Two existing highly-rated award-winning Quay Global Investors ('Quay') funds are now available as actively managed exchange traded funds (‘Active ETFs’) for investment via the ASX.

|

Active ETF |

ASX code |

Learn more |

|

Quay Global Real Estate Fund (Unhedged) Active ETF |

QGRU |

|

|

Quay Global Real Estate Fund (AUD Hedged) Active ETF |

QGFH |

The funds provide access to a wide variety of listed real estate opportunities across multiple geographies, with QGFH providing hedging to the AUD. The strategy is a concentrated, high conviction approach, aiming to consistently deliver attractive total returns over the long term.

Recent updates from Quay

Chris Bedingfield recently spoke to Livewire’s James Marlay on the demand and supply dynamics of property and the opportunities available today.

Chris Bedingfield recently spoke to Livewire’s James Marlay on the demand and supply dynamics of property and the opportunities available today.Listen to the full podcast

Owen Raskiewicz from Rask Media recently spoke to Chris Bedingfield about the global property market today, market inefficiencies and the recent launch of Active ETFs.

Owen Raskiewicz from Rask Media recently spoke to Chris Bedingfield about the global property market today, market inefficiencies and the recent launch of Active ETFs.View the full interview

Quay's Investment Perspectives are widely-read monthly updates from the team, with recent topics including data centres, global equities and US senior housing.

Quay's Investment Perspectives are widely-read monthly updates from the team, with recent topics including data centres, global equities and US senior housing.Read Quay's Investment Perspectives

What makes us different

Focus on delivering investors total returns, not relative returns

- Anchoring values to replacement cost and focus on post depreciation cash flows

- The ‘Investment Process’ of the investee is critical to returns

- ‘Risk’ defined as a permanent loss of real purchasing power

Index unaware, concentrated with a high conviction approach

- We seek the best global rent based total return opportunities

- We do not invest in developers and emerging markets

- Stock selection is based on sustainable total returns as opposed to discount to NAV

- Weight given to low pay-out ratios, strong balance sheets and re-investment returns

Alignment with investors:

-

- Business is majority owned by founders

- > 80% team members are personally invested in the strategy

- Diverse and deep experiences in global real estate with a strong focus on risk gained from roles in equity research, corporate finance and investment management

Quay research ratings and awards

- Money Management / Lonsec Global Property Manager of the Year (2025, 2024 finalist, 2023, 2021, 2020, 2019 & 2018)

- Financial Standard Investment Leadership award for International Listed Global Property (2025, 2024, 2023, 2022 & 2021)

- Financial Newswire / SQM Research Fund Manager of the Year Award (2025, 2024 finalist, 2023 & 2022)

- Zenith Global REIT Manager Award (2024, 2023 finalist, 2022 finalist & 2021)

- Morningstar Fund Manager of the year “Real Assets” (2024, 2022 & 2021)

View research rating and award disclaimers.

