New projects are not stacking up

Most management teams concur - in the new cost of capital environment, greenfield development feasibilities are rarely yielding acceptable returns. This is being driven by:

- construction costs rising by approximately 30% to 60% since pre-covid,

- elevated funding costs and new projects’ drag on leverage ratios, and

- heightened hurdle rates required to achieve day-one accretion.

The widely touted ‘impact of tariffs’ on construction costs is yet to materialize as the headlines have forecasted. For larger-scale developments, most management teams estimate that tariffs increase construction costs by 0-5% (since most build cost represents labour).

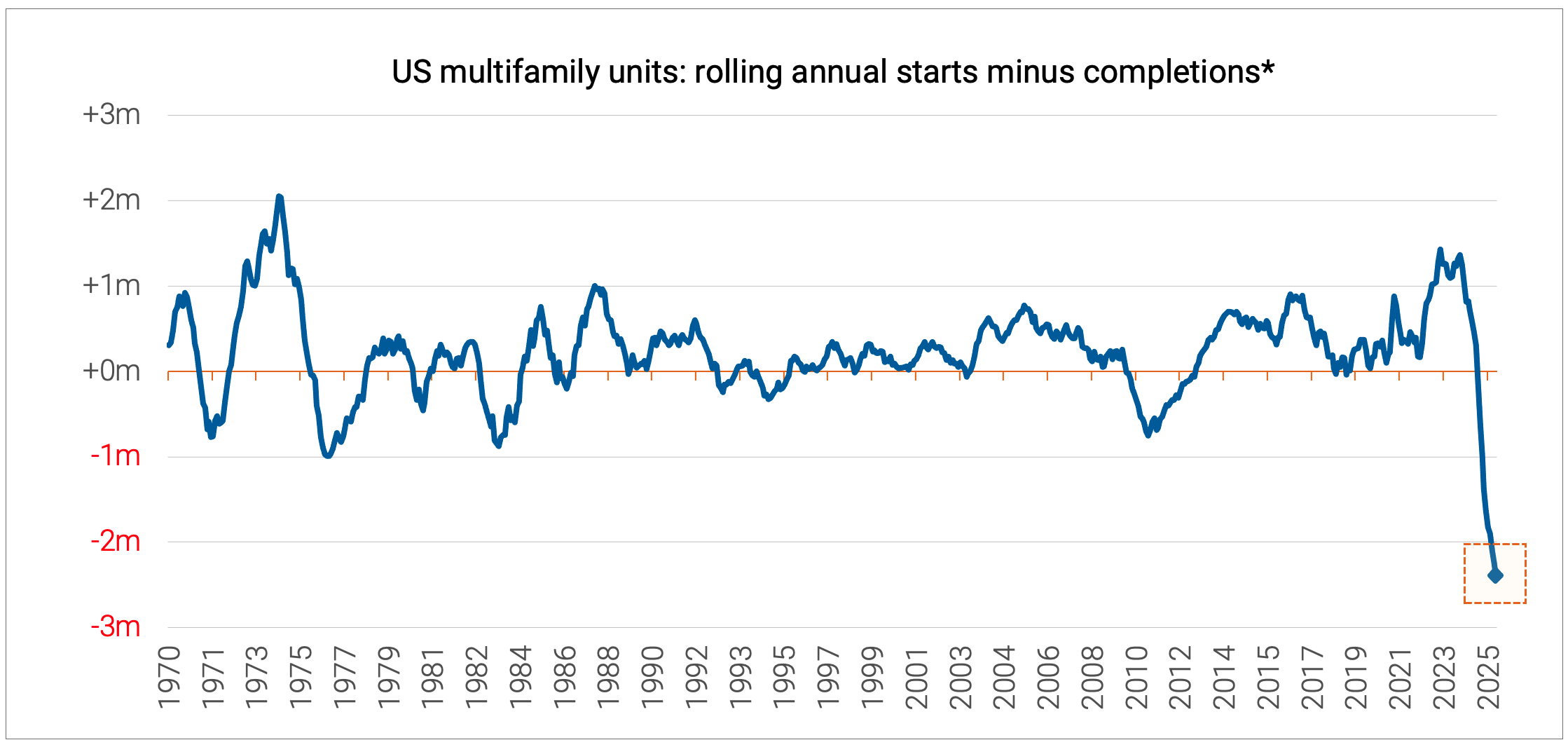

While many REITs acknowledge that strong recent flows into private credit have bolstered debt availability for new builds, poor initial returns have largely kept equity capital on the sidelines. This has led to a rapid decline in the ‘starts’ of new development projects across the world. US Multifamily (apartment) supply is a good (albeit not the only) example of the current challenge.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

* Completions set at t-12 months to reflect build time.

Fortunately, companies in Quay’s investible universe have earnings profiles that are not reliant on development profits. Rather, our investees are rent collectors with multiple levers at their disposal to create value for shareholders through-cycle.

