After 10 years of relative calm, punctuated with the odd bout of relatively minor volatility, markets sold off with a ferocity not seen since the global financial crisis. Suddenly, the outlook for global economies changed from one of optimism to one of deep pessimism as the word ‘recession’ became mainstream and now seems certain.

It is during such times that fund managers and their approach to risk management are tested. And it is in these times that a well-considered process, investment skill and a bit of luck are all needed to help minimise losses and preserve investors’ capital.

Given this environment, we thought it worthwhile to remind investors how we at Quay think about risk and what measures we have in place, in both product design and our investment process, to manage it.

Starting with a blank piece of paper

When we launched the Quay Global Real Estate Fund in 2014, preserving investors’ capital and minimising the risk of permanent loss was central to our philosophy. Bold statements in a time when markets around the globe are in free-fall and risks of a global economic recession are very real. So, what do these statements really mean?

Back then, we spent a good part of six months prior to launch thinking about what the design of the strategy should be, with memories of the GFC still fresh. First and foremost, we wanted a strategy that would have the ability to truly preserve our investors’ capital in times of stress, so that over the long term we could provide our investors an acceptable real return; in our case, CPI + 5% per annum over five years.

We started the Fund with our own money and were soon followed by some family and friends. Therefore, for the sake of personal wealth and personal relationships, this objective had to have substance and could not merely be a bullet point in a marketing presentation.

Starting with a blank piece of paper enabled us to truly think about capital preservation from a strategy design perspective. They key pillars of this were:

- Index unaware

- Currency unhedged

- Cash limit of 20%, and

- Recommending prospective investors take a longer-term view; in our case, at least five years.

Index unaware

Being index unaware was important. Most index aware strategies manage risk with a tracking error limit, which is the divergence between the price behaviour of a portfolio and the price behaviour of a benchmark or index. When volatility reaches extremes, in order to adhere to this rule, portfolio managers are often required to adjust portfolio weights to be closer to the index. This can mean selling and buying investments for reasons other than investment merit. Having worked for an institution and experienced this during the GFC, this was one design characteristic we were not going to emulate.

Currency unhedged

We also debated whether the strategy should hedge its foreign currency exposure or not.

