As 'generation rent' makes its mark, multifamily housing starts have been increasing, while on the other side of the housing ledger, the effects of the Global Financial Crisis and an ageing US population continue to lead to a decline in the proportion of US housing starts from single family housing.

Stock in focus – Sun Communities (SUI)

Investment themes play an important part in the Quay investment process. Our regular readers would be aware of our favourable view towards parts of the US housing market. As 'generation rent' makes its mark, multifamily housing starts have been increasing, while on the other side of the housing ledger, the effects of the Global Financial Crisis and an ageing US population continue to lead to a decline in the proportion of US housing starts from single family housing.

When students graduate from college and seek work in America's growing cities and rent apartments, what happens to their 'empty nester' parents sitting in the suburbs? Or those who find traditional housing unaffordable?

These cohorts have a number of options, including Manufactured Housing (MH). In this space, we think community operator Sun Communities (SUI) presents as an interesting investment proposition.

SUI acquires, operates and develops MH and Recreational Vehicle (RV) communities. Operating since 1975, it leases to its customers over 116,000 individual sites with utility access for placement of manufactured homes and RVs. As well as leasing sites, it also sells and leases new and pre-owned manufactured homes sitting on the site.

Three aspects about SUI appeal to us: 1. The value proposition for its customers; 2. Its resilient earnings profile; and 3. The demographic tailwinds.

1. SUI’s customer value proposition

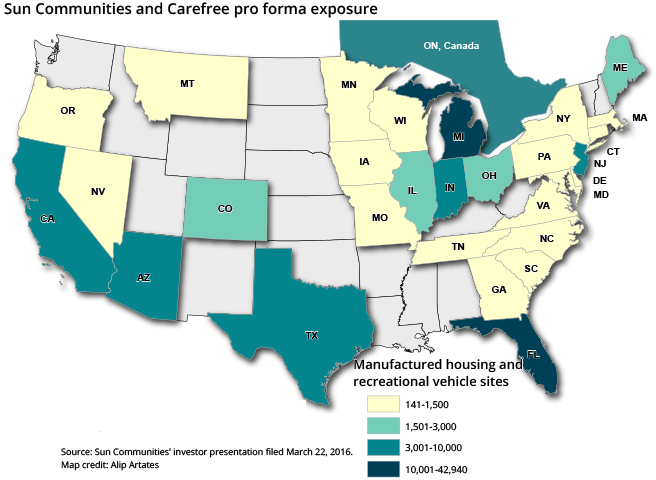

SUI’s properties are concentrated in Florida and other ‘sunbelt’ states (Texas, Arizona and California), as well as Michigan. While Michigan no doubt has its own redeeming features, the other states appeal to retirees looking for warmer climes or a sea change. The map below shows where Sun’s sites are located, having taken into account its recent acquisition of the Carefree portfolio.

Besides being in desirable locations for retirees, the benefit of manufactured housing as a retirement option is its ability to unlock equity for homeowners.

According to the company, using data sourced from the US census, average single family dwellings in the US cost $345,800 in 2014, about 5.3 times the median household income in 2014, up from 4.3 times in 2009. This compares to the average cost of a manufactured home of $65,300, or roughly one year of median household income.

But does MH stack up against an apartment? According to SUI, compared to multi-family, on average manufactured homes provide approximately 14% more space at approximately 45% less cost per square foot. Again, SUI estimated the average rent of an apartment, at $1,100 a month, is still, on average, 28% more expensive than the average manufactured home.

What this means is that customers can unlock the equity in their home and keep more cash in their pockets, in a manufactured home.

It is regularly reported that about half of all new manufactured homes end up being placed in an MH community, the sort that SUI operate. For a customer of MH there are no hassles over zoning, no need to seek local government approvals and there are a range of amenities available the day customers move into an established community. In our opinion, MH communities should remain a viable competitor to other accommodation options for years to come.