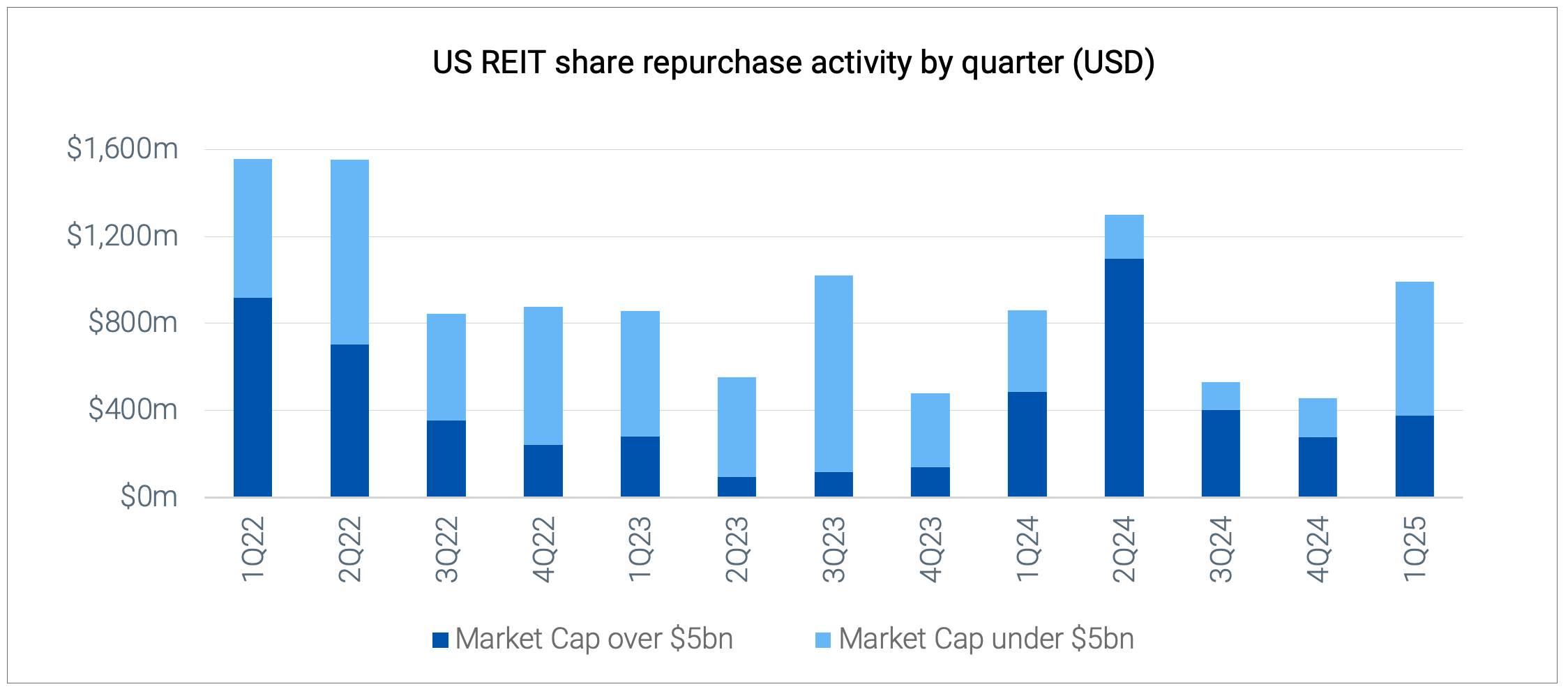

While the maths does not work for new developments, with the credit and equity markets widely available most REITs have been concentrating their capital deployment toward acquisitions, deleveraging, and share buy-backs. The latter, in particular has been an effective way for REITs to capitalize on de-rated share prices (and implied discounts to replacement cost) to drive immediate earnings per share accretion.

Source: S&P Global Market Intelligence, RBC Capital Markets, Quay Global Investors.

Source: S&P Global Market Intelligence, RBC Capital Markets, Quay Global Investors.

