The sector continues to see strong and growing demand from its largest tenants

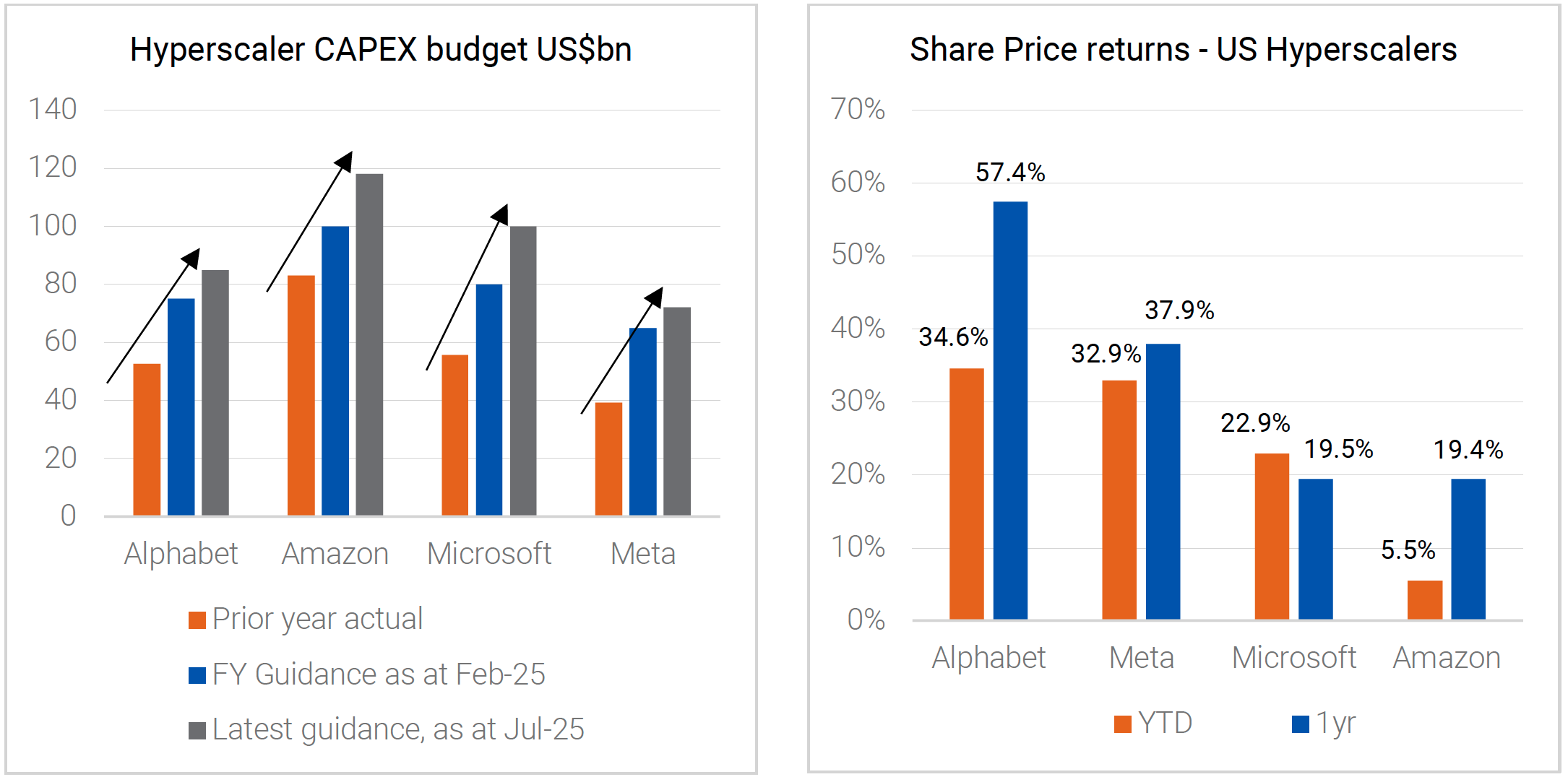

Source: Company reports, Bloomberg. Share price returns as of 19 September 2025.

