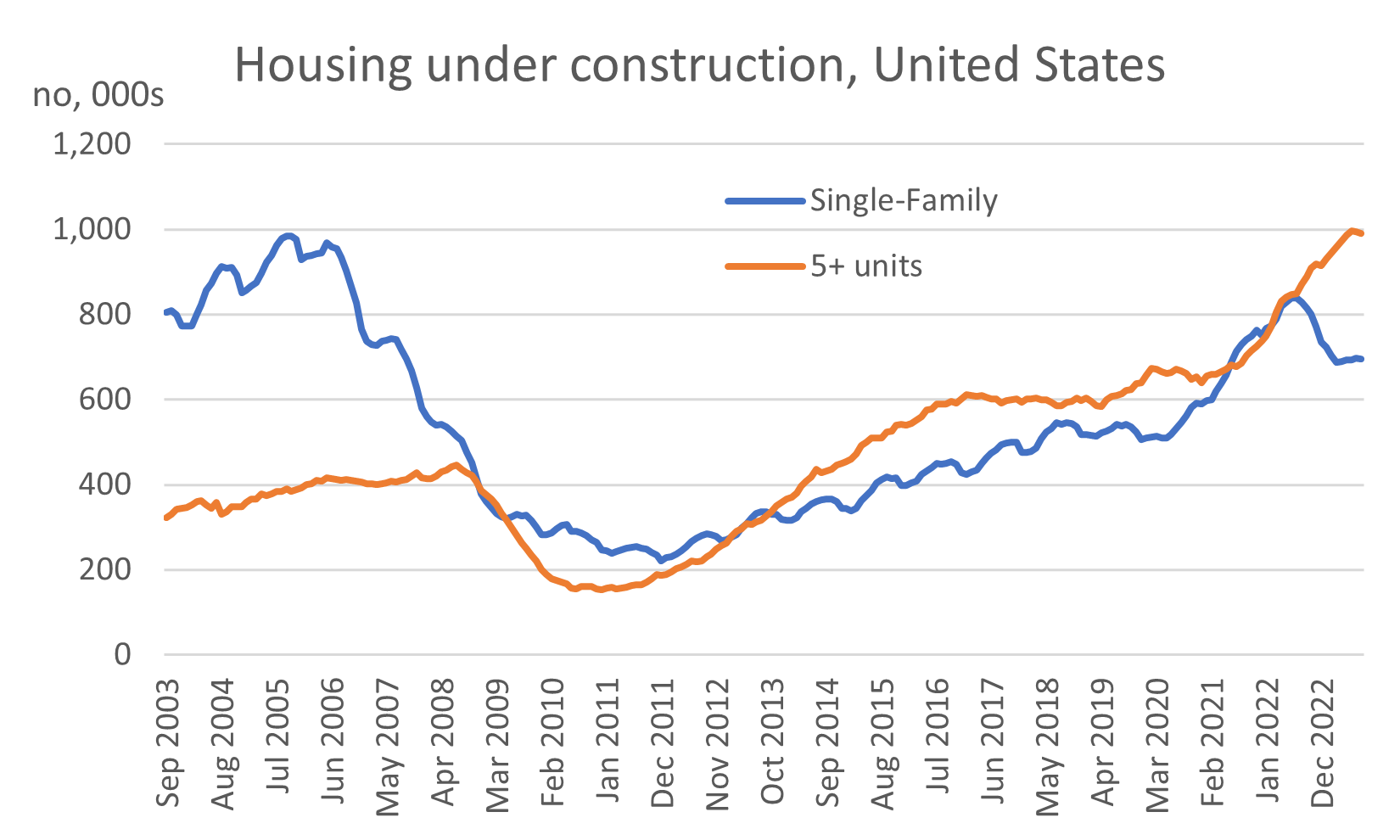

In our Investment Perspectives article last month, A big disinflation tailwind is coming, we discussed the impact of decelerating rents and their impact on the US CPI. This deceleration will likely be assisted by a significant amount of residential property under construction, which is due to be completed over the next six to nine months, and especially in the multifamily sector (5+ units).

Source: Fred, Quay Global

The perverse impact of interest rates on future supply

One of the primary transmission mechanisms for interest rates is via the housing sector, including the all-important construction sector. As interest rates rise, investment activity falls, and economic conditions across the construction sector contract. Part of the reason we have not yet seen a slower US economy is current levels of construction remain very high (as seen in the first chart).

