Pricing and profits are feeling disconnected

For those who study the history of markets such observations may resonate. The consequences of AI are almost certain to be profound, much like the rise of the internet in the 1990s. And like the 1990s maybe markets are getting ahead of themselves, and a meaningful correction is in the offing.

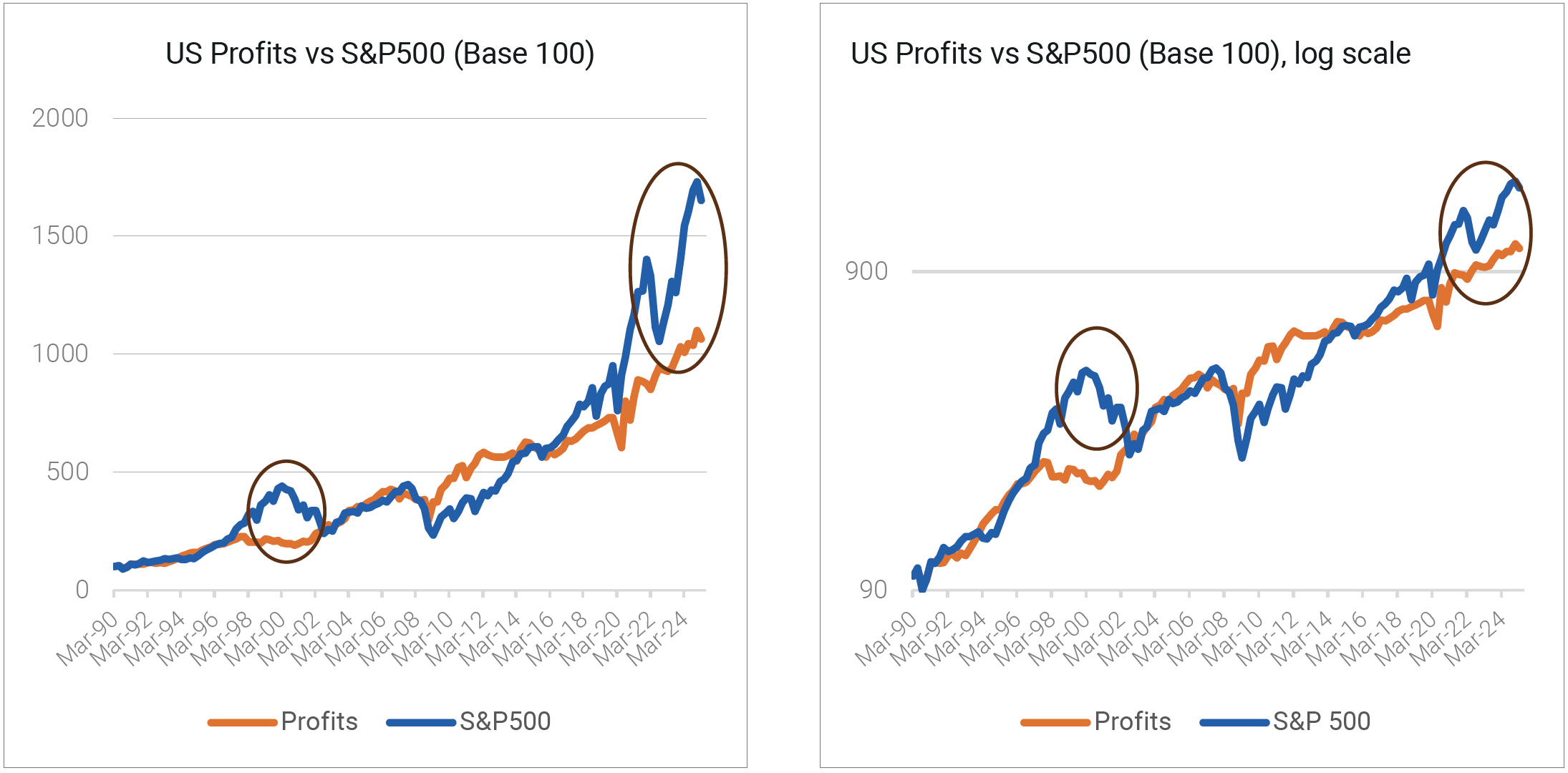

Certainly, if we look at the long term relationship between US corporate profits and the S&P 500 there appears to be a similar price-profit disconnect that occurred in the late 1990s. This seems like a red flag.

Source: Z1 fund flow accounts, Quay Global Investors.

Source: Z1 fund flow accounts, Quay Global Investors.

While this disconnect shares similarities to the tech boom of the late 1990s, there are some differences which suggest this cycle may play out differently. We explore these differences below.

Fiscal support

In the late 1990s the US government was running a fiscal surplus. Such a notion may seem quaint these days, but from a macroeconomic perspective, a government surplus undermines US corporate profits, household balance sheets and ultimately the economy.

