The world is a big place. The opportunity set in global real estate is significant.

Consider:

- there are approximately 700 listed real estate companies globally;

- the opportunity set represents around A$2 trillion in market value;

- this opportunity set is 20% larger than the Australian share market (S&P/ASX 200).

The size of the market represents opportunity, but can be somewhat overwhelming for a relatively small investment team. At Quay we implement a number of strategies to whittle the vast array of opportunities into a manageable pool. We do this by, utilising a proprietary quantitative screen to find the best value and growth prospects, and identifying and focusing on companies exposed to long-term secular themes or megatrends.

We recently gave a number of presentations touching on these themes and megatrends in real estate. Regular readers will know we have identified some of these themes to include:

- the aging population;

- the rising need for affordable accommodation;

- the knowledge gap and access to quality student accommodation; and

- re-urbanisation of major cities.

However, important anti-themes can exist alongside these long-term positive themes. There are sectors with potential long-term headwinds that may detract from future performance. Knowing what to avoid is critical when the mandate is to preserve capital. Many of these anti-themes actually represent a significant proportion of today’s index benchmark, highlighting the importance of a truly active investment strategy.

Mid-market malls (shopping centres)

We wrote Thinking about Malls in June 2016. While we are not bearish on all retail property, we did identify a number of headwinds for malls and the retail asset class in general. In summary we believe:

-

the old retailer model of +500 stores (+200 stores in Australia) will end. Retailers will have significantly fewer stores to supplement their online offering;

- many mid-level malls will close – particularly in the US. Some research suggests department stores may need to close 15-20% of stores just to get sales per sqm back to 2006 levels, and over half of the 1,200 malls across the US will close by 20351;

- development will be more targeted – to the best centres. We expect return on capital to remain competitive but lower relative to history. This is because of a higher land value component due to the dense urban location of flagship malls. Centres that do not fit with ‘best-in-class’ will have limited development opportunity and may become ‘capex machines’ in the same way as office property – lots of capital for low return – in order to keep major tenants.

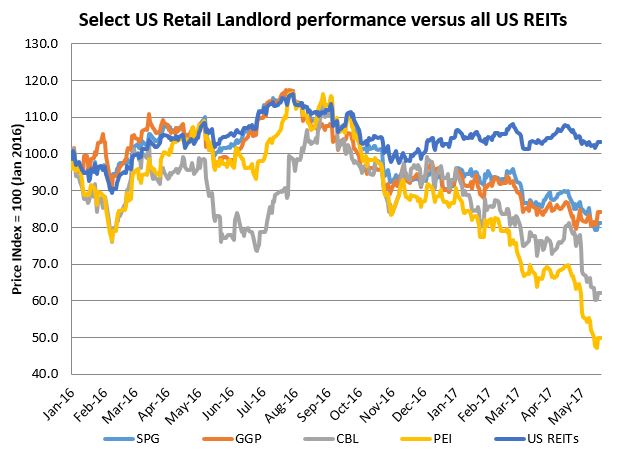

The share price collapse of the mid-market mall REITs occurred over the past 12 months. CBL Associates (CBL) and Penn REIT (PEI) are currently trading at a 67% and 52% discount to their post-GFC highs2. Sentiment has also hurt REITs with a higher proportion of ‘A-malls’, including Simon (SPG) and General Growth (GGP). Because of our anti-theme, we do not own any US mall REITs. We have accordingly managed to preserve investor capital from the recent share price carnage – something that would have been difficult with an index-based approach.

While our call has been correct, there seems to be over-reaction in some share prices. We believe interesting retail property opportunities may be emerging. However, these opportunities are limited, and we remain generally cautious toward the sector.

Japan

Since we launched the Quay Global Real Estate Fund in July 20143, we have never owned a Japanese REIT or developer. To be fair, most developers are outside of our mandate as we primarily seek rent-based returns.

Japanese real estate presents a number of challenges; the main issue being demographics, as well as poor prospective returns.

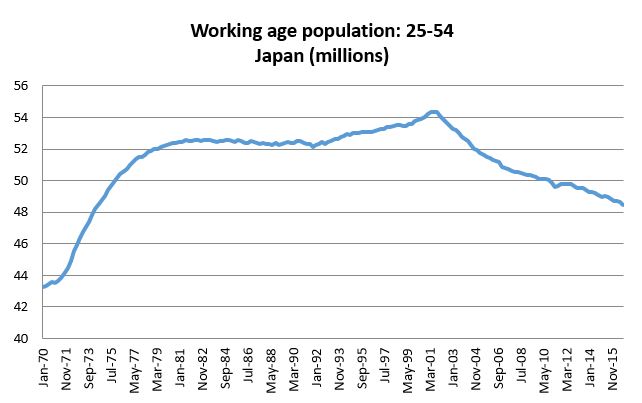

We’ve always believed demographics are an important driver for total real estate returns. The logic being – more people into fewer buildings is good for rental growth. Less people into the same number of buildings is bad for rental growth.

