In February 2015 we published an article with the argument that Australian interest rates would approach 0%. At the time the official cash rate was 2.5% and the consensus was the next move would be up. The RBA’s next move proved to be down (May 2015), and the RBA continued to cut rates until October 2019 to 0.75%. By then unemployment (5.3%) and inflation (1.6%) pointed to a weak local economy. In the absence of the pandemic, a zero rate policy seemed inevitable.

Our argument in 2015 was simple: without the benefit of ongoing government fiscal support, the private sector was required to borrow to sustain economic growth. The incremental borrowings added to the stock of household debt, requiring ever-decreasing interest rates to sustain the appetite for more credit.

As the dust settles in a post-pandemic and normalising inflation world, we see a similar pattern emerging in Australia again.

The biggest macroeconomic lesson from the GFC

One of the biggest macroeconomic lessons learned from the Global Financial Crisis (GFC) is investors tend to overestimate the impact of monetary policy and underestimate fiscal policy. Even today, the amount of time dedicated to the impact of fiscal balances pales in comparison to the scrutiny dedicated to central bank actions.

Yet the evidence suggests this focus is misdirected.

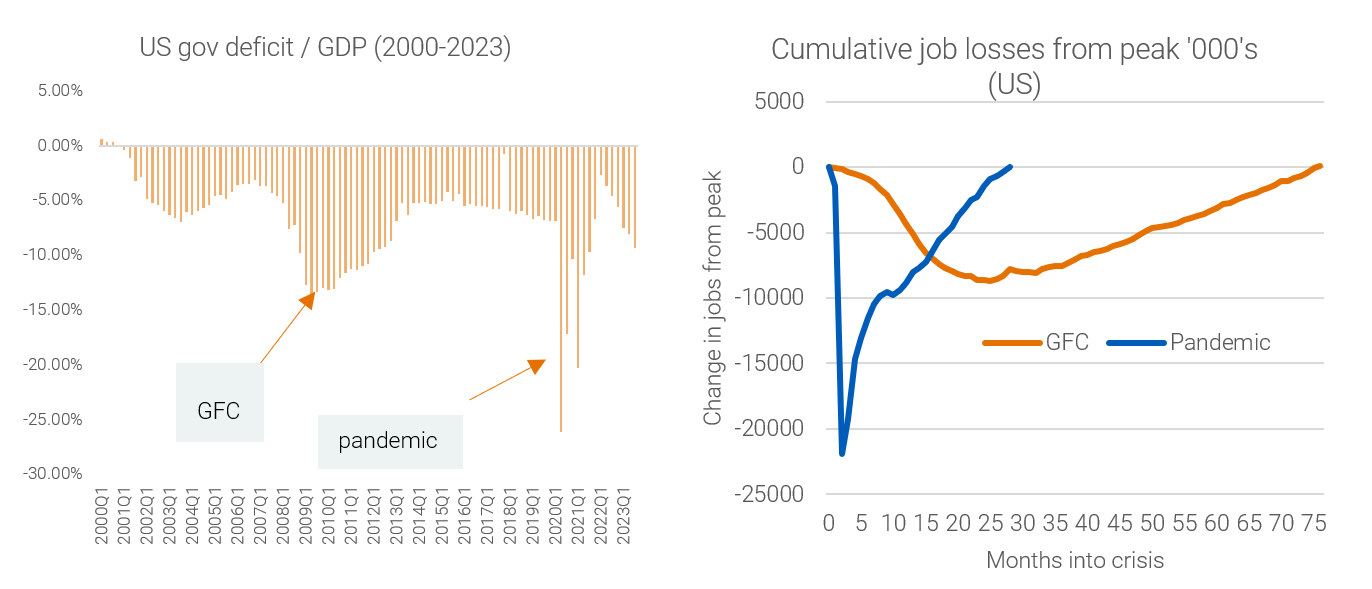

After the GFC, the US responded with some deficit spending via the American Recovery and Reinvestment Act (2009). In historic context, the scale of the response seemed large, however, most of the stimulus was left to the central bank that enacted an extended zero interest rate policy (2008-2015).