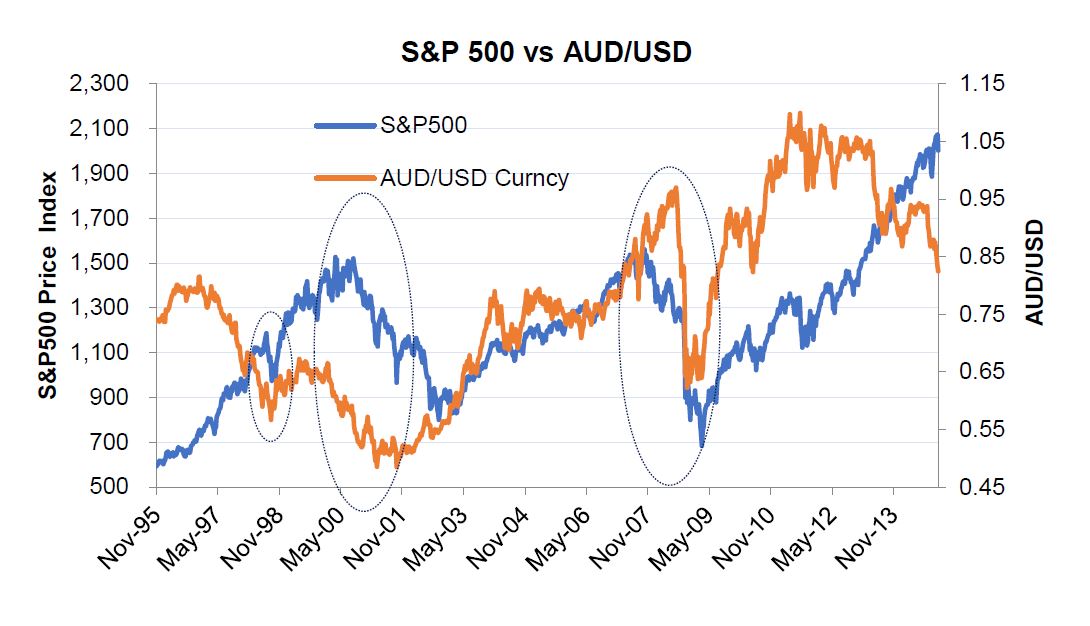

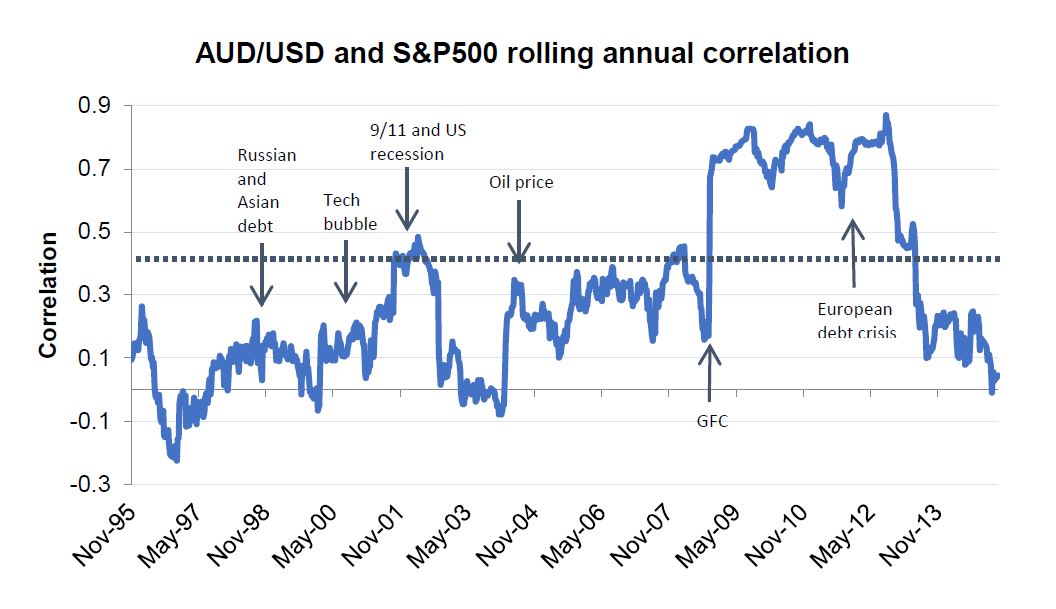

To many the idea of being unhedged seemed risky, but to us it was the opposite. We produced the following charts that show there is a long-term positive correlation between the stock market, represented by the S&P500, and the Australian dollar’s (AUD) relationship with the US dollar (USD).

Source: Bloomber, Quay Global Investors

What this means is at times of heightened risk or when markets are volatile, the AUD is inclined to sell off or devalue against the USD (and other currencies). For an Australian investor in international equities, an unhedged currency exposure can act as a buffer against adverse share price movements in such times.

There are also other issues that we identified, such as, for a hedged investor, having to fund FX ‘mark-to-markets’ during such times can force selling into a falling market and generating irrational and unnecessary turnover. Again, a feature we didn’t want to emulate.

As the current pandemic engulfed markets, the AUD depreciated against the USD from $0.66 at the start of the month to approximately $0.61 today. That is an +8% cushion that if we were hedged, we would not have enjoyed.

Cash limit and long-term investment horizon

Being unhedged was only one part of the design to reduce risk at times of market volatility. We also recommended a minimum five-year investment period and gave the strategy the flexibility of up to 20% cash. This reasoning consisted of a two-part analysis.