In recent years the US government has run a sustained fiscal deficit. And while that may be cause for alarm for some old school economists, for investors who understand the value of net fiscal flows, such deficits have been the reason the US has avoided recession since the pandemic – as we correctly predicted on several occasions.

Source: US Census, Quay Global Investors.

Source: US Census, Quay Global Investors.

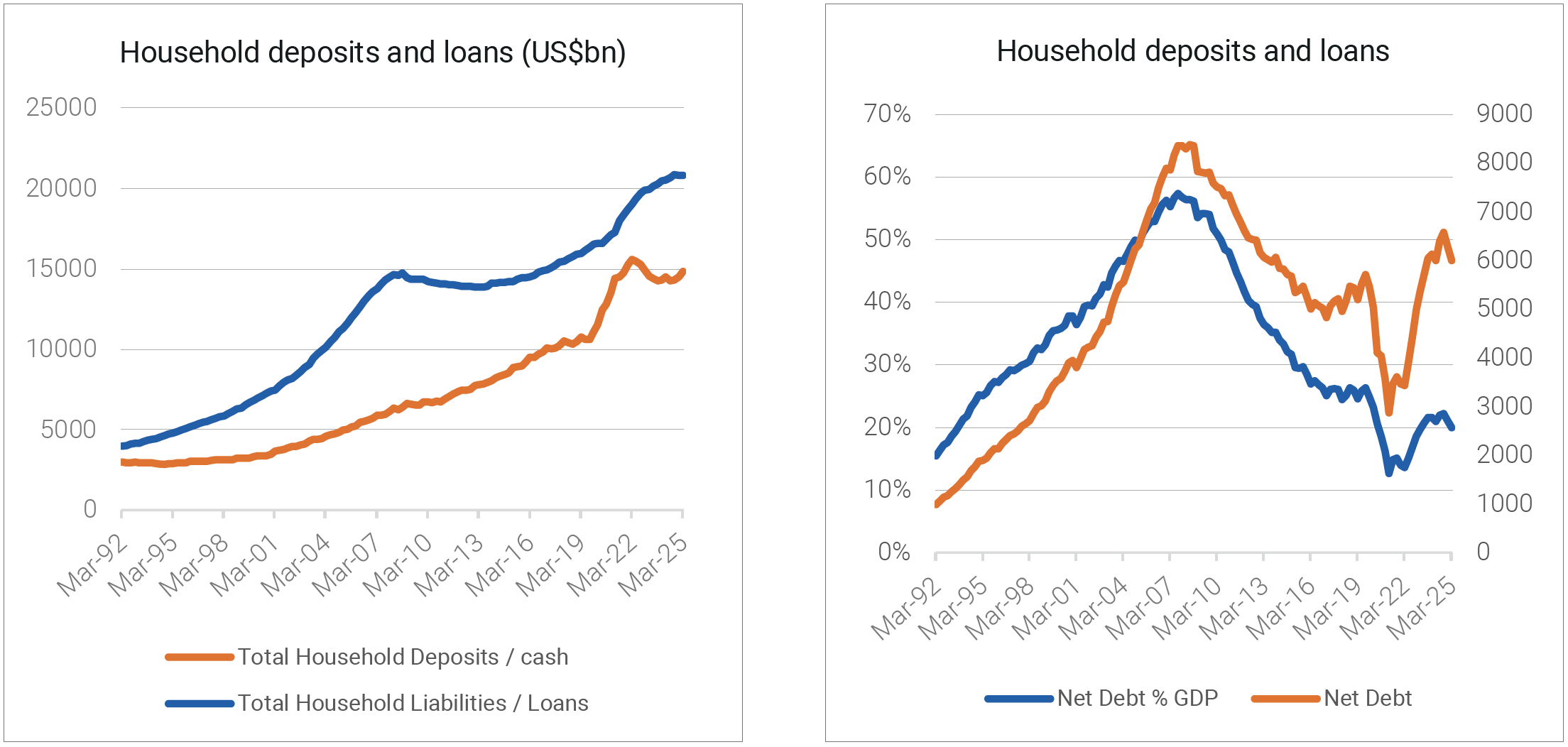

Household balance sheets are in good shape

One of the consequences of net fiscal spending is that it adds to the non-government fiscal balances – which includes households. And as we highlighted in our 2021 paper Let's get fiscal, one of the defining features of the government response to the pandemic was that stimulus was directed to households (where post GFC most was direct to companies). The end result was a dramatic improvement is household cash balances and therefore greater economic resilience compared to previous cycles.

Compare this to the late 1990s: household debt was accelerating in absolute and relative terms and cash balances were very low. This meant the household sector (which accounts for +65% of GDP ) was vulnerable to financial market shocks (such as a tech correction).