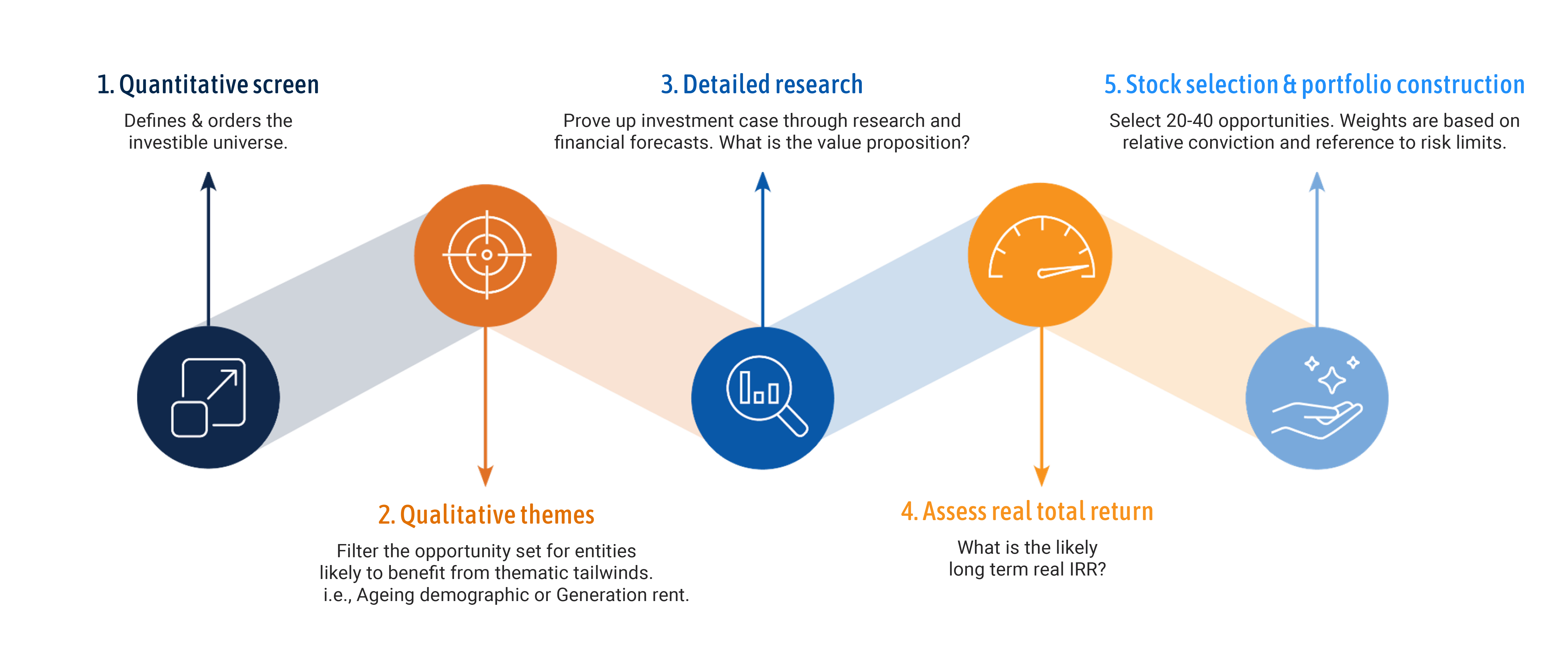

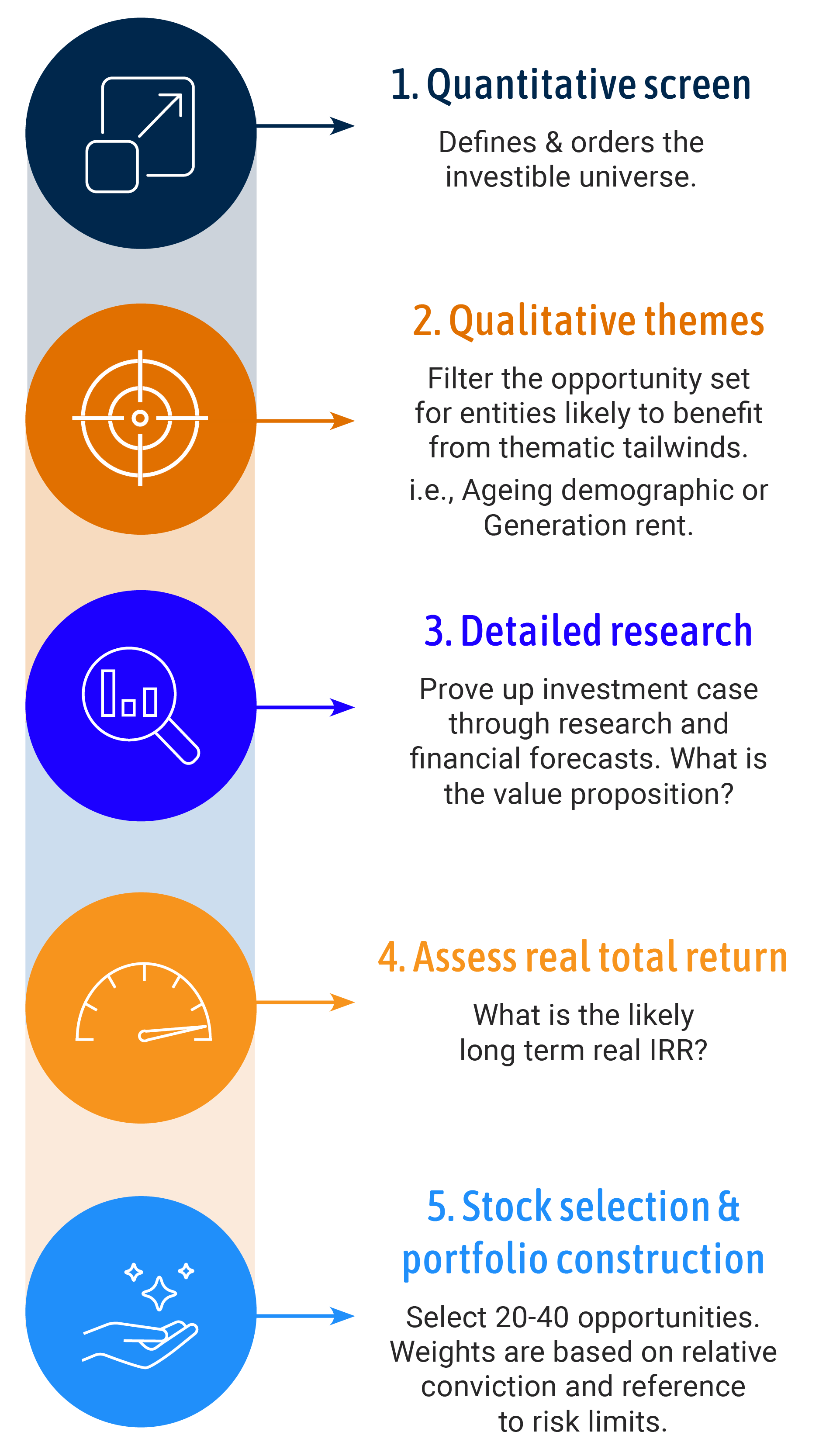

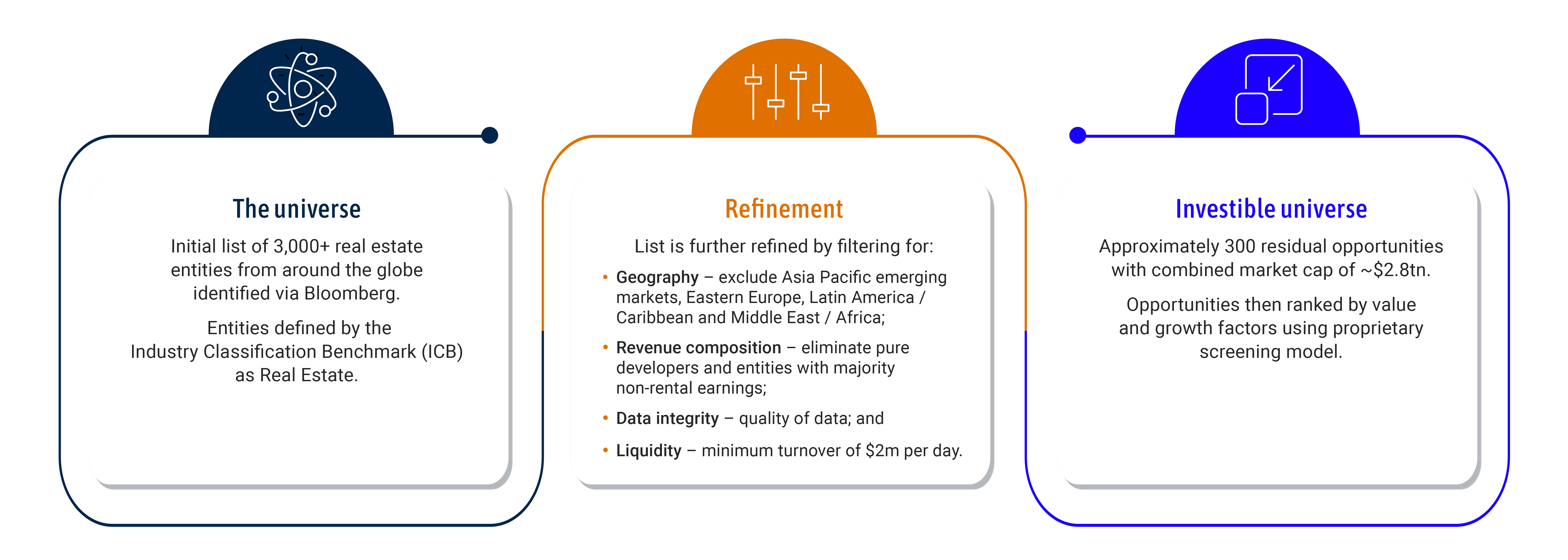

Quay’s investment process

Defining the universe

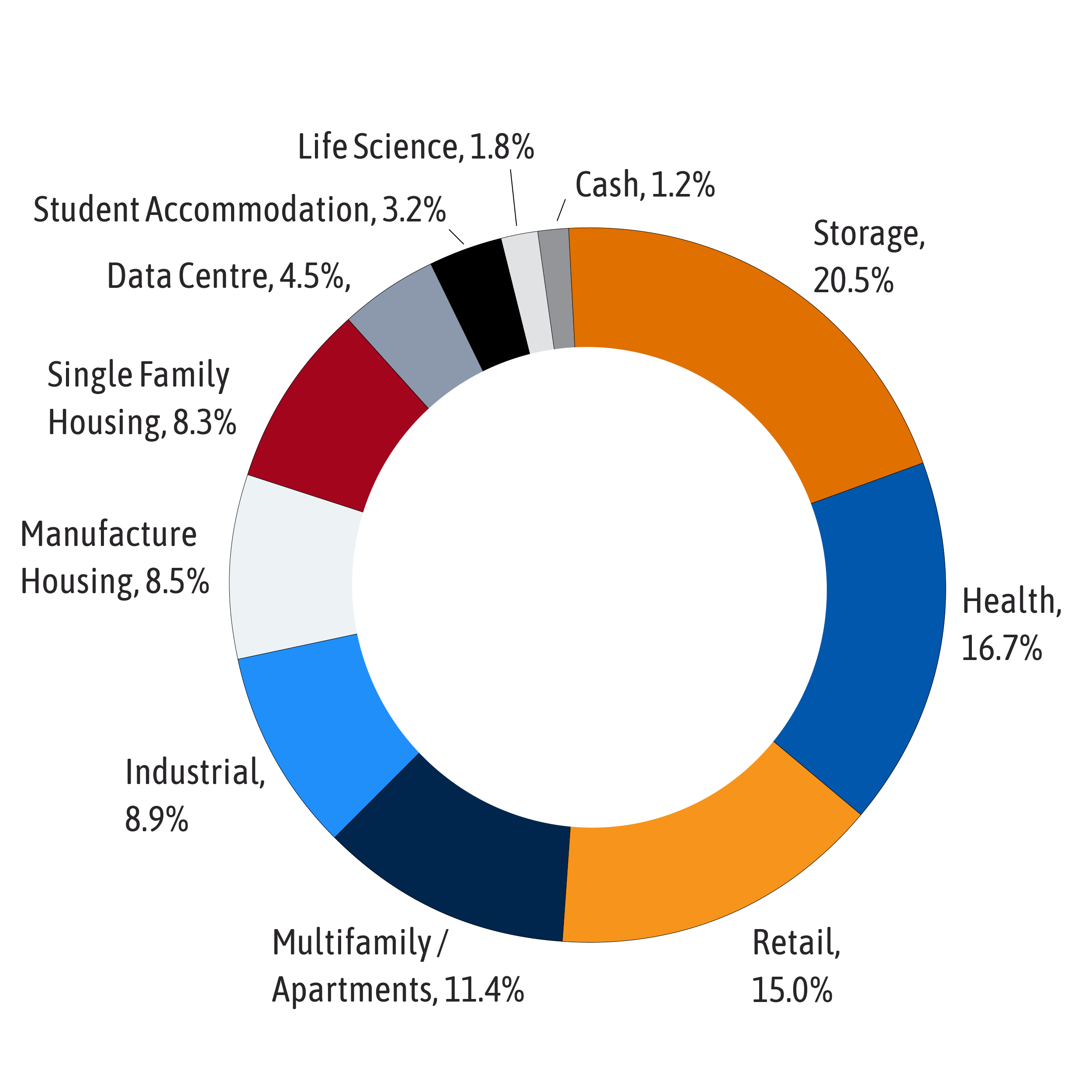

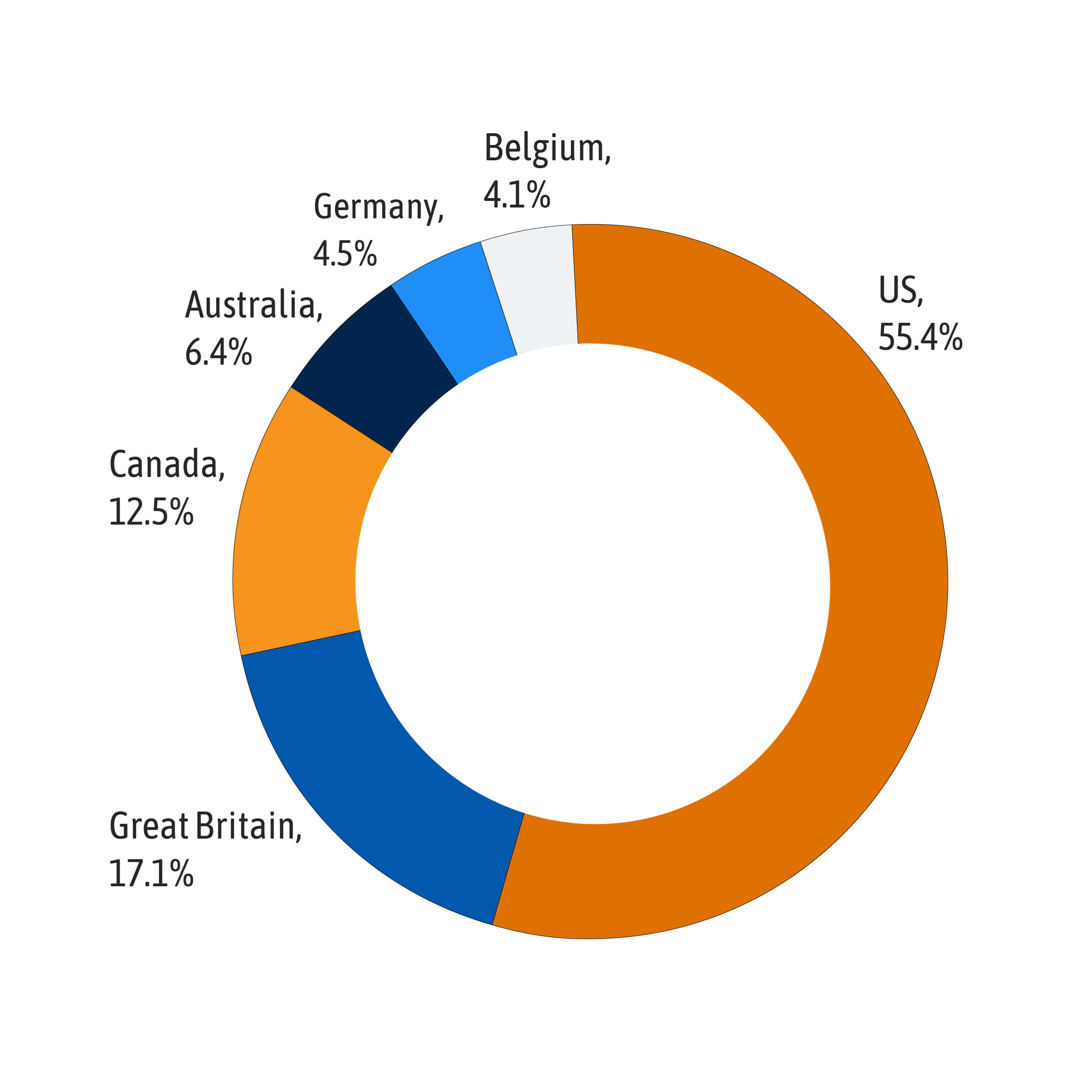

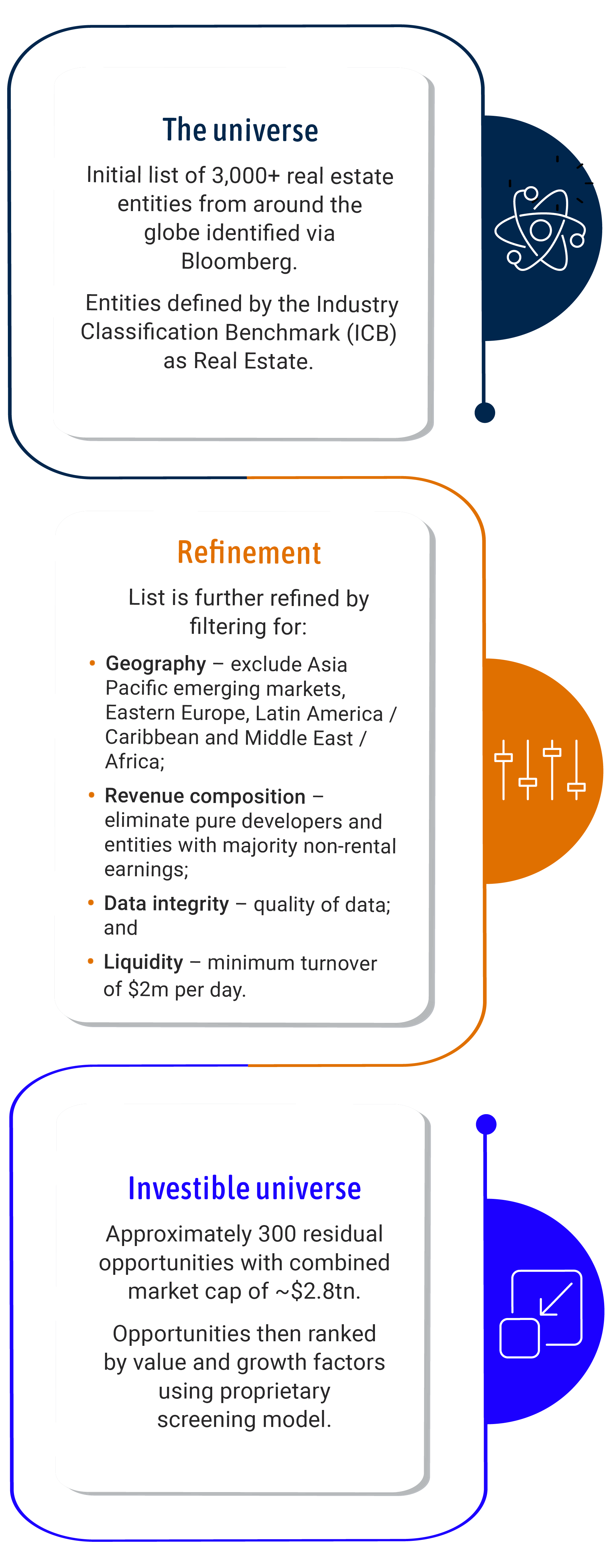

Portfolio diversification

|

|

*Weightings shown are for the Quay Global Real Estate Fund (Unhedged) as at 31 October 2025.