2. Resilient Earnings

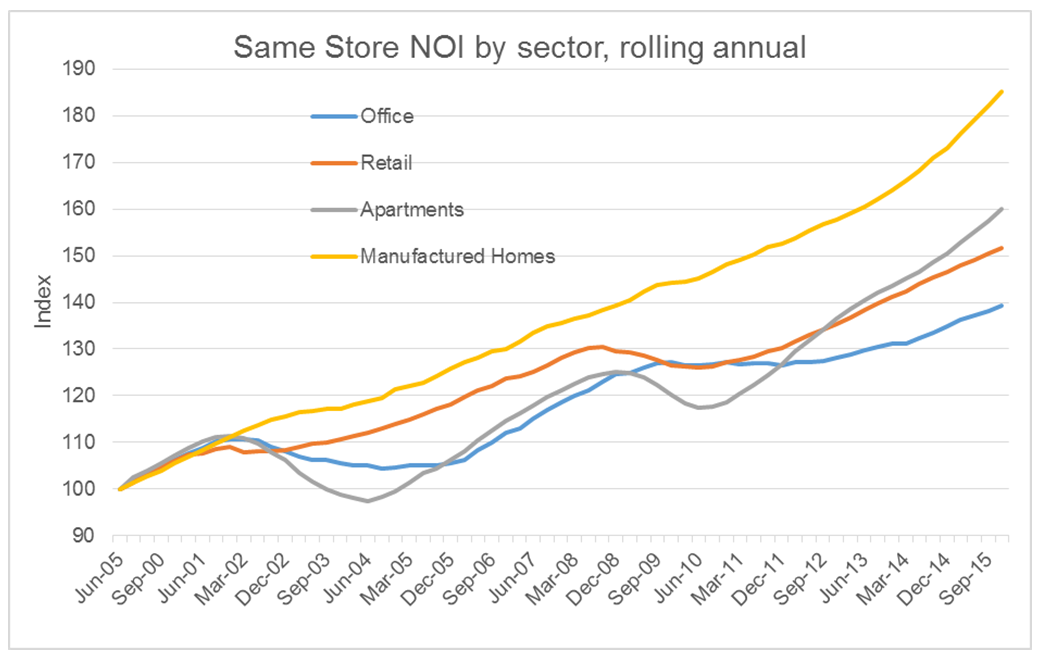

The MH sector has only posted negative same-store Net Operating Income (NOI) growth once over the past 16 years. Putting this into perspective, an MH community generating a million dollars of NOI per year at the end of 1999 would now, on average, be generating $1.85 million of NOI at the end of 2015. Compare that to an office building that would be generating $1.39 million of NOI by the end of 2015.

Importantly, this growth has also come with comparatively less volatility.

Underlying SUI’s resilient cash flow generation is the low stay-in-business capital (SIBC) expenditure requirements in the MH space. Again according to SUI, in apartments or multifamily SIBC represents just over 12% of revenue, or the equivalent of $12.20 of capital expenditure for every $100 of rent. (We note this can vary greatly on the quality of property). In comparison for MH, SIBC only represents 3.6% of revenue, which doesn’t eat into free cash flow like other asset classes.

Low SIBC is good. It means that there is more free cash left over from a company’s operations to give to shareholders, or importantly reinvest back into the business and ideally generate incremental growth compound the shareholder returns. In SUI’s case, we estimate they are reinvesting 30% of their Funds from Operations (FFO).

