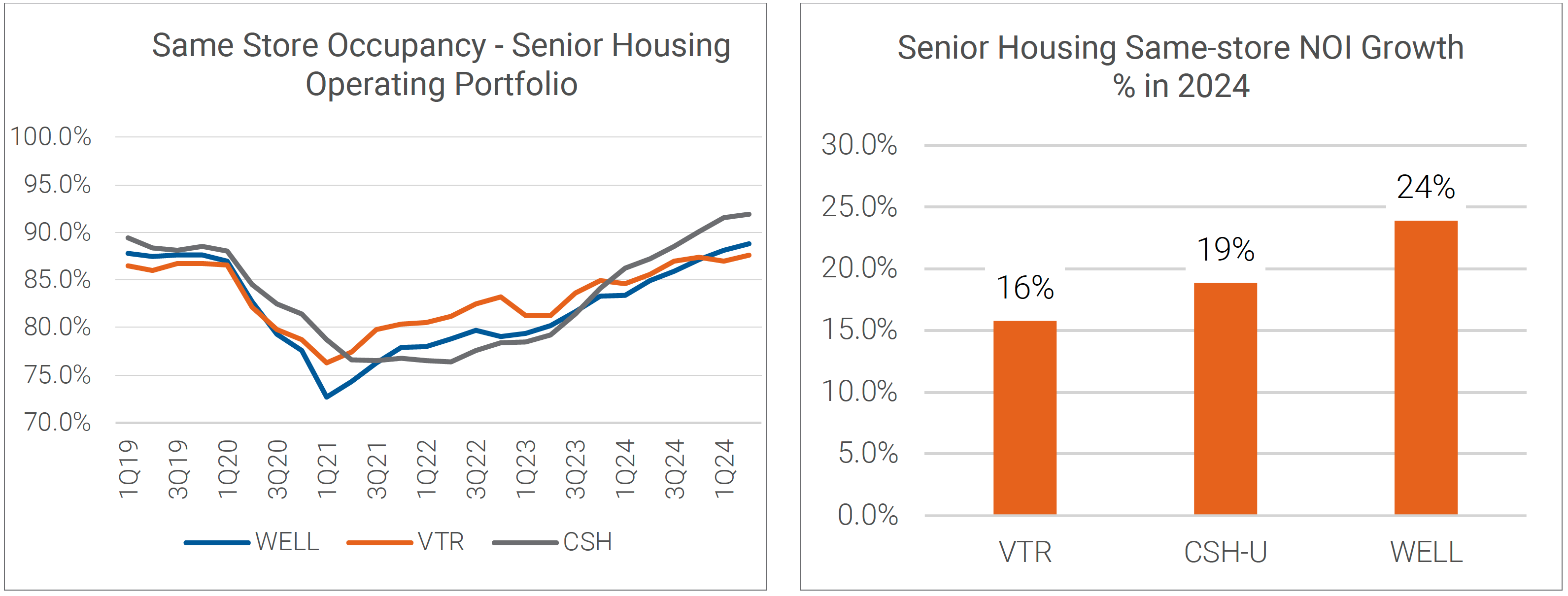

In summary, demand is running at 4% growth, while supply is 1%. The result has been a strong increase in occupancies (recovery from COVID) with an outsized impact on rental income (net operating income, or NOI). With such a clear mismatch between demand and supply, occupancies and rents are surging.

WELL = Welltower; VTR = Ventas REIT; CSH = Chartwell Residences

WELL = Welltower; VTR = Ventas REIT; CSH = Chartwell Residences

Source: Company filings, Quay Global.

Given such a positive environment, the obvious question is why is supply muted?