Source: Company reports, Bloomberg. Share price returns as of 19 September 2025.

*Microsoft’s latest guidance is for FY26 as its reporting year end is 30 June 2025.

The US hyperscalers continue to pour tens of billions of dollars into AI and cloud capex – and these budgets have increased almost every time they report quarterly earnings. Notably, these increased capex budgets came despite the release of DeepSeek in January 2025.

And, why not keep spending? The market has rewarded this aggressive capex investment – share price performance has been stellar, helping drive equity market gains in the past year.

This will translate to a need for more data centre capacity – though just how much is unclear

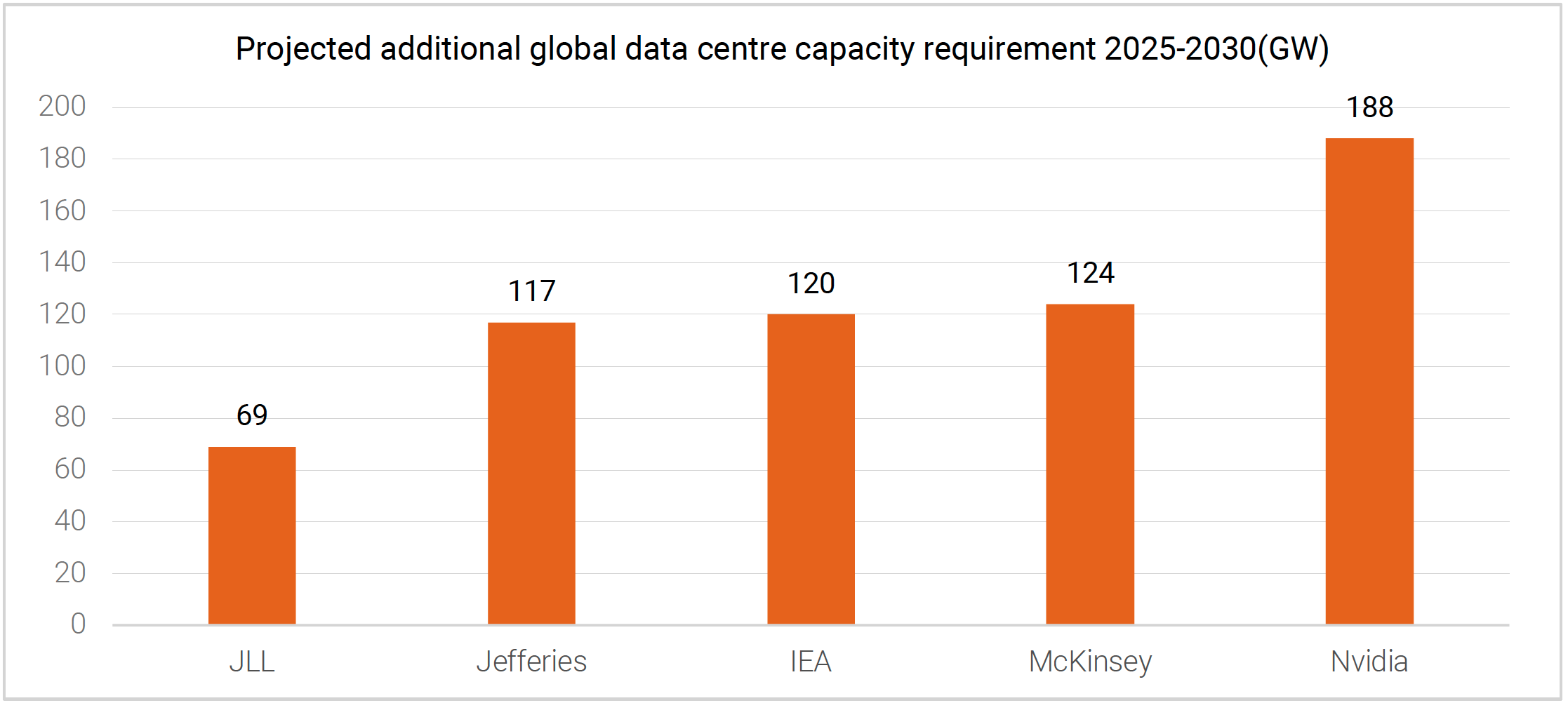

Source: Quay Global Investors. GW derived based on market size forecasts and other data points.