Unlike the GFC, the policy approach during the pandemic reflected a significant shift toward greater fiscal support (via deficits). The massive fiscal response during the pandemic resulted in a speedier recovery compared to the post-GFC era in terms of jobs and overall economic growth. The aggressive fiscal policy was mirrored in other developed economies, including Australia, with similar results.

Source: Bureau of Labor Statistics (US), Bureau of Economic Analysis (US), Quay Global Investors

In contrast, the economic recovery after the GFC was very slow and inflation consistently remained below target, despite zero interest rate policy in the US and Europe. Compare that to the current environment where the economy and employment (in the US) are growing strongly despite a +5% interest rate environment.

Fiscal policy matters. A lot.

Spending equals income

Why is fiscal policy so influential?

Unlike central bank actions that cannot unilaterally create new money[1], the process of deficit spending puts money directly into the bank accounts of the private sector. This allows the private sector to spend this ‘new money’ without a corresponding debt obligation (unlike taking out a new loan).

This new spending is critical since one entity’s spending is another’s income. Cumulatively, it also follows that one entity’s financial deficit is another’s surplus.

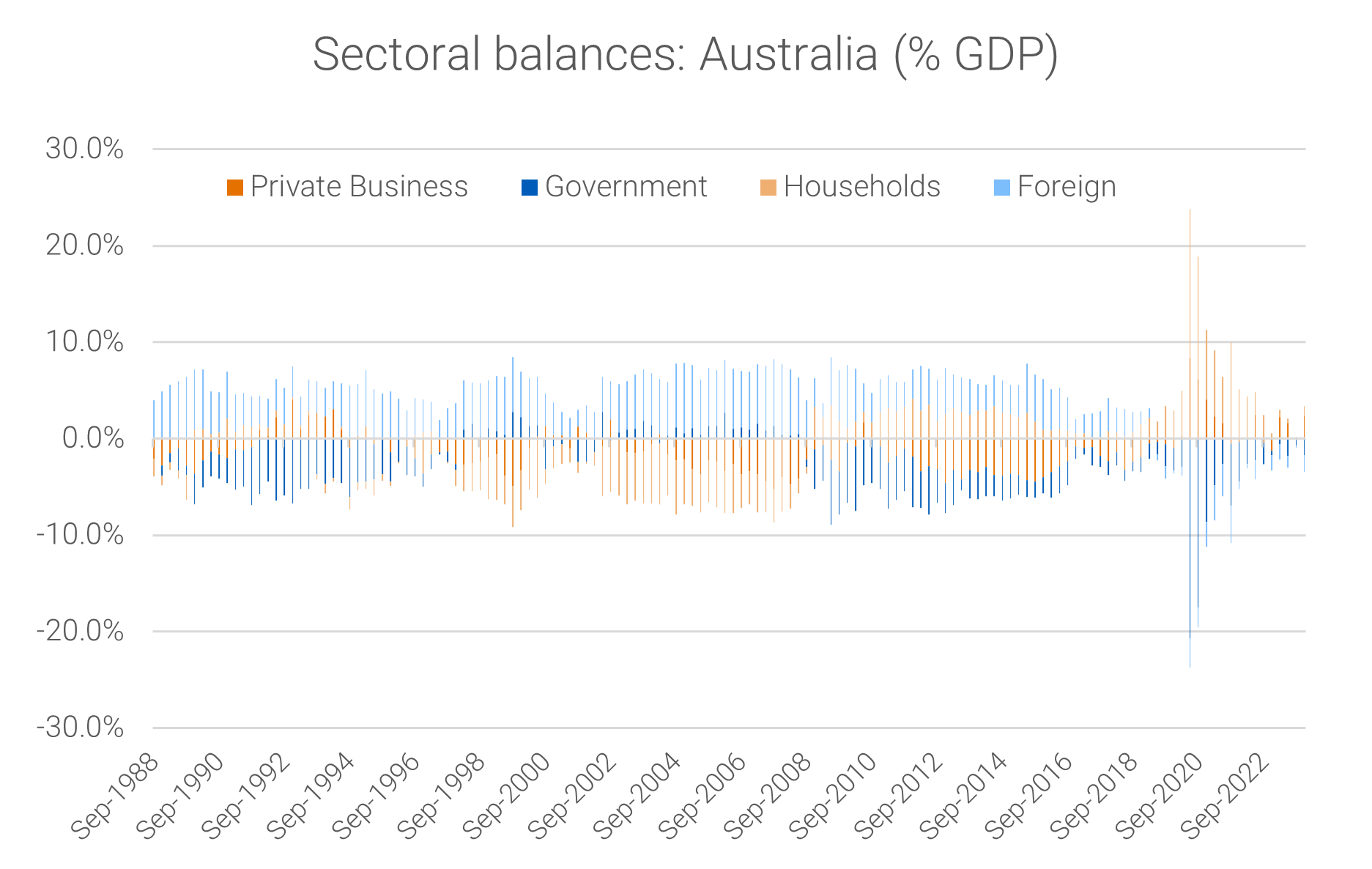

The idea that spending equals income is not only intuitive but is also supported via data published by the ABS[2]. The chart below highlights Australia’s sectoral balances and neatly demonstrates this ‘flow’ of net spending (borrowing / lending) across the four major components of the Australian economy (households, government, foreign entities, and domestic companies).