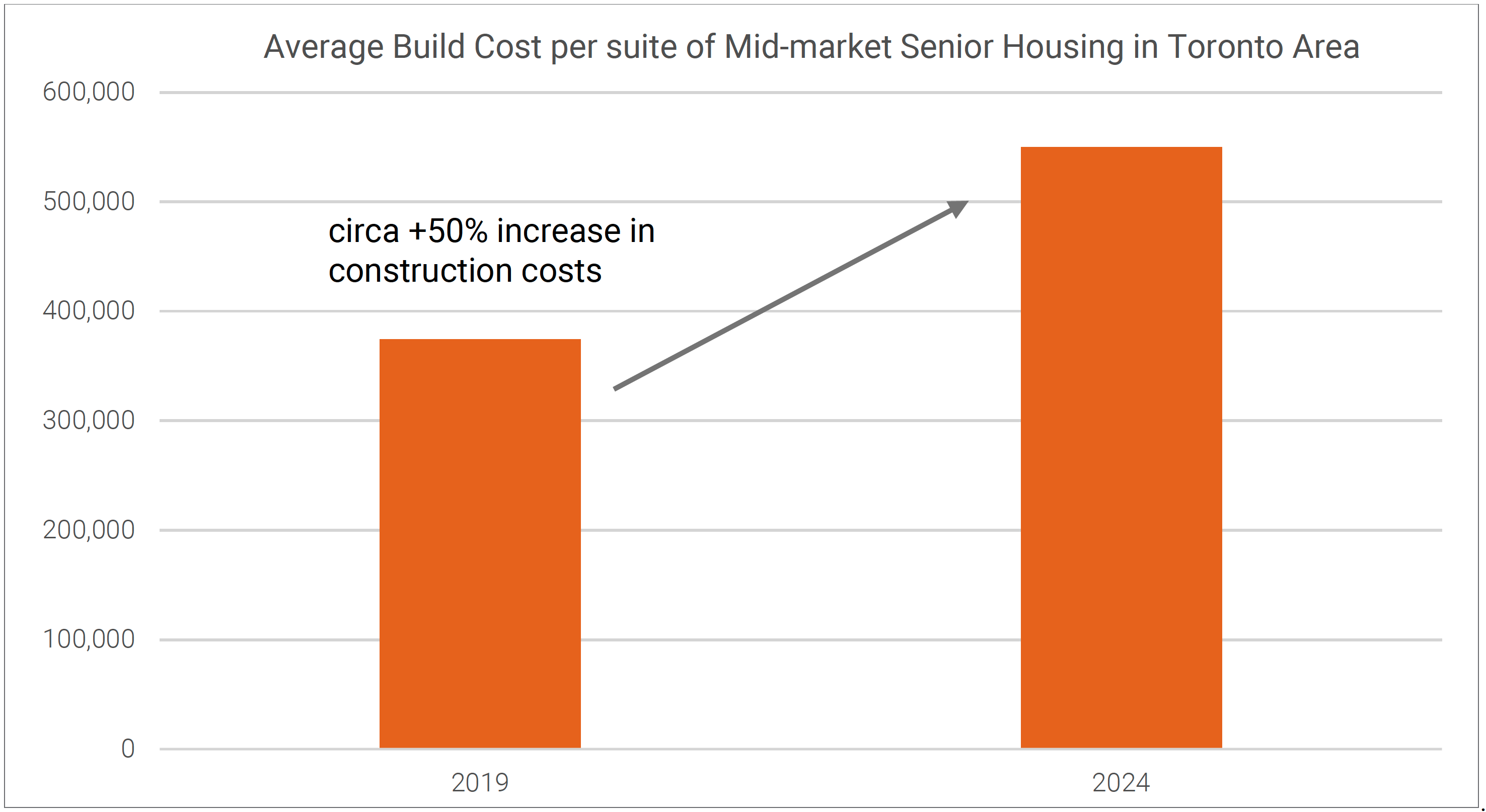

The answer lies in the significant increase in construction costs post pandemic as a result of high inflation. For example, some estimates peg the average cost increase for a new senior housing facility in Toronto at 50% since 2019 (see below). That, coupled with the fact banks and other financiers require a substantially higher yield on the higher cost means in many markets rents still have a further 20-30% to rise to justify new development.

Source; Scotia Bank, Quay Global.

Source; Scotia Bank, Quay Global.

Affordability issues

Clearly there is a limit as to how high rents can go before affordability becomes an issue. Industry commentators believe there is significant room for higher rents / fees due to the following factors.