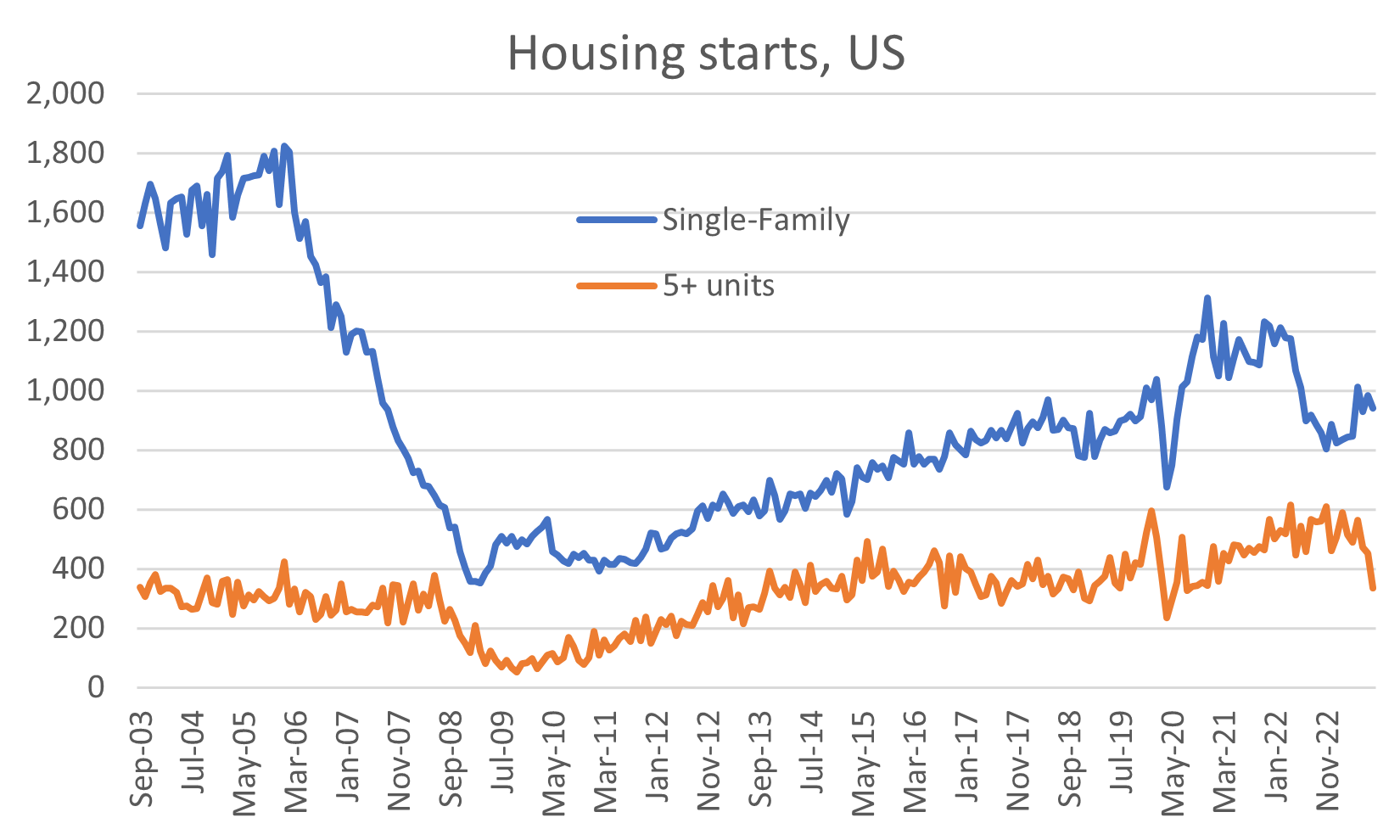

However, as the chart below highlights, US housing starts (which is future supply) has contracted across both sectors of US residential – multifamily and stand-alone houses.

Source: US Census Bureau, Quay Global Investors

Seasonally adjusted annual rate of dwelling starts

Once the current level of construction is completed there will be very little new construction in the pipeline.

The seasonally adjusted annual rate of starts in the 5+ unit category (which covers apartments) is rapidly declining to a current 330,000 unit per annum run rate. Interestingly, single family homes were initially impacted by rate hikes in 2022, have recovered somewhat and remain at a seemingly stable run rate of about 940,000 homes per annum. While still elevated, it’s nowhere near the amount of home building before the GFC.