Emerging construction headwinds

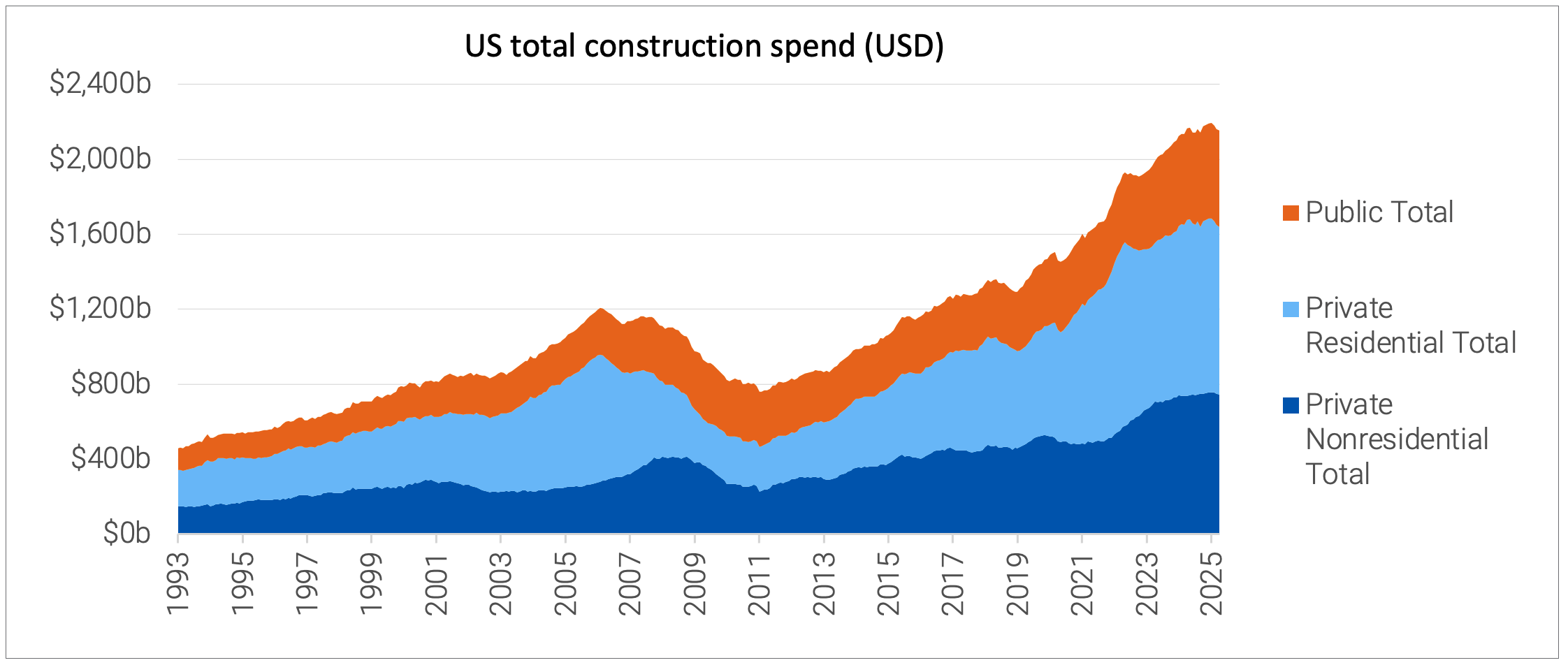

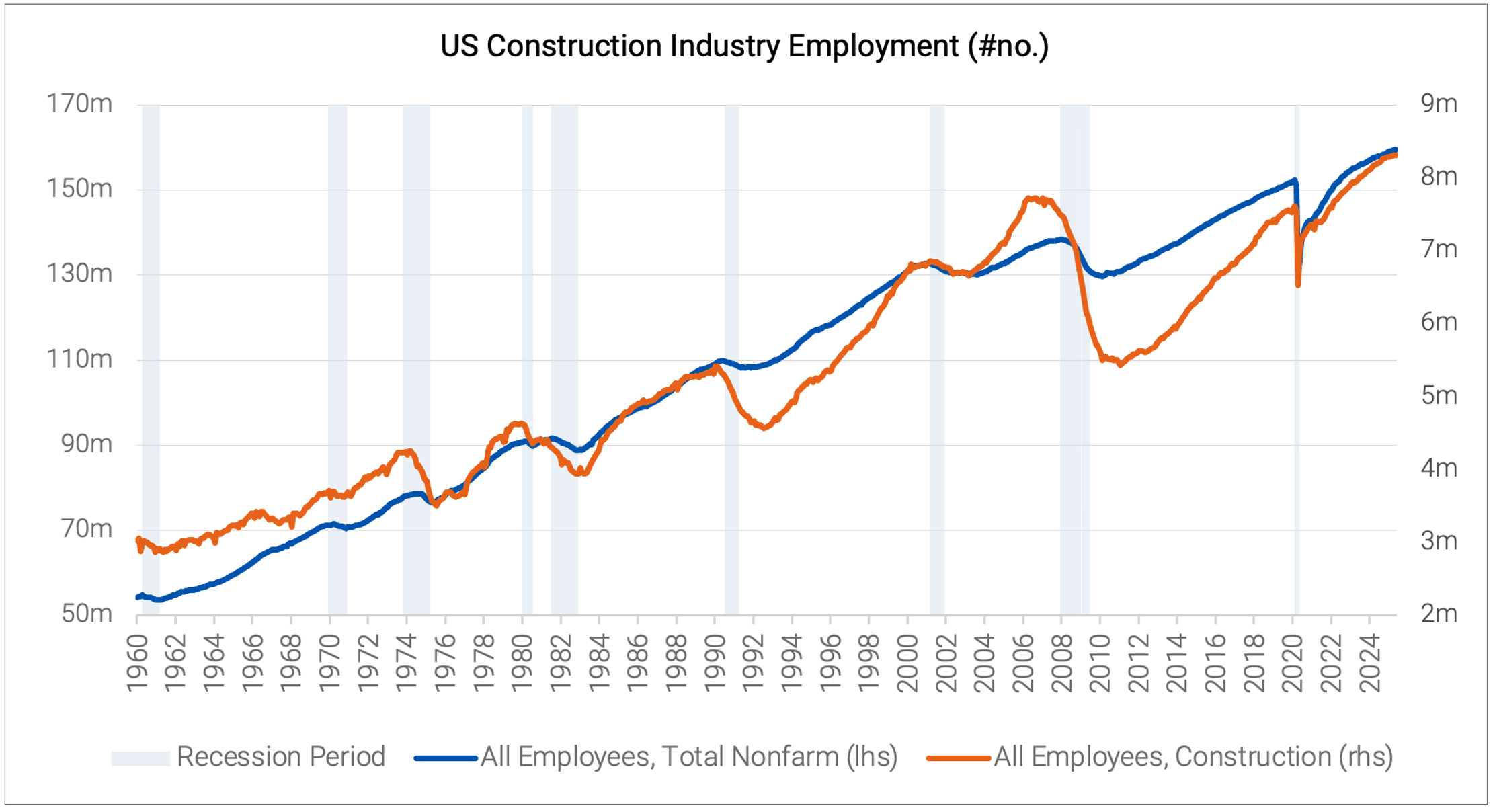

The second order impact of a slowdown in new project ‘starts’ is the emerging ‘rightsizing of the US construction industry’. Examining current headline data would infer the industry is in rude health.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

We believe these headlines are misleading due to:

- The development lag: Today’s construction outlay reflects the tail-end of projects underwritten in 2021-22, at a time when interest rates were low, and the secondary transaction market was highly liquid.

- Rising construction costs: Building input costs have risen by approximately 30 to 60% since pre-covid. As a result, the headline figures which reflect ‘dollar supply’ overstate the ‘real supply’ (no. projects).

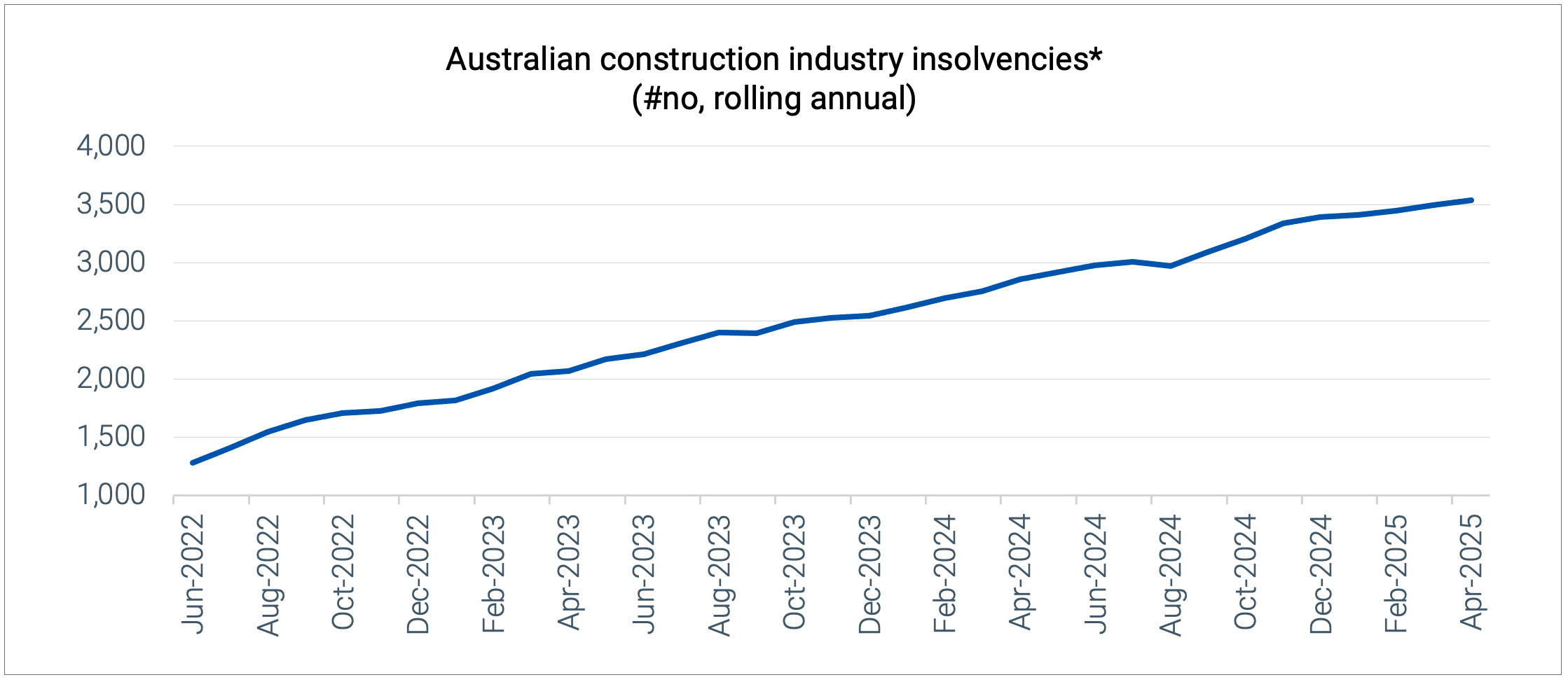

The state of the construction industry is markedly less favourable when examining forward looking indicators, as our regular readers would know from our analysis of the AIA Architecture Billings Index. We’re seeing this global phenomenon unfold rapidly in our own backyard.

Source: Australian Securities & Investment Commission, Quay Global Investors.

Source: Australian Securities & Investment Commission, Quay Global Investors.

*The first time a company enters external administration or has a controller appointed.