Source: ABS Cat 5232.0, Quay Global Investors

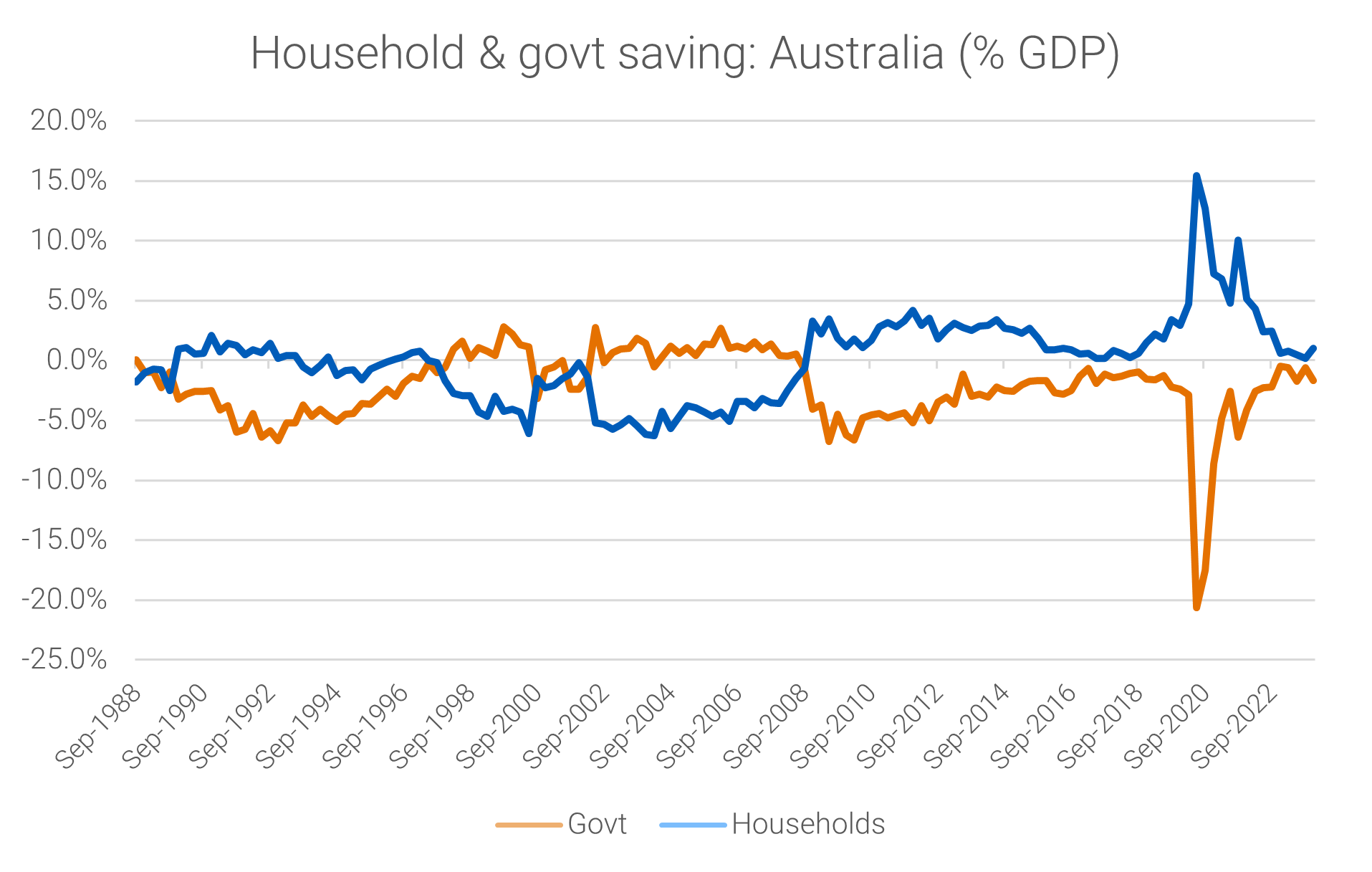

Isolating the household and government sectors from the above, we find a very powerful inverse relationship.

The government’s so-called ‘red ink’ directly supports Australian household’s ‘black ink’. Unfortunately, this relationship all-too-clearly reflects the current policy of a balanced fiscal budget which is draining the flow of savings to the household sector. In effect, we are experiencing the opposite of the policy response during the pandemic that gave us such strong economic performance.

Source: ABS Cat 5232.0, Quay Global Investors

Government policy REQUIRES fiscal deficits.

Households are getting squeezed. However, this is not a function of ‘the cost-of-living pressures’ or interest rates. The squeeze is coming from deliberate government fiscal policy in Canberra.

Low or negative household savings are not new. They were at similar levels in the late 1980s (just prior to the recession ‘we had to have’), early 2000’s (just prior to the GFC), and in the late 2010’s (as the RBA aggressively cut interest rates). Notice the pattern?

While households can run on low savings for a time, it cannot be sustained. Why? Because in Australia we have legislation that requires workers to allocate +10% of income to saving via the superannuation guarantee levy (SGL). By law, workers (households) must save.