The reason for the recent divergence is due to the activity of US homebuilders (mostly listed), that have been able help prospective home purchasers by offering vendor finance at lower interest rates. New home buyers have been getting better finance terms from homebuilders than available from banks. However, multifamily developers and condo buyers must source (more expensive) capital, with the ultimate resident usually being a tenant.

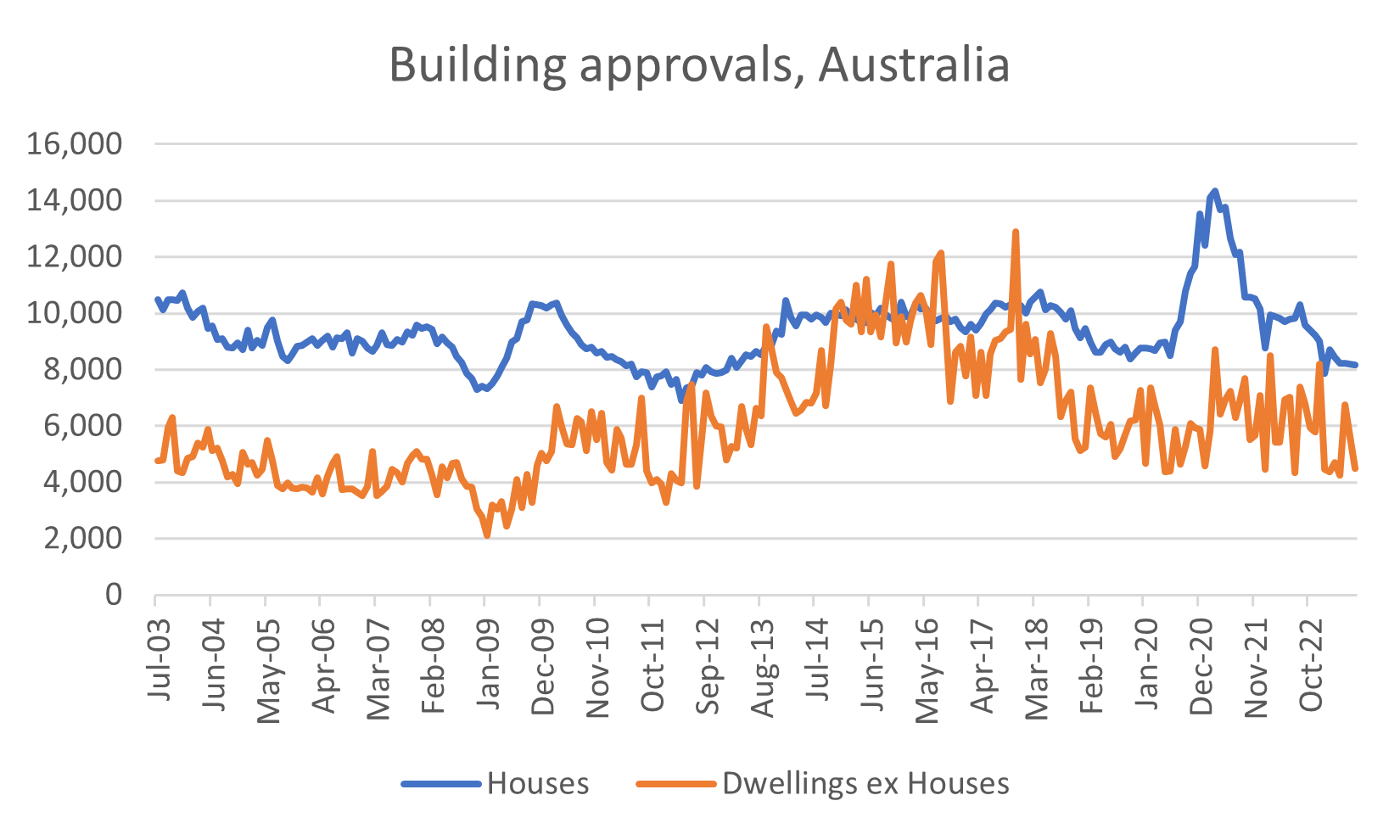

Australian data tells a similar story. While the Australian Bureau of Statistics only releases housing starts quarterly, it does publish monthly building approvals. At a time where we already have a rental squeeze, central bank policy, i.e. higher interest rates, is resulting in a sharp reduction in new starts.