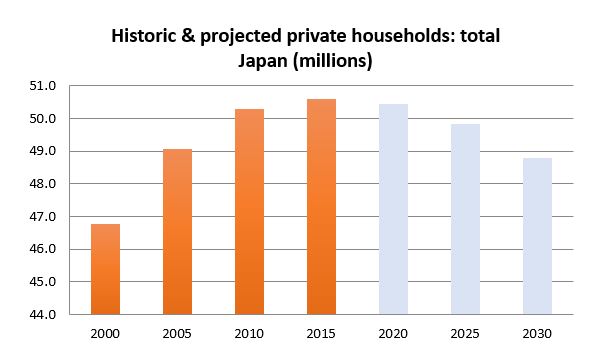

Japan’s demographics are now in full reverse. Household formation is collapsing, as is the total workforce. This is bad for most sectors including retail, residential, office and industrial property. With unemployment at 2.8% (lowest since 1994), the economy is already at or near full employment. It’s hard to see ‘economic slack’ or underutilisation available for future near-term demand.

The following charts highlight some of the challenges for Japanese real estate owners.

In terms of earnings multiples, Japan also generally screens poorly on quantitative filters. This is likely a result of very low interest rates and a relentless search for yield and poor real FFO/share growth outlook. Challenging demographics along with low prospective total returns means Japan probably isn’t a place for long-term investors. This is despite Japan accounting for over 10% of the global index benchmark. We continue to avoid it.

Office Property

Despite having some exposure through a diversified investee, we recently sold our only pure office investee. We are becoming wary of the sector.

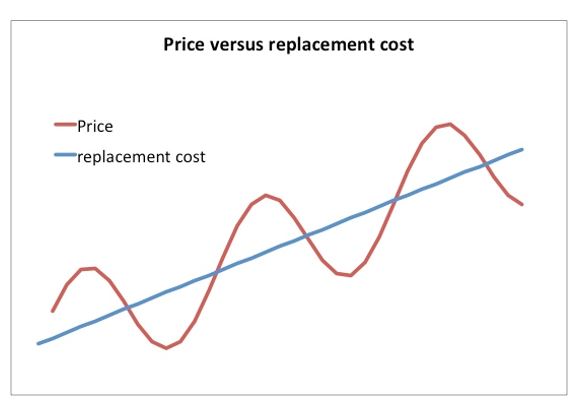

An important framework for Quay is to categorise certain types of real estate into ‘franchise’ or ‘commodity’. Commodity real estate is easily replicated; it therefore trades around replacement cost. We believe office property fits neatly into this category.

Low interest rates and the search for yield tends to push prices above long-term marginal cost, which in turn encourages a supply response. The chart below attempts to depict the typical cycle.

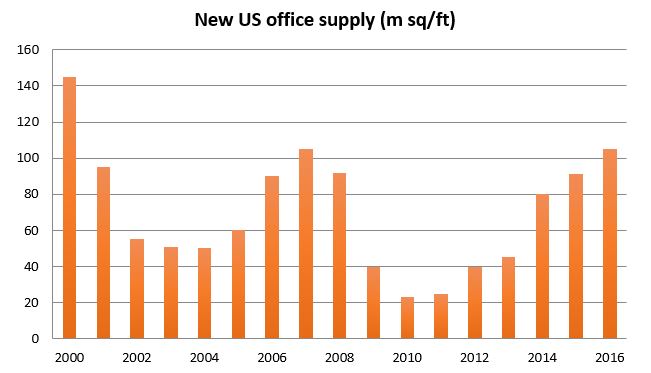

We believe this ‘framework’ helps explain the current office supply surge across key gateway markets around the world. As an example, the following chart shows the strong supply response for US office property – now nearing previous cycle peaks of 2000 and 2007.

In some instances, the supply response will deliver new stock right at the time demand potentially begins to weaken. For example, London and Brexit.

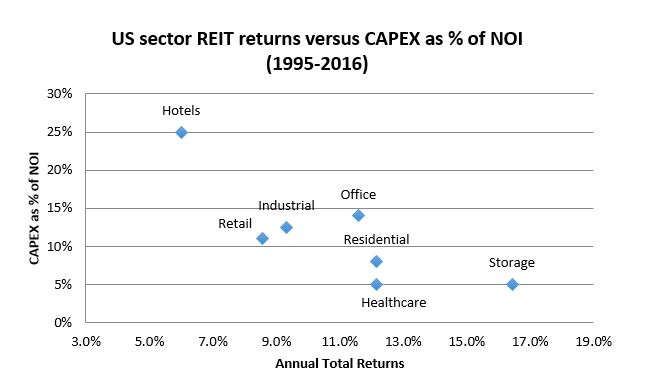

Moreover, office tends to have very high on-going capital expenditure requirements due to:

- high levels of tenant incentives and leasing commissions; and

- high build-to-land ratios, resulting in high economic depreciation rates (especially in urban locations).