Source: Quay Global Investors. GW derived based on market size forecasts and other data points.

It is clear there needs to be significantly more data centre capacity to meet demand going forward. However, predicting just how much additional demand there will be is more art than science. Current market forecasts assume continued willingness by big tech to invest more and more capital into AI. Forecasts also assume eventual widespread adoption of AI by enterprises as AI technology matures into the inference stage, though the level of penetration varies by forecast.

The chart above shows a wide range of projections for additional data centre capacity needed between 2025 and 2030. With global capacity at 81GW at the end of 2024, in most cases, capacity is projected to more than double.

Where demand actually lands will go a long way in determining the fortunes of the players in the space…particularly as a wall of supply is building.

What’s clearer is that supply is responding – and it’s reasonable to be cautious

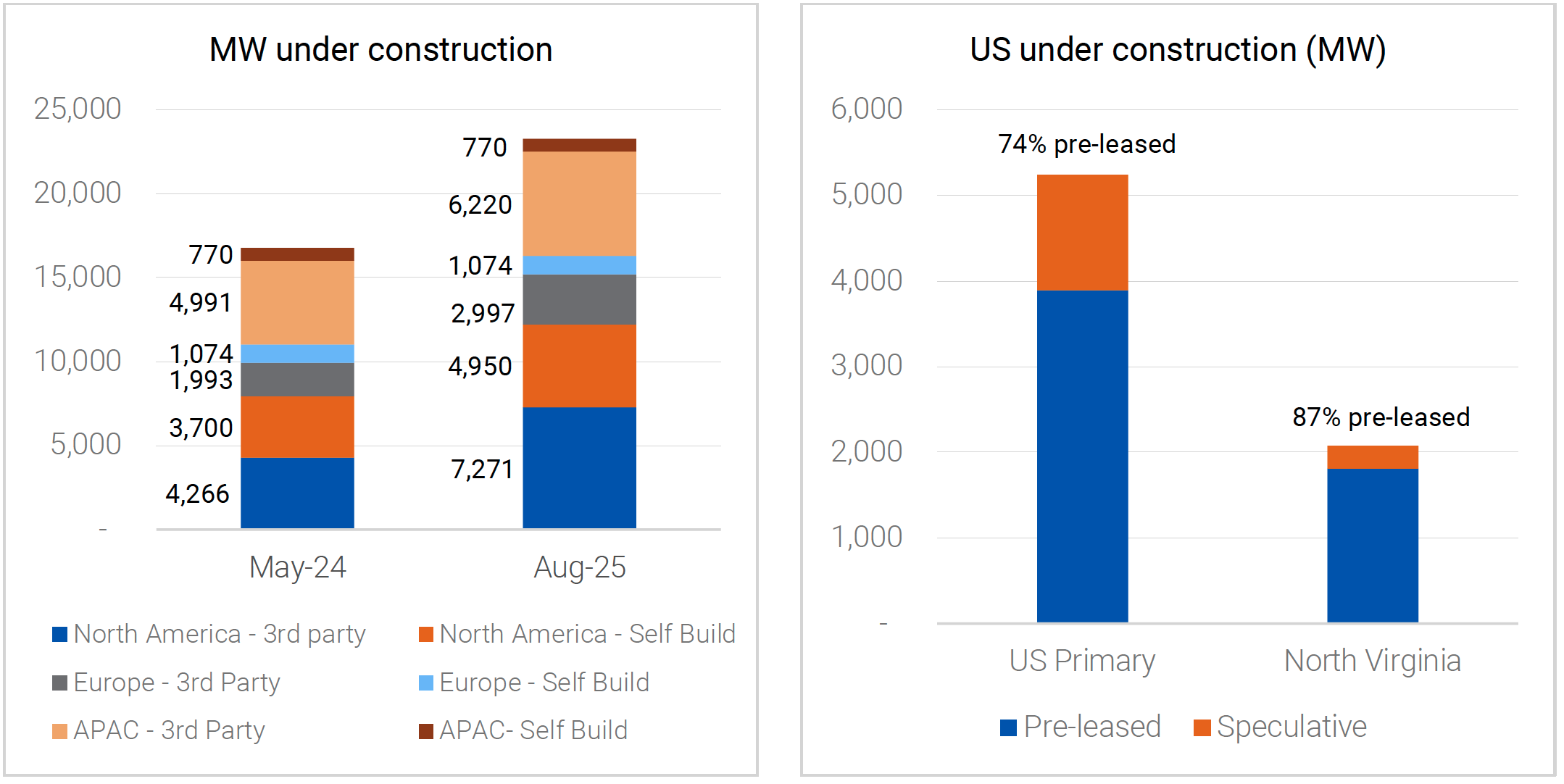

Source: RBC Capital Markets, CBRE, Quay Global Investors. US under construction (MW) figures as at 30 June 2025.

Source: RBC Capital Markets, CBRE, Quay Global Investors. US under construction (MW) figures as at 30 June 2025.

With seemingly insatiable demand both from tenants and investors, and lucrative double digit development yields on offer – capital continues to flood into the sector. The only handbrake to new supply remains a shortage of power, particularly in established data centre markets. As a result, secondary and tertiary markets, where land and power are relatively easier to secure, is seeing an increase in new builds.

Rough estimates by RBC identify 132GW of planned/potential projects globally in the next ~10 years if all landbanks are utilised. However, these numbers are likely not achievable as the grid is not ready to supply that much power.

As a result, under construction figures are much lower. In North America (predominately in the US), there is over 12GW of data centre capacity under construction as at Aug-25, up 33% from 9GW in May-24. Globally there is over 23GW under construction, or over 25% of total existing stock.

A large proportion of the third party builds under construction in primary markets are pre-leased – in fact ~74% in US. This is more apparent in the top market North Virginia, where 87% of the 2GW under construction is already pre-leased. In our view, operators that focus on the best markets are well-placed to navigate the risk of any oversupply.

While future supply builds, vacancies in top US data centre markets continue to set record lows, pushing up market rents