Precedents suggest that in the face of waning demand, the construction industry experiences a sharp contraction followed by a sluggish recovery. This is clearly observed when examining the sector’s long-run demand for labour in the US.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

Source: Federal Reserve Bank of St. Louis, Quay Global Investors.

As projects reach completion, the lack of new starts (outside of sectors such as data centres) may act as a drag on construction employment leading to future cases of supply-side inertia for developers.

A long runway for North American healthcare

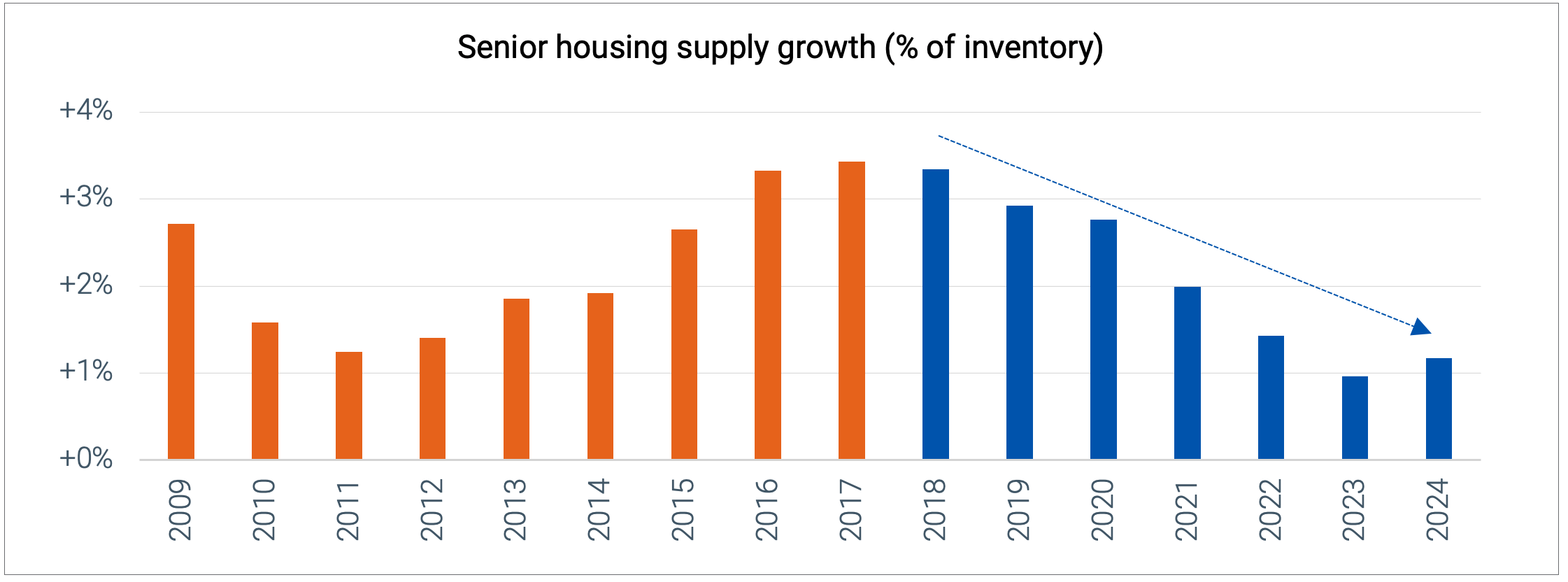

While domestically there is excitement for the data centre sector, globally there is an equally good story in healthcare real estate, especially in senior housing (aged care).

Unlike Australia, most forms of senior housing in the REIT sector are private pay based (minimal regulatory risk) and are in the midst of a demand-supply imbalance - equal to the data centre industry.

However, unlike data centres, senior housing supply growth remains muted. Despite zero interest rates, new supply did not re-accelerate like other sectors in 2021 because of the devastating impact that covid had on nursing homes. Starts have been trending down since 2017 and today are at ~15-year lows.

Source: Green Street Advisers and Quay Global Investors.

Source: Green Street Advisers and Quay Global Investors.

Despite strong occupancy gains and rent growth, new construction deals still do not yield acceptable initial returns. In conversations with management teams, it has been suggested that new rents need to grow a further 20-25% before there is any meaningful supply response.

While supply remains muted, it is matched against a powerful two-pronged demand backdrop:

- Breadth of users: Baby boomers turning 80+ (+28% over the next five years in the US)1.

- Creditworthiness of users: Wealth accumulation via long dated housing / stock gains.