Source: ABS, Quay Global Investors

Seasonally adjusted monthly approvals

Higher-for-longer rates means higher-for-longer rents

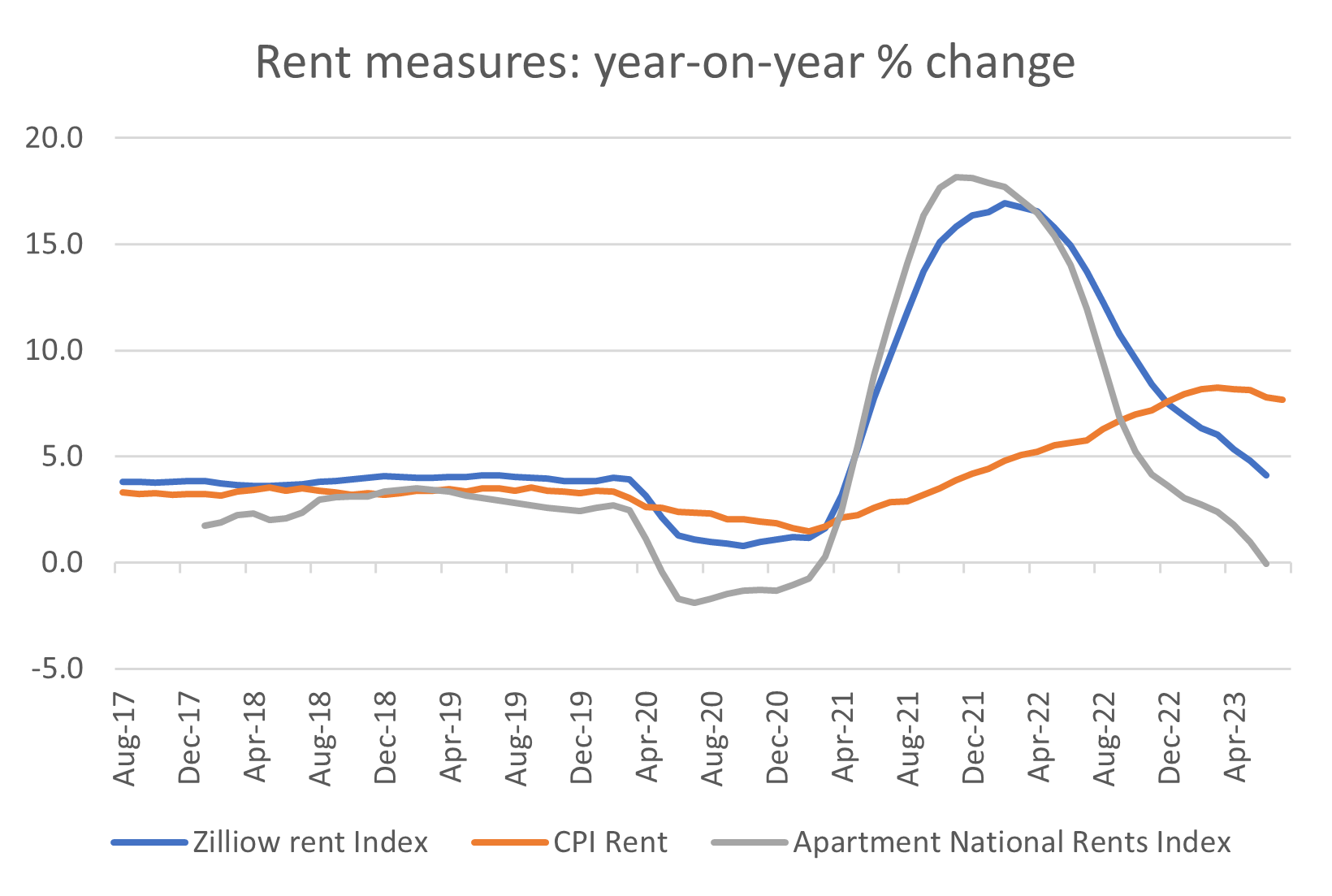

While current levels of supply in certain markets across the US is exceeding demand (contributing to aggregate slower rent growth), the picture becomes murky in the long term.

In markets where populations are growing, and/or households are still forming, an economy needs a steady flow of new housing stock. Based on declining housing starts, we may well see another rental squeeze three to four years down the road.

As we have seen in Australia, such a demand and supply mismatch can result in soaring rents. And like the US, Australian dwelling prices, despite suffering slight declines as rate rises were underway, have recovered.

Australia is experiencing rocketing population growth, as migration levels have soared. While rising interest rates causes some uncertainty in the transaction market, the forces of demand and supply ultimately prevail. Regardless where rates are, developers will resume projects for the right price and margin.