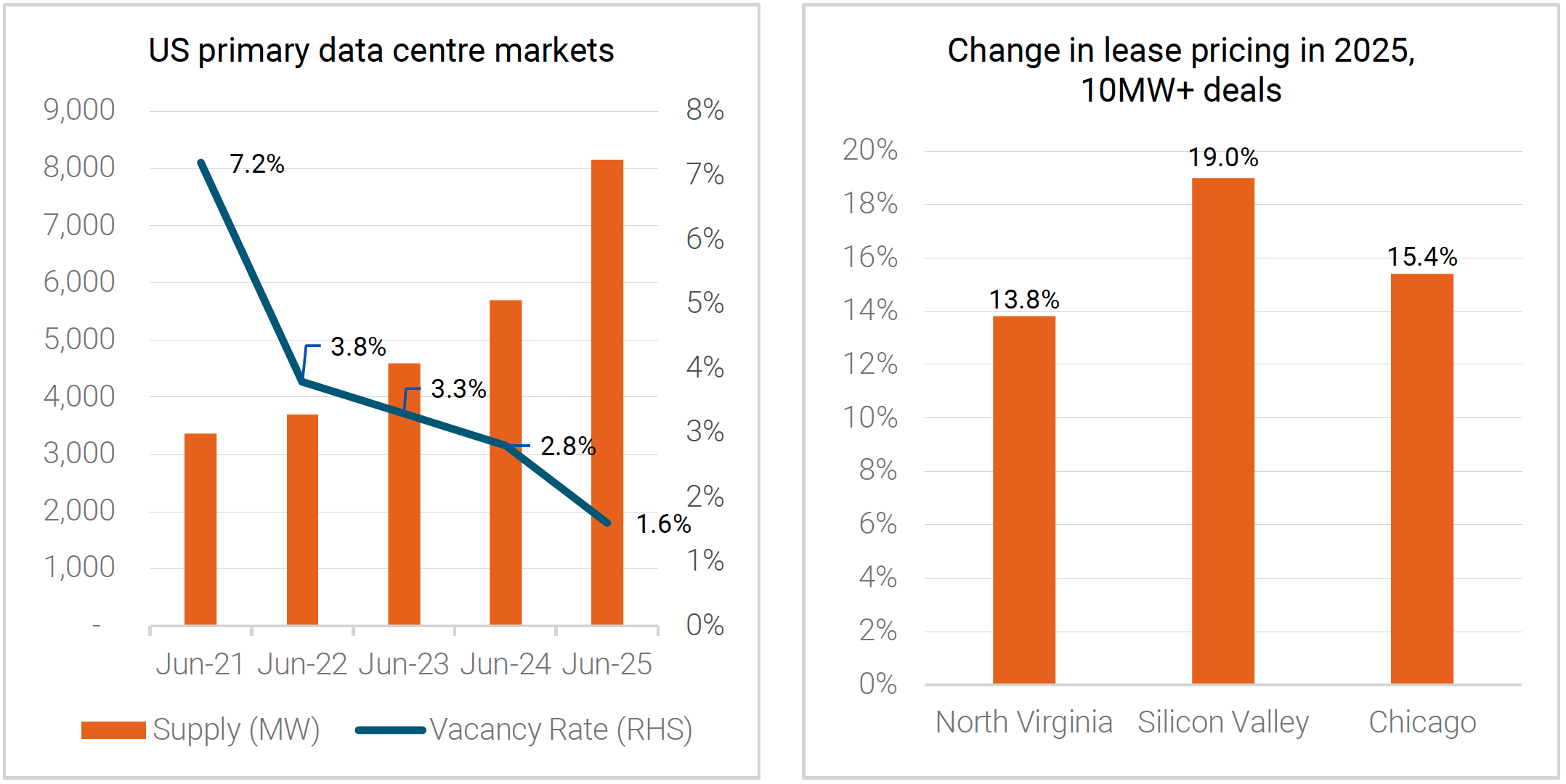

Source: CBRE, Quay Global Investors.

Source: CBRE, Quay Global Investors.

With a typical data centre development taking three years to build (up from two), and mostly pre-leased before delivery, existing data centre capacity in established US markets is in high demand.

As a result, vacancies in these markets continue to set new record lows, most recently falling to 1.6% as at June-2025. This is despite an almost triple increase in supply this half (MW) compared to four years ago.

This dynamic is putting upward pressure on market rents. This is particularly beneficial for data centre owners that can deliver capacity in the top US markets. The chart above on the right shows the market rents for hyperscale leases over 10MW have grown mid to high teens in percentage terms in 2025 in North Virginia, Silicon Valley and Chicago.