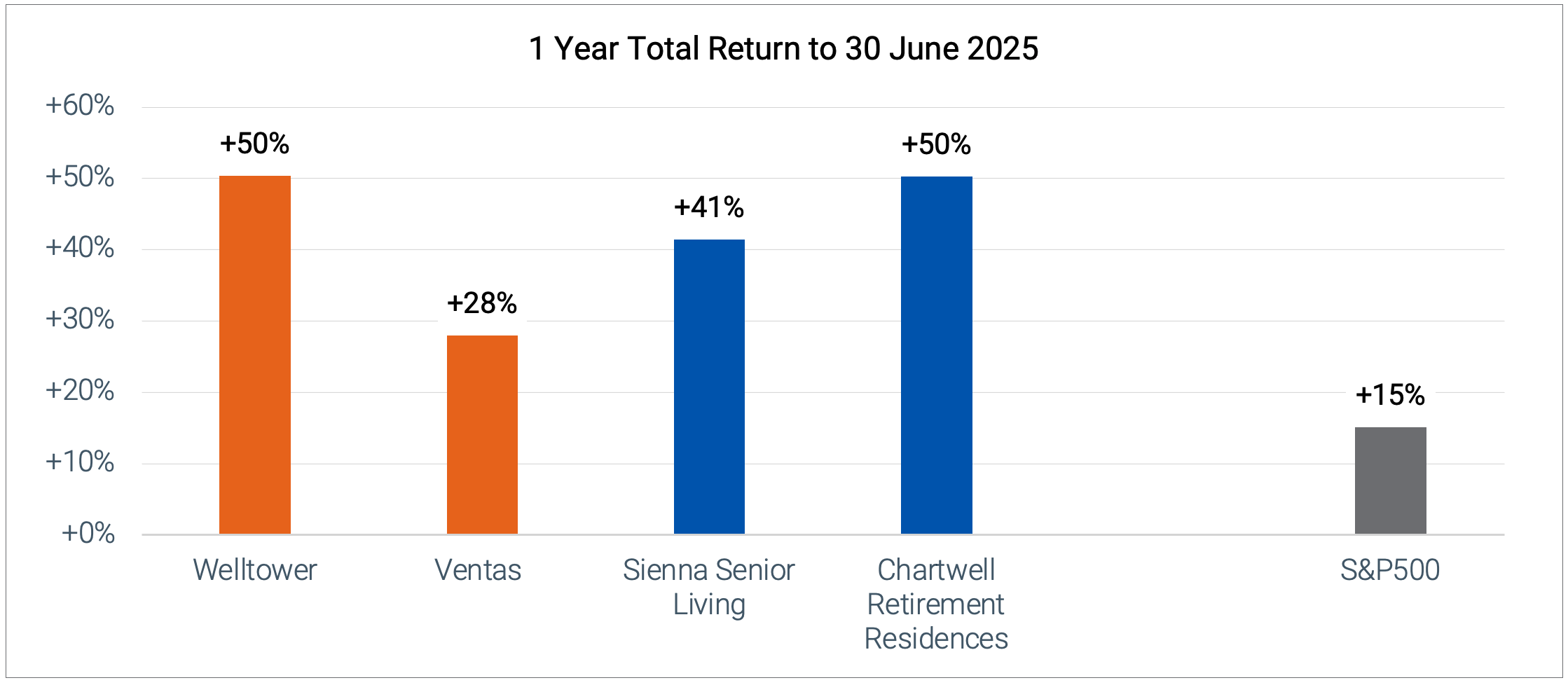

This intersection of demand and supply has led to earnings growth that has overpowered the punitive macroeconomic backdrop for real estate.

Source: Bloomberg, Quay Global Investors.

Source: Bloomberg, Quay Global Investors.

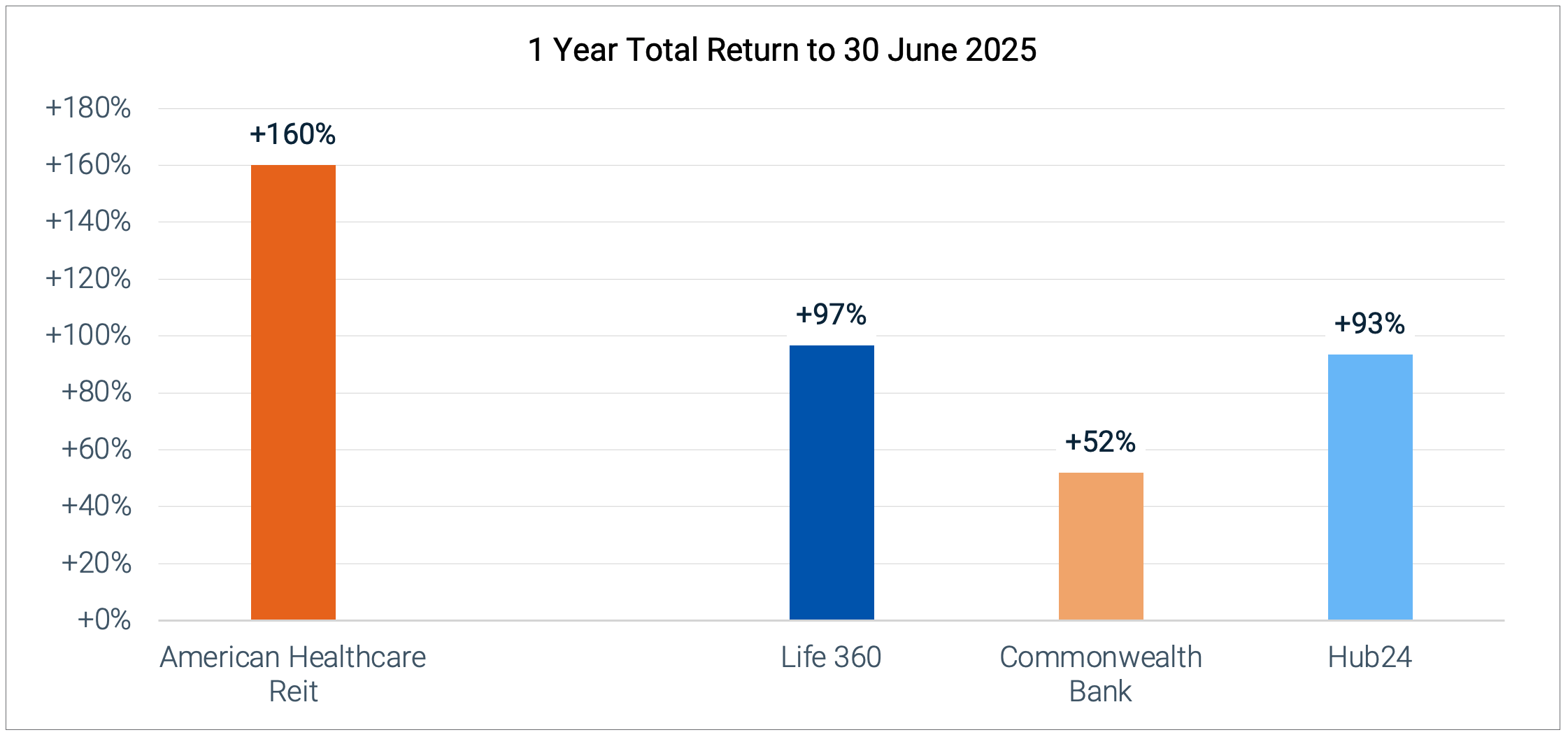

In fact, one standout name in the US healthcare sector – American Healthcare REIT – has outperformed many of the market darlings of the ASX. This is another reminder of the power that a demand-supply imbalance can have in the ‘boring’ real estate asset class.

Source: Bloomberg, Quay Global Investors.

Source: Bloomberg, Quay Global Investors.