If households are required to run a fiscal surplus (save), and the federal government refuses to run a fiscal deficit, one of two scenarios play out:

- The household sector borrows the 10% difference to maintain consumption, or

- Households can only spend 90% of income in any one period[3] resulting in a decline in economic activity from one period to the next

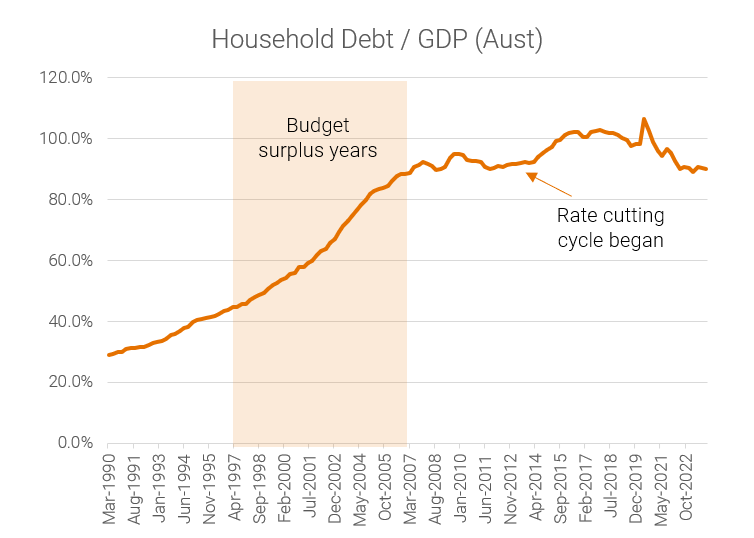

The first option can sustain economic growth for a while, but at the cost of rising household debt. This is something that occurred during the ‘budget surplus years’ of the Howard Costello government in the late 1990’s and early 2000s as per below.

Source: RBA, ABS, Quay Global Investors

However, at some point, as debt balances swell, the appetite for additional household credit wanes, spending slows, and the economy sheds jobs (historically around 90-100% of debt/GDP). In response, the RBA will reduce interest rates to encourage more credit growth. And this will work for a time until the appetite wanes again.

In the absence of fiscal deficits, this process repeats until interest rates approach zero.

The march to zero will be slow, but inevitable.