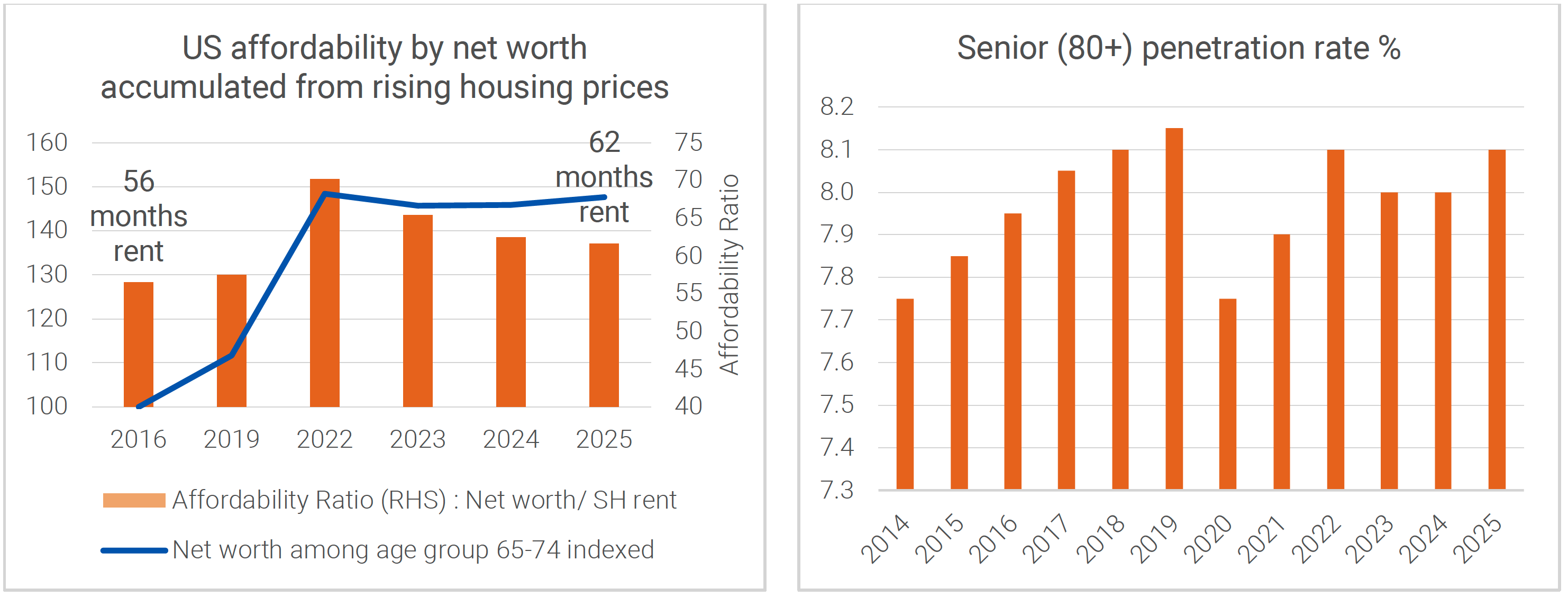

- The incoming generation (baby boomers) have significantly more assets than previous generations (the greatest generation). This has been driven by a strong secular increase in house and equity prices over the past 40 years which means the affordability ratio (wealth divided by rent) has actually improved over the past four years.

- Industry penetration rates are still very low which means (unlike housing) these facilities only need to be affordable to a relatively small percentage of the market.

Source: Welltower, Greenstreet, Quay Global.

Source: Welltower, Greenstreet, Quay Global.

Market inefficiency

The senior housing theme is not new. REITs with exposure have already performed extremely well over the past two years. So much so, according to sell side analysts these companies represent one of the few sectors trading at a significant premium to net asset values (NAV). A sure a sign that the story has been ‘priced in’?

And therein still lies the opportunity. While the listed REITs may trade at a premium to recent transaction values (which generally defined ‘NAV’), we believe many still trade at a discount to replacement cost.

How do we know? The fact we have still yet to see any meaningful supply response.