Not quite apples to apples

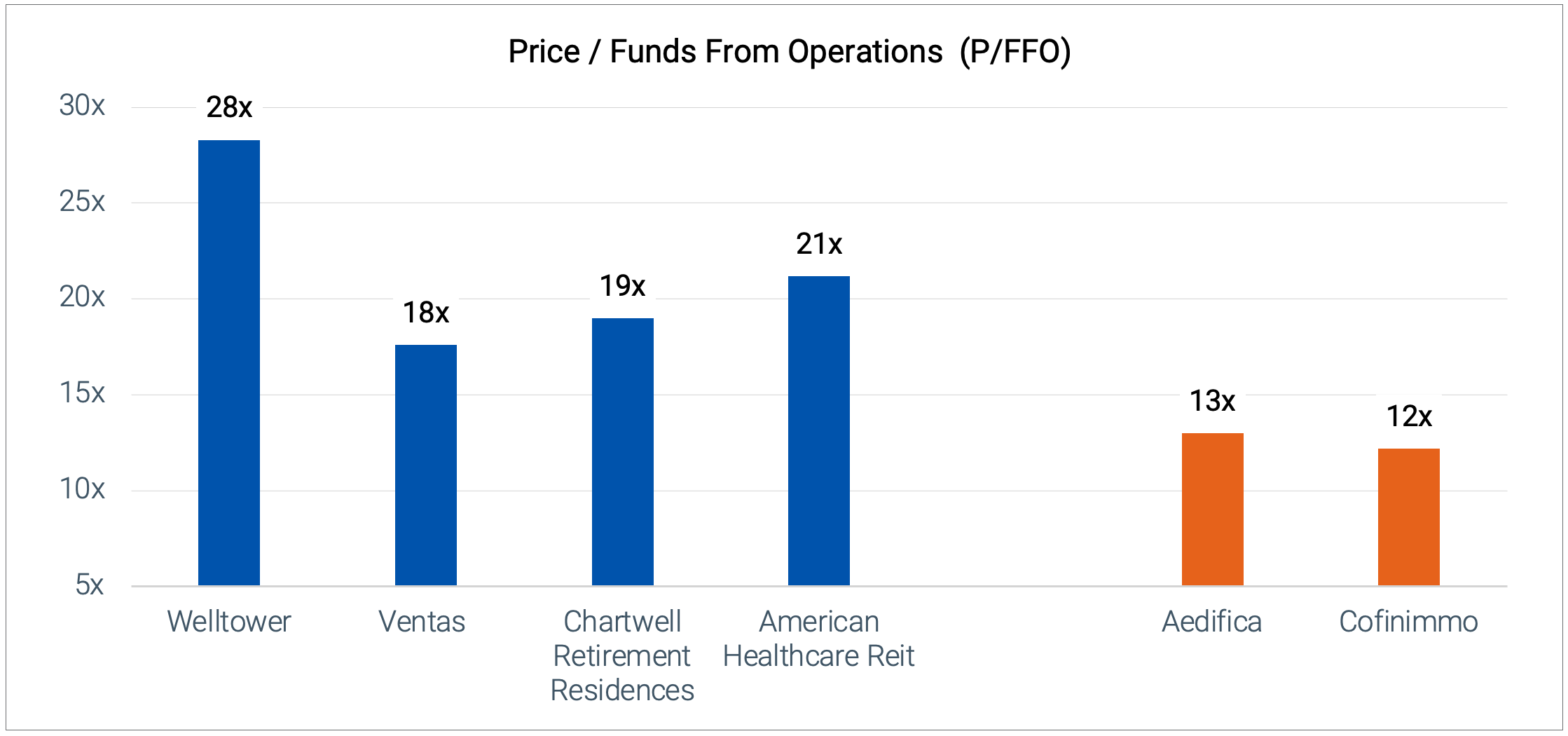

While the North American Healthcare REITs have excelled post-covid, benefiting from a multiple re-rating by the market, their European counterparts continue to trade at a deep discount.

Source: Bloomberg, Quay Global Investors.

Source: Bloomberg, Quay Global Investors.

With comparable demand drivers (aging population) and similar supply dynamics, we conducted on-the-ground research to determine if this valuation differential was rational.

After touring multiple assets, engaging with various operators (tenants), and meeting with the REIT management teams, the following constraints became clear.

- Payment model: There is a cultural norm across continental Europe to transfer wealth down family lines, with the expectation that aged care will be funded by the government. This has prevented the adoption of private pay models, which are preferred for landlords.

- Government dependence: Scarcity of government funding has led to stagnation in new license issuance, which grant operators entitlement to reimbursement. This is an impediment for the REITs’ ability to capture the rising demand with new builds.

- Opaqueness: Private operators are reluctant to publicise their financials to mitigate the risk of funding withdrawal (seen as shameful to profit off aged care). Tenant creditworthiness is an important risk factor in this space, and our inability to dimension this risk presents a substantial challenge for investment.

These market characteristics are layered atop cross-border regulatory risk, the restricted ability to capture profit share in operator outperformance, ongoing staff shortages and an over-reliance on external growth to drive earnings per share accretion.

In our view, absent a material change in the facts, the valuation differential appears to be justified.