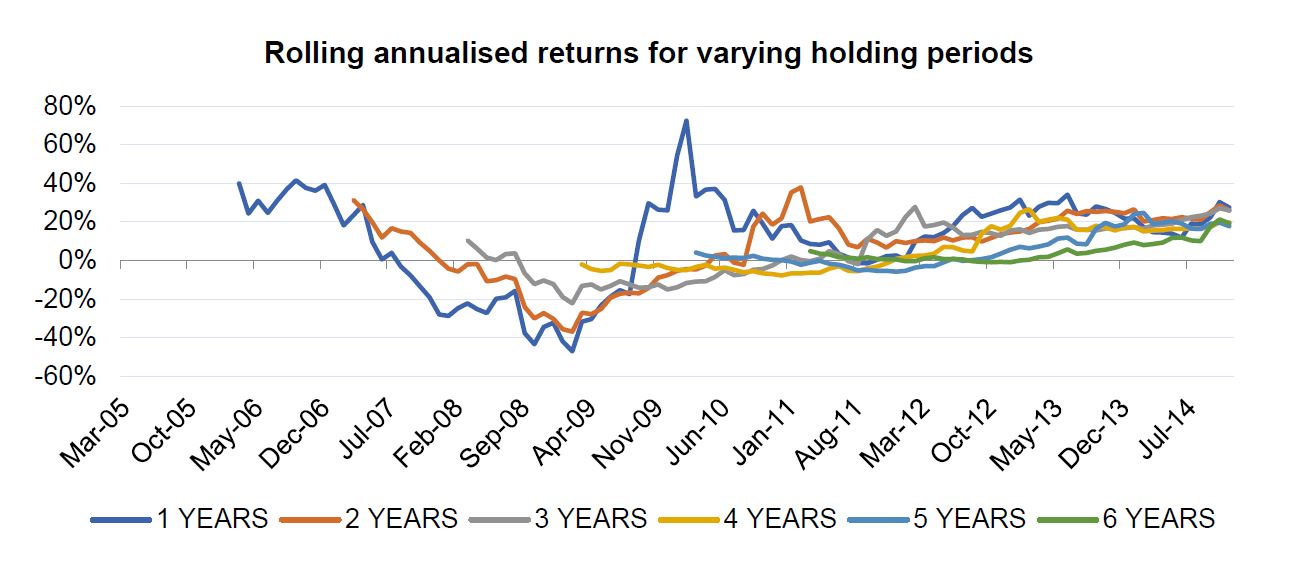

First, using our screening model we analysed the rolling annual returns for a hypothetical portfolio from August 2005 to August 2014, for holding periods of 1-6 years. This timeframe spanned the GFC, the worst drawdown seen in recent history and in our opinion, a good proxy for a worst-case scenario.

What we observed is that if an investor took a shorter time investment horizon (1-3 years), the potential for significant losses were high. However, if an investor showed patience and took a longer timeframe approach (5-6 years), the losses were minimalised to almost zero even if they bought at the pre-crisis high.