To be clear, we are not making any near-term projections. What we are highlighting is a structural feature of an economy that:

- Requires the domestic private sector net save due to the imposition of the SGL;

- Needs a government to run a deficit to support the savings requirement of the domestic sector; and yet

- Has a government that resist running such a deficit.

Much like our prediction in 2015, the march to zero interest rates may take three to five years. But without a significant change in government philosophy regarding the budget, this march feels inevitable.

The cracks are beginning to show.

In our view, it’s very difficult to predict the near-term change in official cash rates.

This is due to the fact the interest rate decisions are based on people, and people can be influenced by factors that can be hard to quantify. For example, it is likely the RBA board is under the incorrect impression that low interest rates were responsible for the recent bout of inflation, just as they are equally likely to believe (incorrectly) that high interest rate will solve it. This may well lead to errors in judgment, and result in a delayed policy response for fear of additional criticism (recency bias).

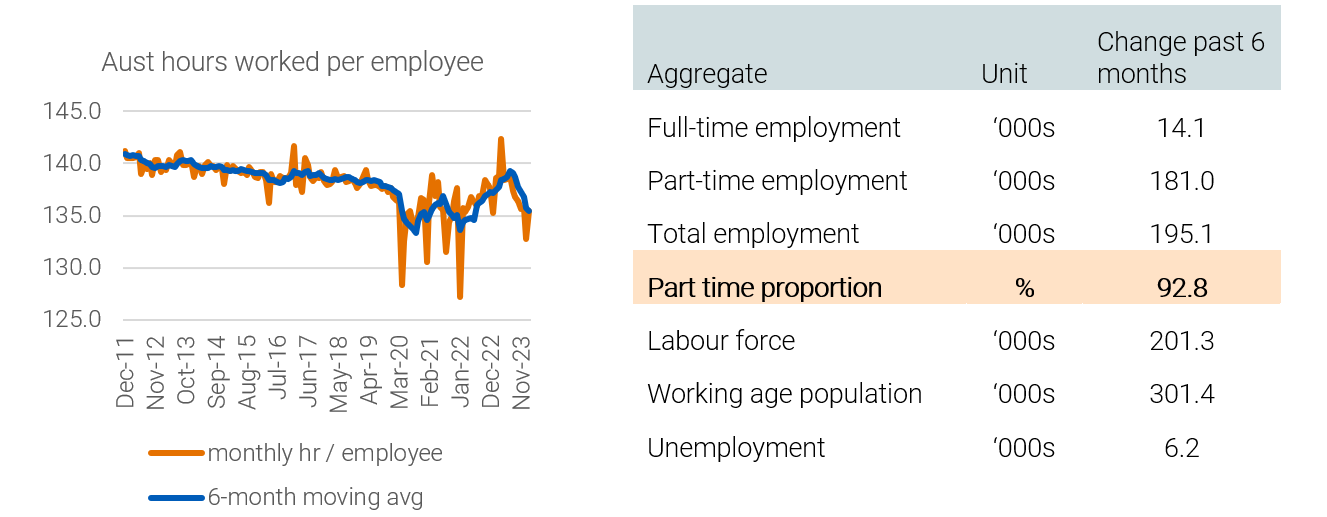

However recent data suggests the RBA may soon change tact. Not because of inflation, but due to a weakening economy. And although February employment data was strong (total jobs +100k), looking at the less volatile six-monthly employment data unveils two concerning trends: most job gains (92.8%) have been part time, which is probably reflected in a significant deterioration in hours worked per employee, which is almost back to the COVID lows.