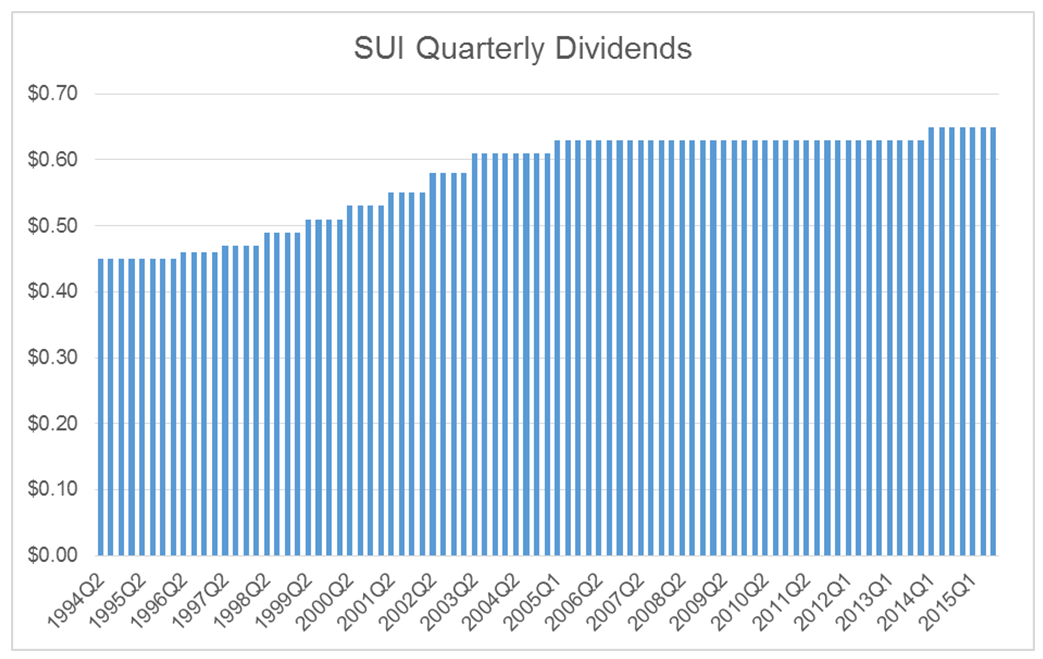

Since listing in 1994, SUI has never cut its dividend. Consistent dividends throughout many business cycles, underpinned by free cash, make for great investment propositions.

3. Demographic tailwind

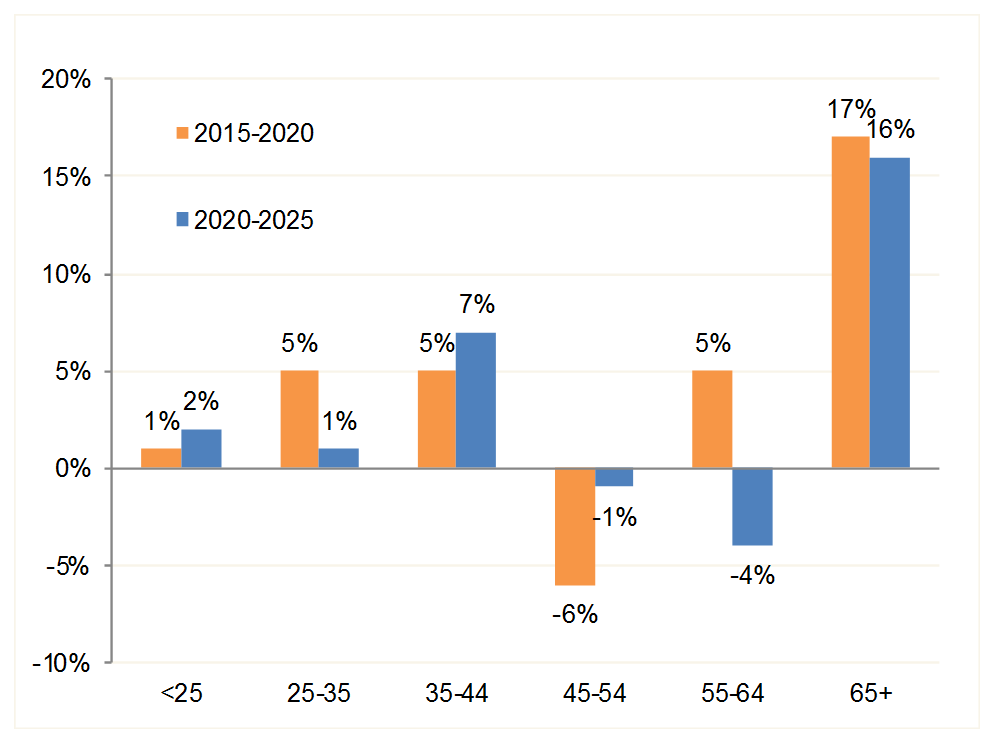

The third reason we find SUI appealing is due to the demographic tailwind it enjoys. Post the Carefree acquisition at the end of March this year, 33% of Sun’s sites are age-restricted, meaning they can only be occupied by those over a certain age, depending on which state. The chart below shows that the US population of over-65’s is expected to grow by 17% between the years 2015 to 2020, before growing 16% from 2020 to 2025. This means that over the next 10 years, the over-65 population of the US is expected to grow by 36%!

Summary

We think SUI is attractive because it offers, in our opinion, a defensive and growing earnings profile, backed by a demographic tailwind of an ageing population and sustained by MH as an appealing value proposition to its customers. We’ve long held Equity Lifestyle Properties (ELS) and SUI’s recent acquisition of Carefree, along with a correction in the share price post a recent equity issue has given us an opportunity to invest in a high quality operator in the MH space with attractive and defensive earnings at a reasonable price.

Disclaimer

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader. In particular this newsletter is not directed for investment purposes at US persons.