Not all data centre plays are created equal

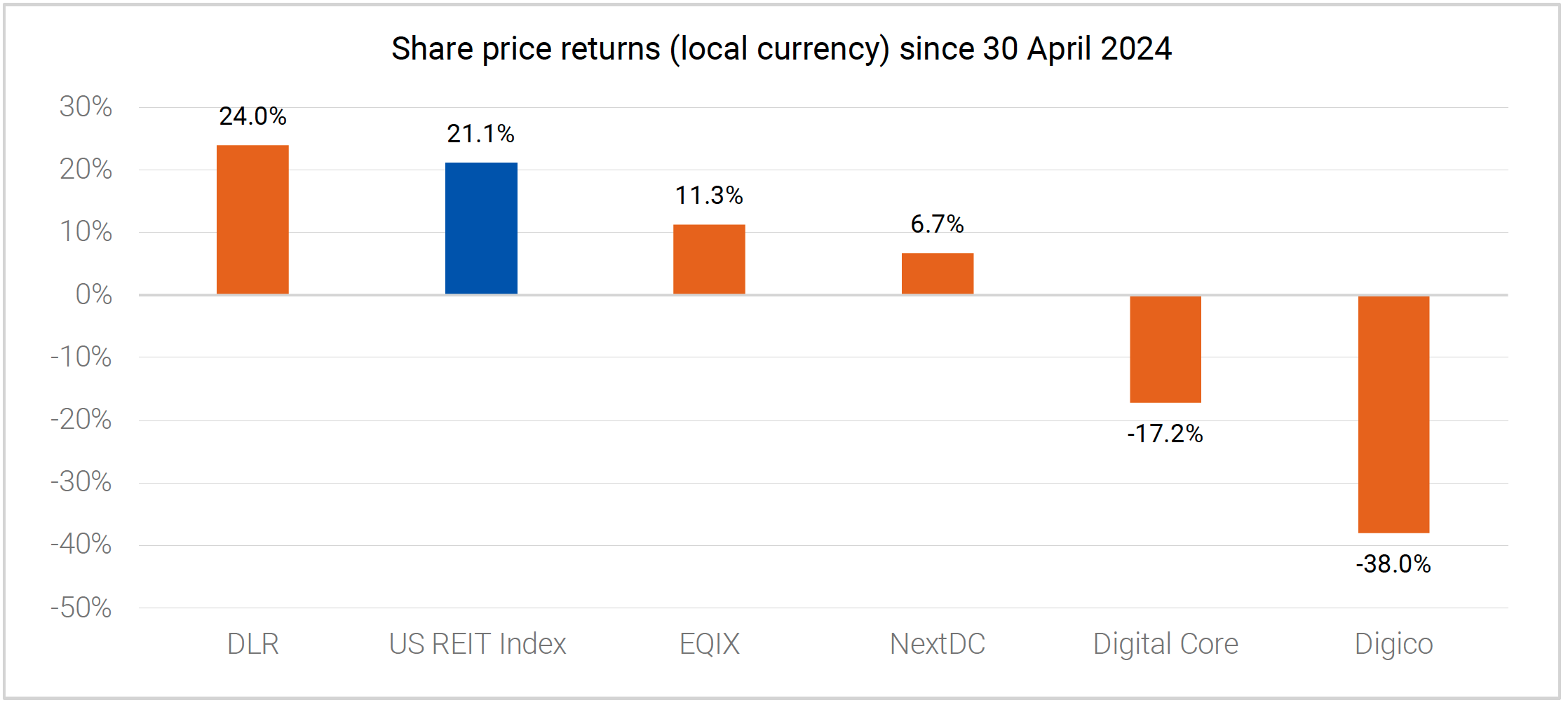

Source: Bloomberg. Returns 30/04/2024 – 19/09/2025.

Source: Bloomberg. Returns 30/04/2024 – 19/09/2025.

We wrote in our initial paper last year that the data centre REITs most likely to thrive in the current environment would have the following characteristics:

- Possess a global data centre platform, ie size matters.

- Have a meaningful exposure to hyperscale-type data centres, particularly in the US.

- Be able to develop new data centres, not just hold stabilised assets.

Subsequent share price performance across global data centre peers has broadly aligned with our initial thesis. One outlier has been China-focused REITs—outside our investment universe—which have rallied on the success of DeepSeek. Excluding these, the larger operators with diversified global platforms, notably Digital Realty and Equinix, have outperformed. Digital Realty’s strong exposure to hyperscale customers has been a key driver of its relative strength.

Where do valuations sit today?