Source: ABS, Bill Mitchell, Quay Global Investors

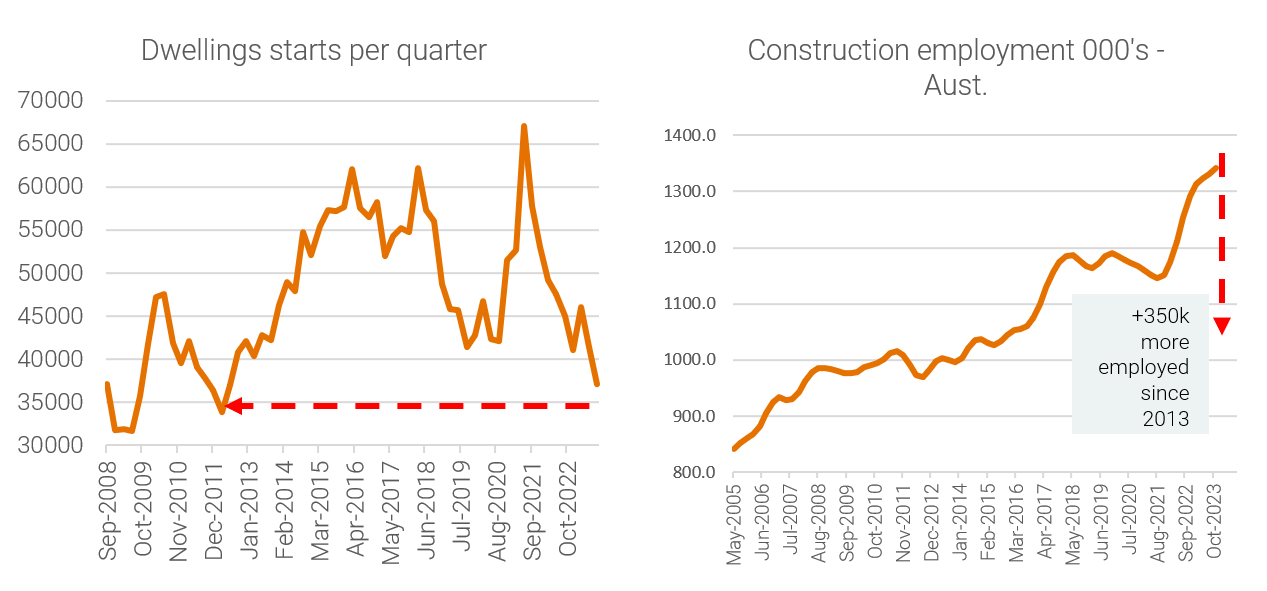

In our view, the industry most vulnerable to a sharp rise in near-term unemployment is the construction sector, where two inescapable truths are beginning to emerge.

- New dwelling starts are at or near 2013 levels, and

- The construction industry currently employs 350,000 more workers today compared to what was required to meet the 2013 construction cycle.

This means the construction industry has significant excess capacity relative to forward workflow. This is meaningful, as one in 10 Australians are directly employed in construction[4].

Source: ABS (6291.0.55.001 Table 04), Quay Global Investors

Concluding thoughts

We believe central banks are making the mistake of thinking they made a mistake.

Global inflation was not a function of low interest rates or even fiscal policy. The fact inflation has been falling despite robust employment and economic growth (especially in the US) supports the thesis inflation was a transitory event stemming from the pandemic and delayed opening of critical manufacturing hubs like China.

In Australia inflation continues to fall despite an unemployment rate of less than 4%, implying there is no policy rationale to slow the economy.

However, we believe a policy mistake is occurring in Canberra. By law, the federal government requires employees and households to save while simultaneously depriving these households of the net financial assets required to support such savings.

As they did prior to the pandemic, households will turn to credit to maintain consumption. And like they did prior to the pandemic, the RBA will accommodate this need via monetary policy. In the absence of a change in fiscal policy, this consumer and policy cycle will repeat until we approach zero (again). The only uncertainty is the timing.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] Actual central bank policies like quantitative easing (QE) requires any recipient of money to sell an existing high-quality asset (e.g. bonds). QE reflects the ‘swapping’ of money – not the issuance of new money. For more on this process, refer to our paper discussing the mechanics of QE, Aussie QE may be coming, but it will probably do nothing.

[2] See ABS series “Australian National Accounts: Finance and Wealth” Cat. 5232.0

[3] Readers who have a deeper understanding of the sectoral balances will know the foreign sector in Australia (the current account) is now running a surplus, which means foreign accounts are now running deficits. While these deficits can theoretically support household savings in the absence of federal deficits, history suggest these surpluses tend to accrue to domestic private business – especially within the resources sector that directly benefit from resource export income.

[4] We note residential construction accounts for a third of total construction activity in Australia so the relationship is not one-for-one. However, unlike 2014, the current construction is unlikely to benefit from the substantial mining construction or commercial property construction activity of prior cycles.