Big landlords have big data

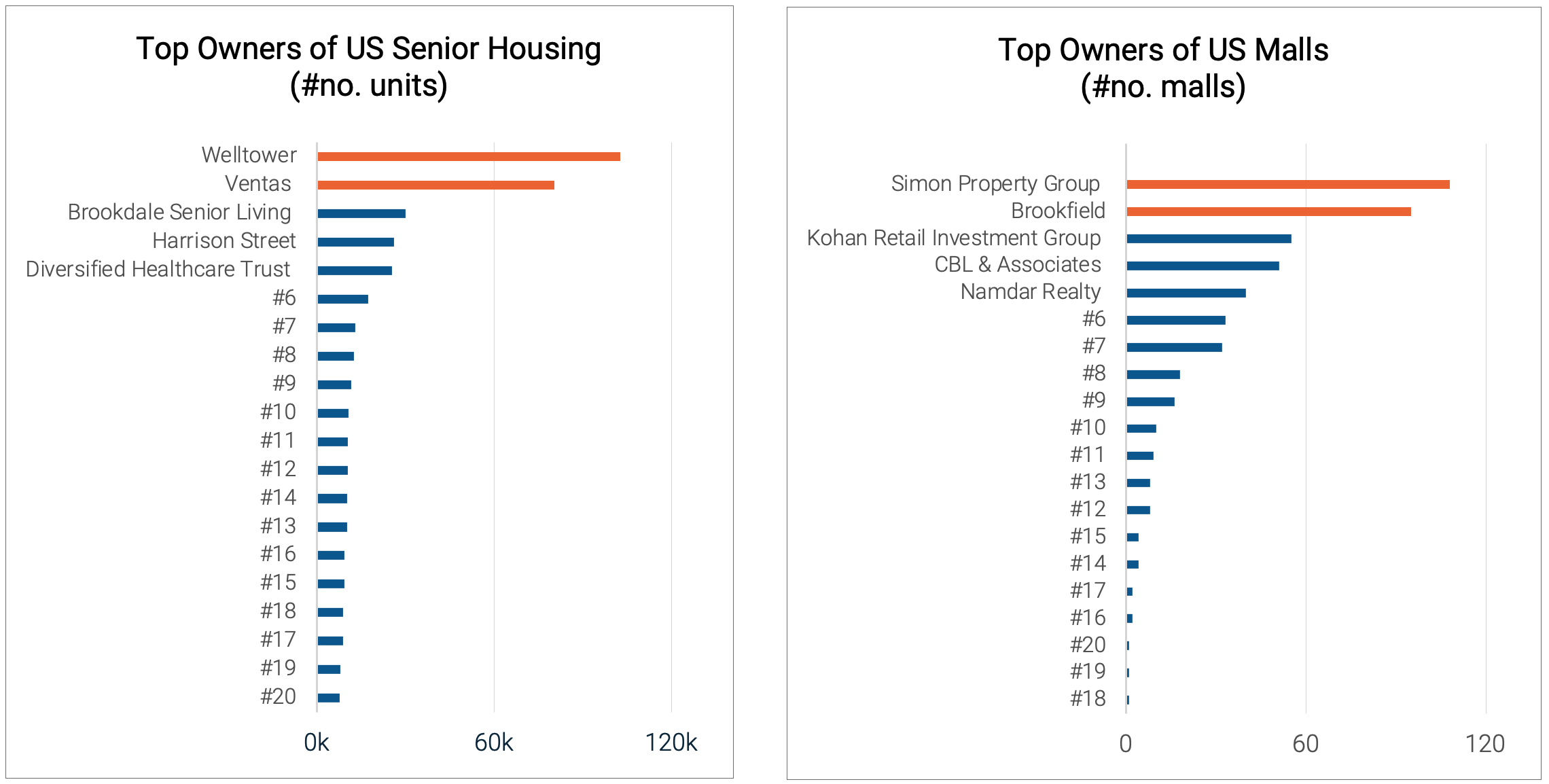

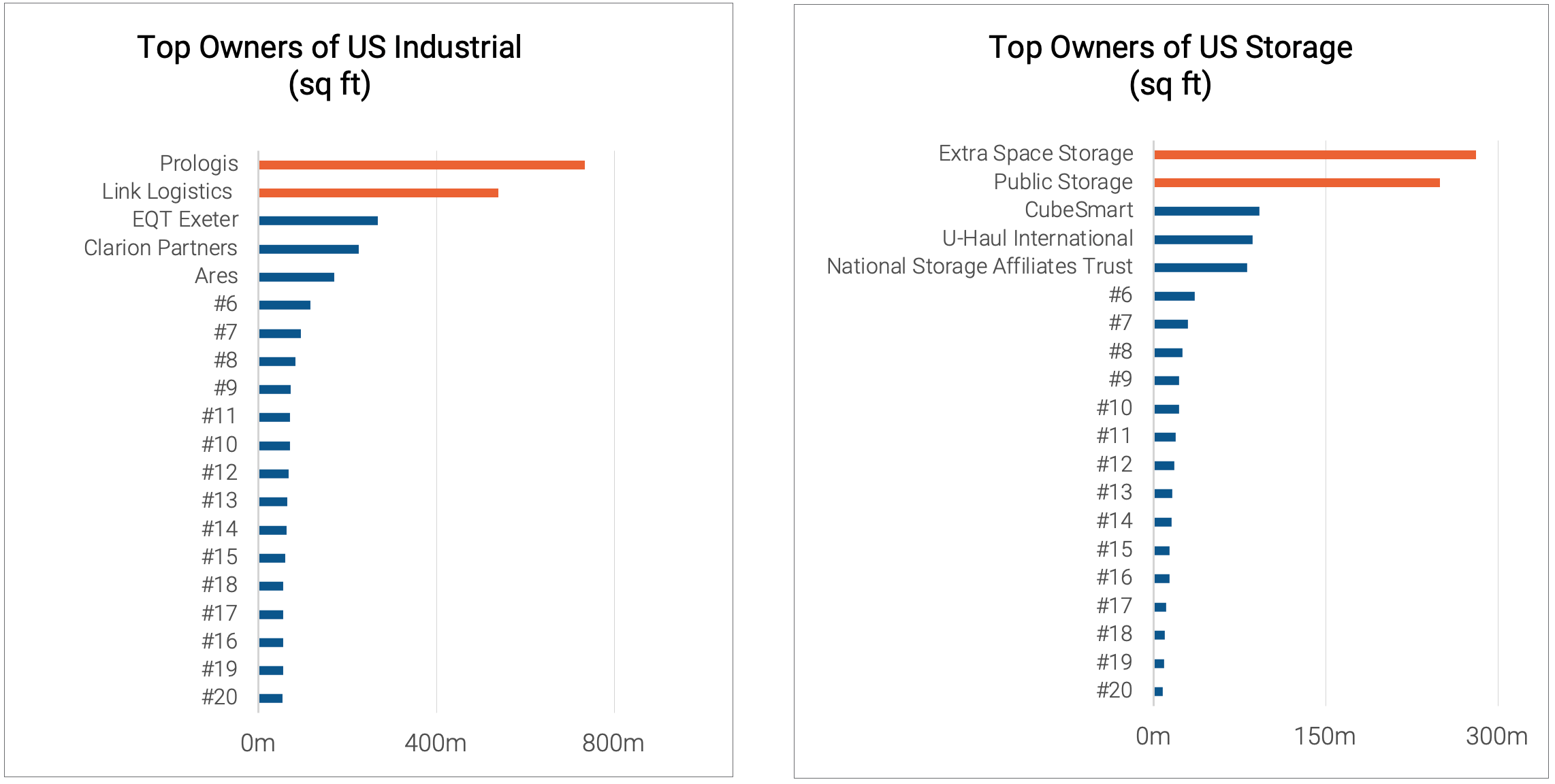

One interesting point of discussion with many REITs was the adoption and use of AI in their business. While the future of artificial intelligence holds many unknowns, one principle that is broadly agreed on, is that machine learning models are only as good as the datasets that they are based on. In this regard, the large landlords argue a data procurement advantage that is insurmountable by smaller peers. As the charts below show, the top two players in various sectors have the right to call out this advantage.

Source: Green Street Advisors, Quay Global Investors. Data is from 2024.

Source: Green Street Advisors, Quay Global Investors. Data is from 2024.

While a range of use cases are emerging, the most successful application of AI that we heard comes from the self-storage sector.