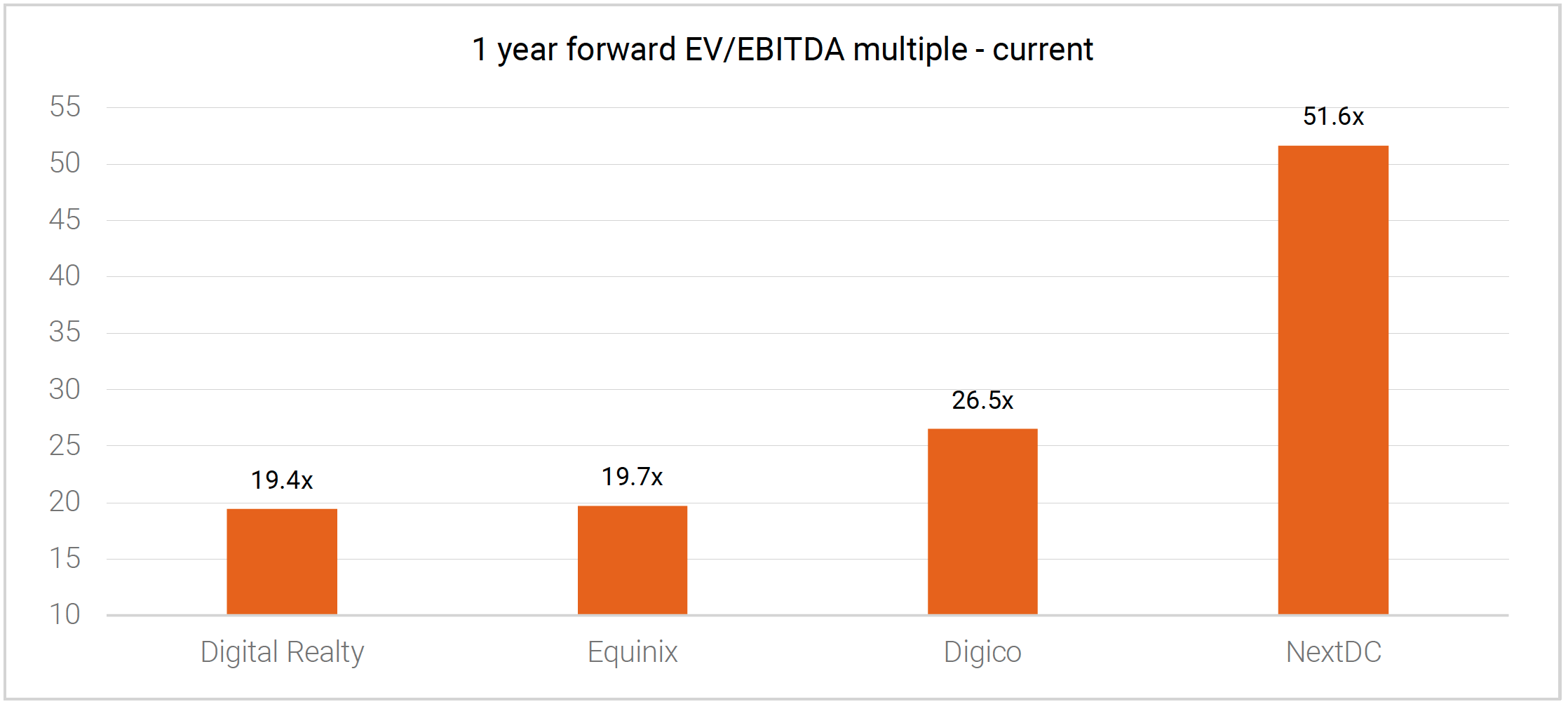

Source: Bloomberg, Quay Global Investors. Data as of 19 September 2025.

Source: Bloomberg, Quay Global Investors. Data as of 19 September 2025.

Despite strong share price performance, Digital Realty’s earnings growth has kept its valuation multiple relatively attractive—still the lowest among global peers, including Equinix, though the gap has narrowed. Australian-listed data centre REITs continue to trade at significant, and in our view, unjustified premiums. Looking ahead, we believe scale and geographic reach will remain key differentiators, with exposure to the US hyperscale market a clear advantage. And as always, valuation matters.

Concluding thoughts

The data centre sector stands to continue to benefit from the growth of AI and cloud spend by large hyperscale tenants. This dynamic is driving the need for substantial new capacity, even as the scale of future requirements remains uncertain. With supply responding in tune, investment into the data centre theme requires a measured approach. Persistently low vacancy rates in primary US markets underscore the sector’s strong fundamentals. However, the sharp divergence in performance among global data centre REITs highlights the importance of selectivity. As always, valuation discipline is critical — investors should balance the sector’s compelling growth prospects against current pricing to identify the most attractive opportunities.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.