There is a strong relationship between ongoing capex and long-term total returns. Historically, this resulted in ‘ok’ total returns from office property through-cycle. As we enter the ‘supply response phase’ of the cycle, we think there is a strong case to make that the best of office returns are now behind us.

Australian Residential Property

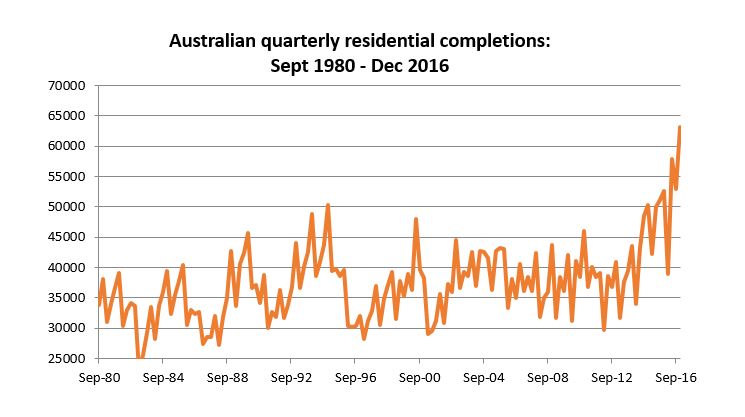

We recently outlined our concerns for Australian residential property in our publication ‘Australian house prices and the law of unintended consequences’. Again referencing our framework of replacement cost, there has been a notable surge in new supply in Australian dwellings over the past 18 months – with this forecast to continue for at least another 12 months.

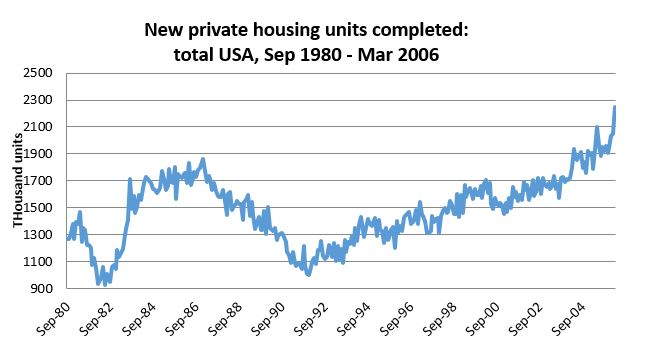

The increase in supply is closely aligned to what we observed in the US around March 2006 – a year before the start of the great housing correction.

As a consequence, we believe the return outlook from residential development in Australia is poor. Developers such as Stockland and Mirvac are potentially exposed to a meaningful correction in local residential prices – and they are also a meaningful component of the Australian real estate index. Being truly active allows Quay to avoid this sector and wait for better opportunities.

How does this affect Quay’s investment approach?

The global real estate universe represents an enormous investment opportunity set. In market value terms, it is significantly larger than Australian equities. But with size comes complexity in identifying the most compelling opportunities, especially with a small investment team.

The use of quantitative filters helps. However, just as important is identifying secular themes or megatrends. We apply our efforts analysing industries with indefinable tailwinds, and preserve our resources from analysing sectors with headwinds – or ‘anti-themes’. Being index unconstrained allows for this efficiency.

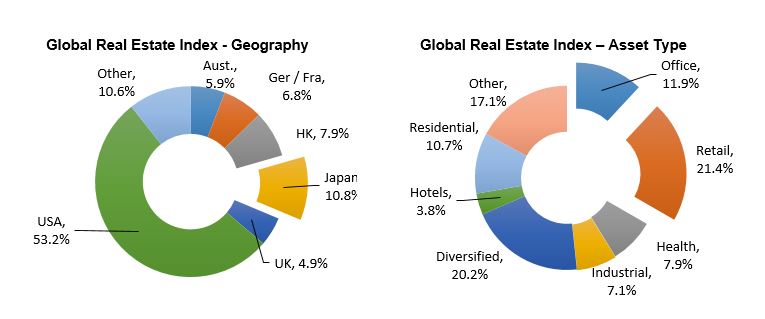

Having an unconstrained global investment mandate means we can avoid sectors that have unusually large weights in the index like Japan (10.8%), retail (21.4%) and office (11.9%) that at least for us, have very clear headwinds. To be sure it does not mean we will never own these sectors, however as a rule avoiding the anti-themes with the ability to be truly active puts us in a strong position to preserve capital and generate our target total return.

Footnotes

1.Source: Business Insider http://www.businessinsider.com/shopping-malls-in-crisis-2015-1

2.As a May 30, 2017. Source: Bloomberg

3.The Quay Global Real Estate Fund (retail fund) was launched 31/1/2016. Performance information before this date relates to the strategy (wholesale fund) which was launched by the team 30/7/2014.

Disclaimer

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. In particular, this newsletter is not directed for investment purposes at US persons.