This information is issued by Bennelong Funds Management Ltd (ABN 39 111 214 085, AFSL 296806) (BFML) in relation to the Quay Global Real Estate Fund (Unhedged) Active ETF and the Quay Global Real Estate Fund (AUD Hedged) Active ETF. The Funds are managed by Quay Global Investors, a Bennelong boutique. This is general information only, and does not constitute financial, tax or legal advice or an offer or solicitation to subscribe for units in any fund of which BFML is the Trustee or Responsible Entity (Bennelong Fund). This information has been prepared without taking account of your objectives, financial situation or needs. Before acting on the information or deciding whether to acquire or hold a product, you should consider the appropriateness of the information based on your own objectives, financial situation or needs or consult a professional adviser. You should also consider the relevant Information Memorandum (IM) and or Product Disclosure Statement (PDS) which is available on the BFML website, bennelongfunds.com, or by phoning 1800 895 388 (AU) or 0800 442 304 (NZ). Information about the Target Market Determinations (TMDs) for the Bennelong Funds is available on the BFML website. BFML may receive management and or performance fees from the Bennelong Funds, details of which are also set out in the current IM and or PDS. BFML and the Bennelong Funds, their affiliates and associates accept no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. All investments carry risks. There can be no assurance that any Bennelong Fund will achieve its targeted rate of return and no guarantee against loss resulting from an investment in any Bennelong Fund. Past fund performance is not indicative of future performance. Information is current as at 17 November 2025. Quay Global Investors Pty Ltd (ABN 98 163 911 859) is a Corporate Authorised Representative of BFML.