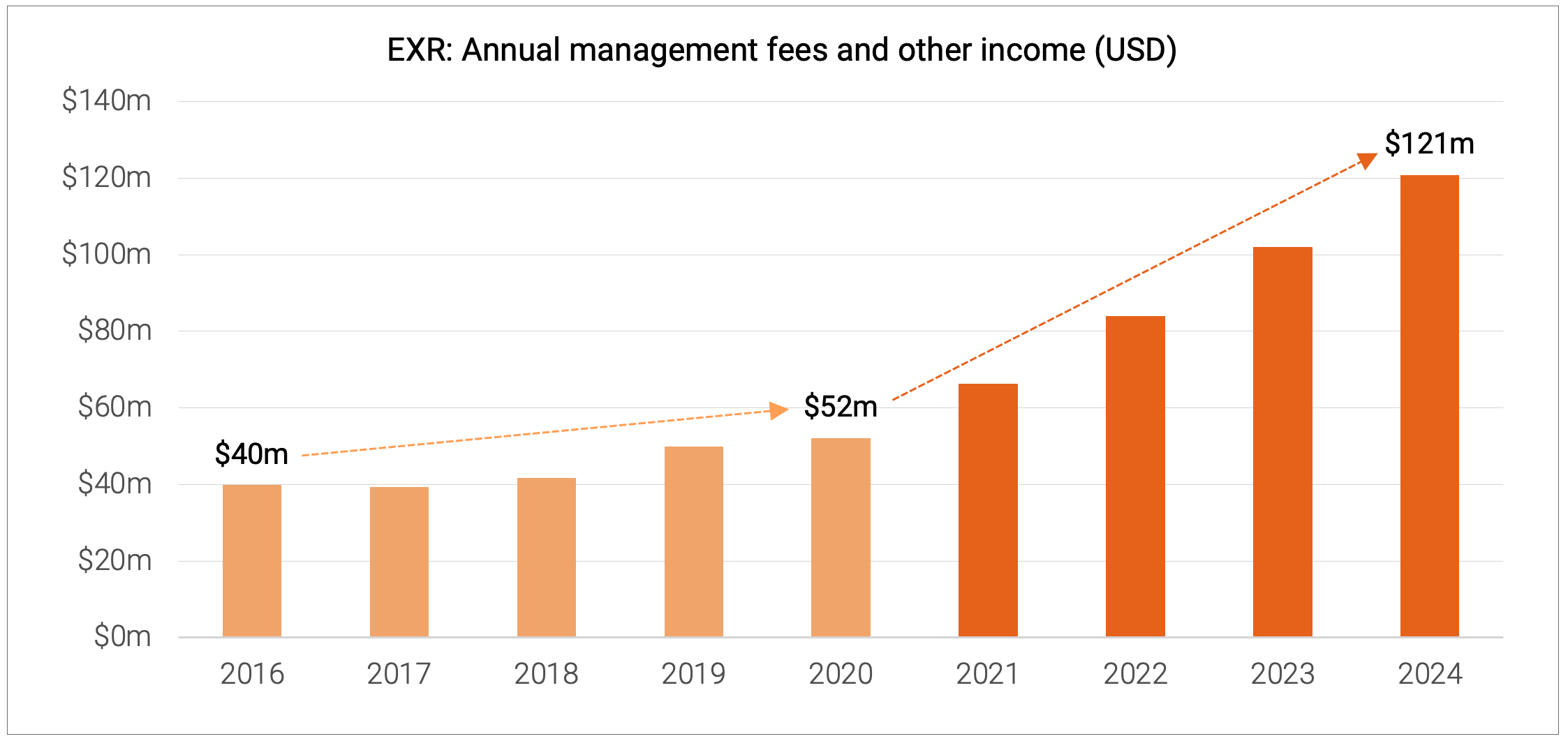

A leading owner of Self Storage in the US, Extra Space Storage (EXR), is leveraging data from its ~2,8million unit self-storage portfolio to drive an AI-centric, dynamic pricing algorithm to optimise rental rates in real time.

Not only has the pricing algorithm been effective in maximising rental revenue for the EXR portfolio, but this operational tool forms a key component of the offering to smaller private landlords as part of a management agreement. These agreements extend EXR’s data advantage, provide top-of-funnel acquisition opportunities, and provide meaningful ancillary income. This business segment has experienced a second point of growth inflection following the increased sophistication of their AI pricing algorithm.

Source: Company Disclosure, Quay Global Investors.

Source: Company Disclosure, Quay Global Investors.

Data Centres - relationships matter

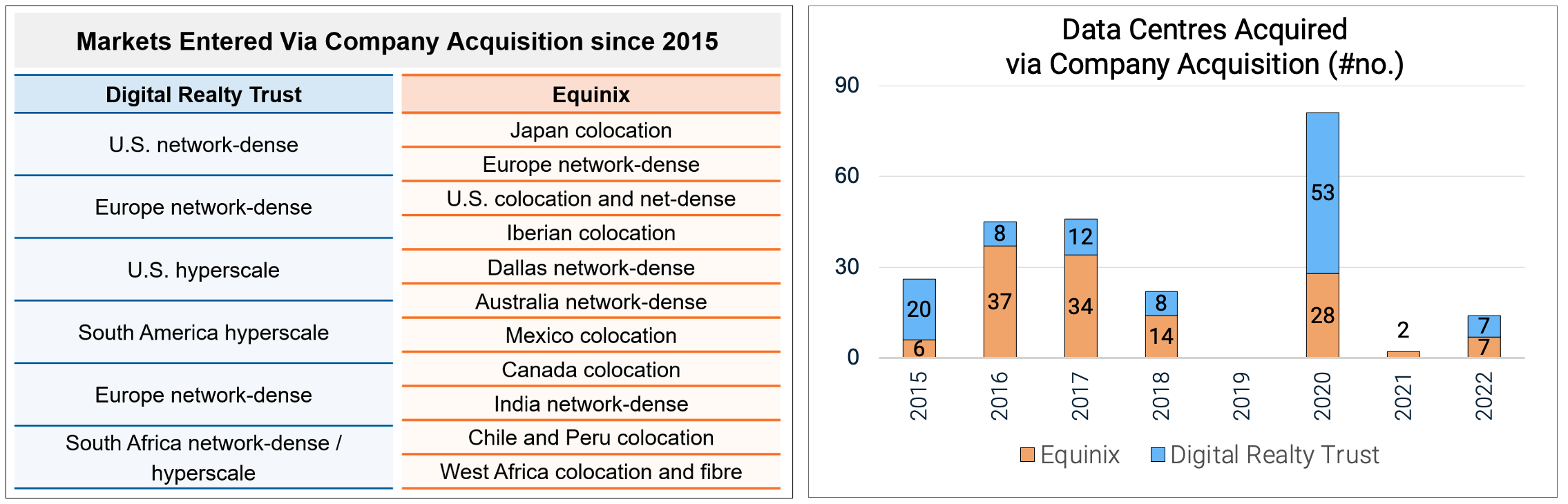

The data centre (DC) space has been characterised by mass consolidation – with the largest global players, namely Digital Realty Trust and Equinix acquiring local companies in a Pac-man-like fashion.

Source: Green Street Advisers, Company Disclosure and Quay Global Investors.

Source: Green Street Advisers, Company Disclosure and Quay Global Investors.

This growth by acquisition approach has enabled the global DC landlords access to the expert personnel in each local market they enter. These personnel enhance the breadth and quality of tenant relationships that fall under the REIT’s network. Management teams cannot place enough emphasis on the importance of this global relationship network, highlighting two market segments.

- Hyperscale segment: Build-to-suit nature of the leases fosters a collaborative relationship between landlord and tenant eg Amazon, Microsoft, Meta. This facilitates a nuanced understanding of the dynamic needs of tenants across the three vectors of utilisation (space, power and heating / cooling).

- Retail segment: To develop a rich interconnection system and sophisticated networking capability, landlords must know which tenants add the most relative value. Equinix conceded that they prioritise the long-term relationships with tenants above short-term pricing objectives.

This ‘relationship network’ is a hidden barrier to entry that is seldom discussed by market participants. We are often asked our views on the smaller, newer entrants to the data centre space. This research trip confirmed our prior conclusion that without these key relationships, they are bringing a knife to a gunfight.

Concluding thoughts

Meeting with management teams of REITs around the world provides us with unique insights that form a key part of our investment process. By reviewing the entirety of our investible universe and constantly re-assessing our views, we enhance our ability to be selective and invest with conviction.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] 80+ population estimates from Oxford Economics (as at March 2025).