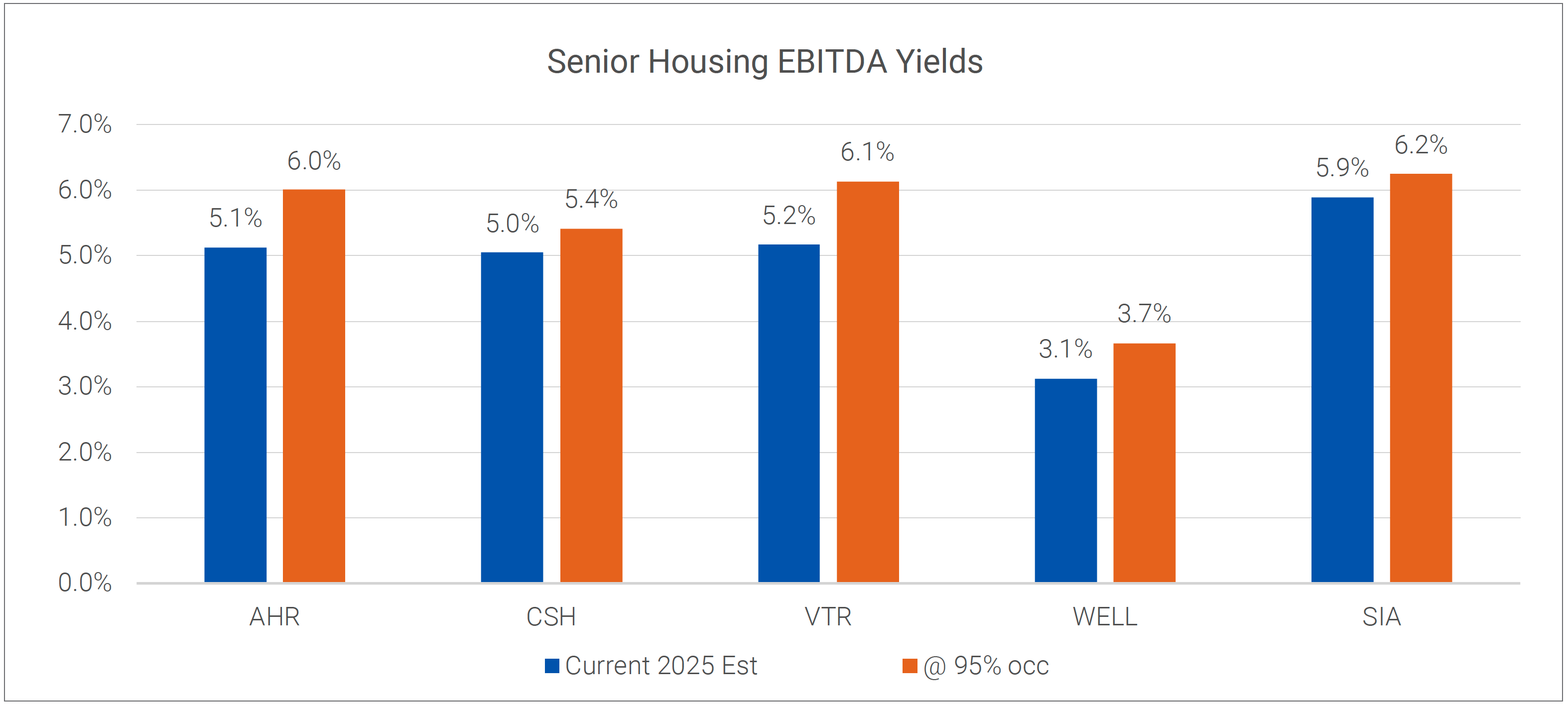

Another inefficiency (we believe) is the wide pricing differential across the listed peers. For example, the chart below shows a simple EBITDA yield of selected senor housing exposed REITs based on current estimates and proforma reflecting 95% occupancy. The value (as is usually the case) can be found by looking past the largest REIT in the market (WELL). And while we acknowledge there are differences in business models across different REITs, we saw the same pricing differentials in other previous hot sectors in the past (ie logistics, data centres).

Why such a wide disparity? Generalists who buy into a theme generally allocated to the largest and most liquid company. The benefit of being a small manager with an ‘all market cap focus’ is we can go where the numbers are the most attractive.

AHR = American Healthcare REIT; CSH = Chartwell Residences; VTR = Ventas REIT; WELL = Welltower; SIA = Sianna Senior Living

AHR = American Healthcare REIT; CSH = Chartwell Residences; VTR = Ventas REIT; WELL = Welltower; SIA = Sianna Senior Living

Source: Quay Global (prices June 30 2025).

Concluding thoughts

Over the years there have been plenty of themes that have benefited real estate investors. To us, the North American senior housing sector so far is proving to be quite unique. Sectors that have historically benefited from secular demand (industrial, apartments, or recently data centres), usually go hand-in-hand with some type of supply response – albeit lagged at times.

In the case of senior housing, despite strong rental growth and share price performances, there still appears to be an unwillingness to supply new senior housing.

This means rents simply must keep rising driving earnings dividends and share price gains. This could be a very long cycle. Our discipline of buying and owning below replacement cost keeps us invested.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.