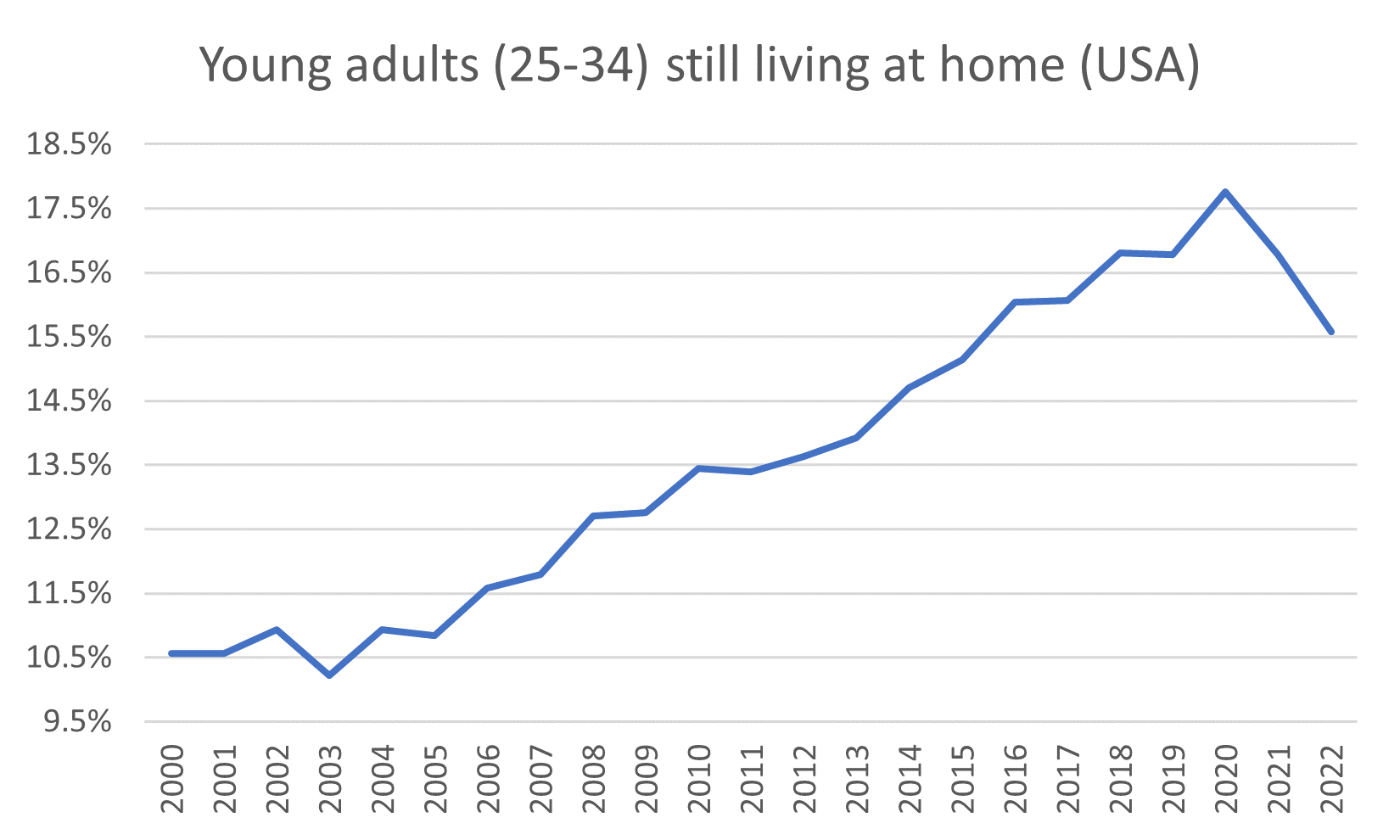

While the US population isn’t growing as quickly as Australia, there are clear signs of pent-up occupier demand, as the number of under-34’s still living with their parents remains at near a post-GFC high. As this cohort inevitably moves out, demand for rental accommodation will again increase, potentially at a time when new supply is declining.

Source: U.S. Census Bureau, Quay Global

Concluding thoughts

The future demand and supply mismatch in US housing, and current Australian housing, will not be unique to these markets. As we meet many of our investees around the globe, the overwhelming feedback is that new construction is hard to justify. This includes sectors such as logistics, senior housing, data storage, office towers and life sciences.

This is in part due to higher construction costs, but central banks have also played their part. The reduction in construction activity today may lead to a multi-sector rental squeeze in the future.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.