Source: Bloomber, Quay Global Investors

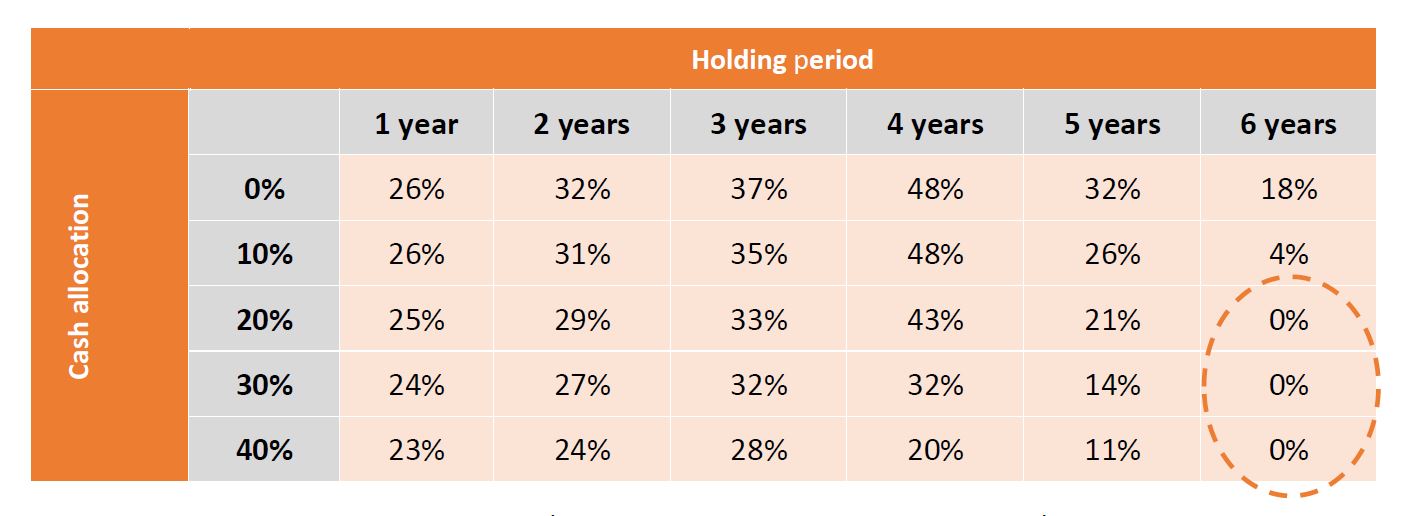

We then tested what would happen if we added cash as a buffer during times of stress using the same hypothetical portfolios and observing the rolling annual returns on a monthly basis.

The following matrix shows a range of observed negative returns expressed as a percentage of total observations for different holding periods (horizontal) and cash allocation (vertical). In simple terms, if at any time over the nine years analysed you invested in this hypothetical portfolio and held for four years with 20% invested cash, then 43% of the observed rolling returns were negative (i.e. the potential for loss is high). However, if using the same portfolio you held for greater than five years, the potential for loss was much reduced – and was in fact zero the closer you got to six years.

We never want to hold too much cash (we are paid to own listed real estate), nor do we want to tell investors they should wait 10 years to get their money back. The balance was an allowance to hold up to 20% cash, and guide investors to a minimum five-year investment horizon.

Minimising risk through portfolio construction

While the use of tracking error is commonly used by many fund managers as a key component of portfolio risk management, we were adamant that for the reasons discussed, this was not going to be the case for the Quay Global Real Estate Fund.

Philosophically, we believe the best risk management is to understand the risks inherent with each of your individual investees.

We are all human, and despite our best efforts we all make mistakes; and it is often not until times like these that you find out what those mistakes were. To minimise our mistakes, we wanted to restrict our investment universe to only include simple, easy to understand, listed real estate companies. For example, we deliberately exclude property developers, listed property fund managers and/or entities that generate returns from non-real estate sources where operating leverage is high and earnings can be volatile. When times are good, these exposures attract real estate-type multiples and returns can appear very attractive – but when the operating leverage works against them, the earnings collapse and the EPS multiple will also likely decline, leading to potentially devastating losses.

Managing risk is also about understanding balance sheet strength. In our opinion, balance sheet strength isn’t measured by just a simple leverage ratio (LVR), but includes debt relative to pre-interest earnings, the laddering of maturities, analysing the quality of the underling rental cashflows, access to adequate liquidity, and ensuring compliance with and stress testing of key covenants.

Conclusion

How best to manage risk during time of market stress? Every manager will have their own process.

For Quay, part of the approach is our mandate. Not being constrained to an index, our ability to hold cash, being unhedged, and restricting our universe to business backed by more reliable rental cashflows helps.

But equally important is our fundamental approach to investing. To us, risk is not tracking error, standard deviation or any other statistical measure. Risk comes from not understanding each company’s operating environment, their balance sheet or credit profile. It is this risk we spend our time managing.

Download a copy of the article here.