Source: Z1 Flow of Funds, Quay Global Investors.

Source: Z1 Flow of Funds, Quay Global Investors.

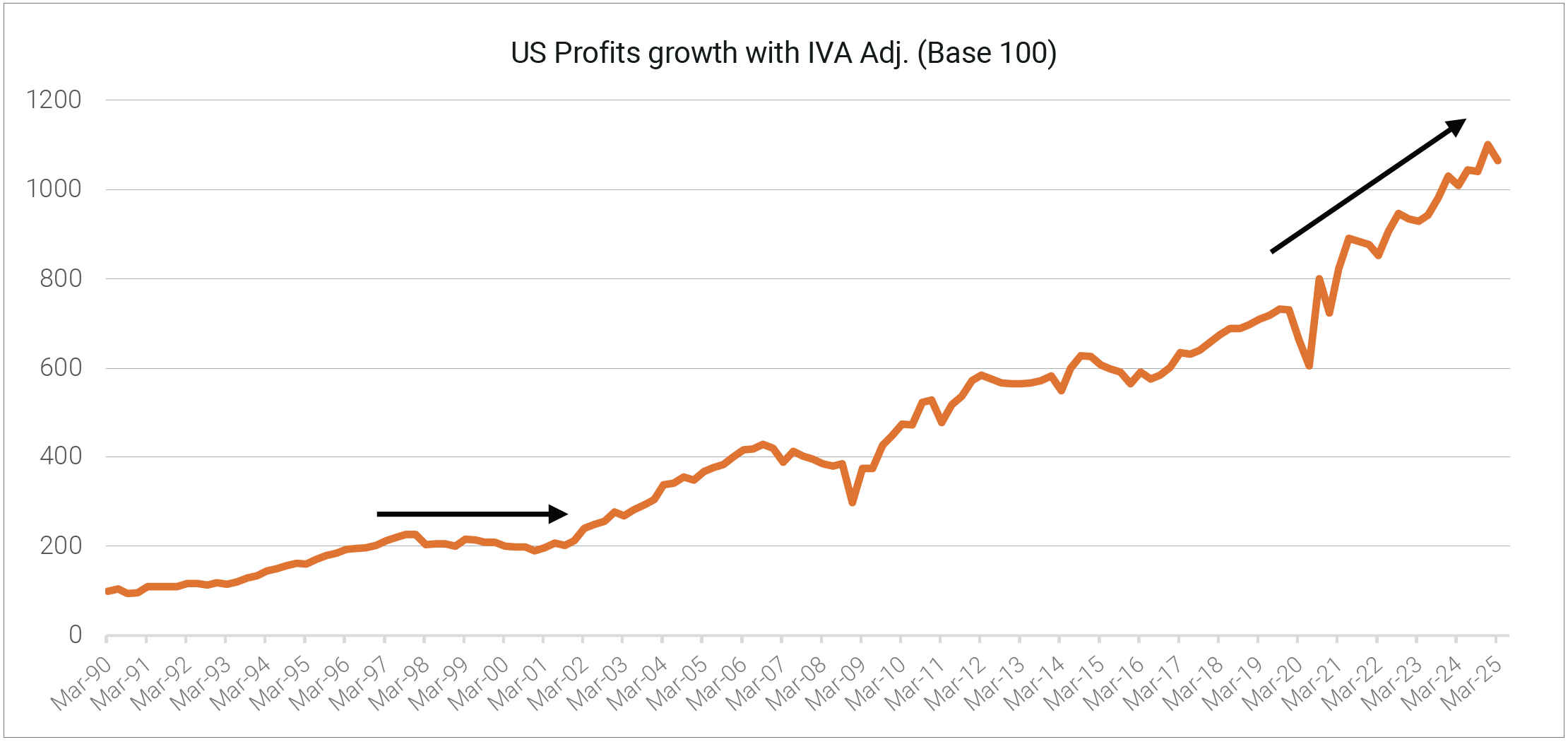

Company profits are growing

Another consequence of net government spending is it is supportive of company profits. (For more discussion on this point, please refer to our paper on the Kalecki profits equation.) Again, the small government surplus in the late 1990s was a headwind for corporate profits which were essentially flat between 1996-2000 (see below).

Source: Z1 Flow of Funds, Quay Global Investors.

Source: Z1 Flow of Funds, Quay Global Investors.

But it’s not just net government spending that supports corporate profits. The Kalecki profits equation also informs us that declining household savings rates (which is sustainable due to good balance sheets) and net investment (from the AI boom) also add to profits. So while market pricing appears to be running ahead of profits, unlike 1999, there is an argument that profits are likely to ‘catch up’ relatively soon.

Source: St Louis Fred, US Census, Z1 data, Quay Global Investors.

Source: St Louis Fred, US Census, Z1 data, Quay Global Investors.

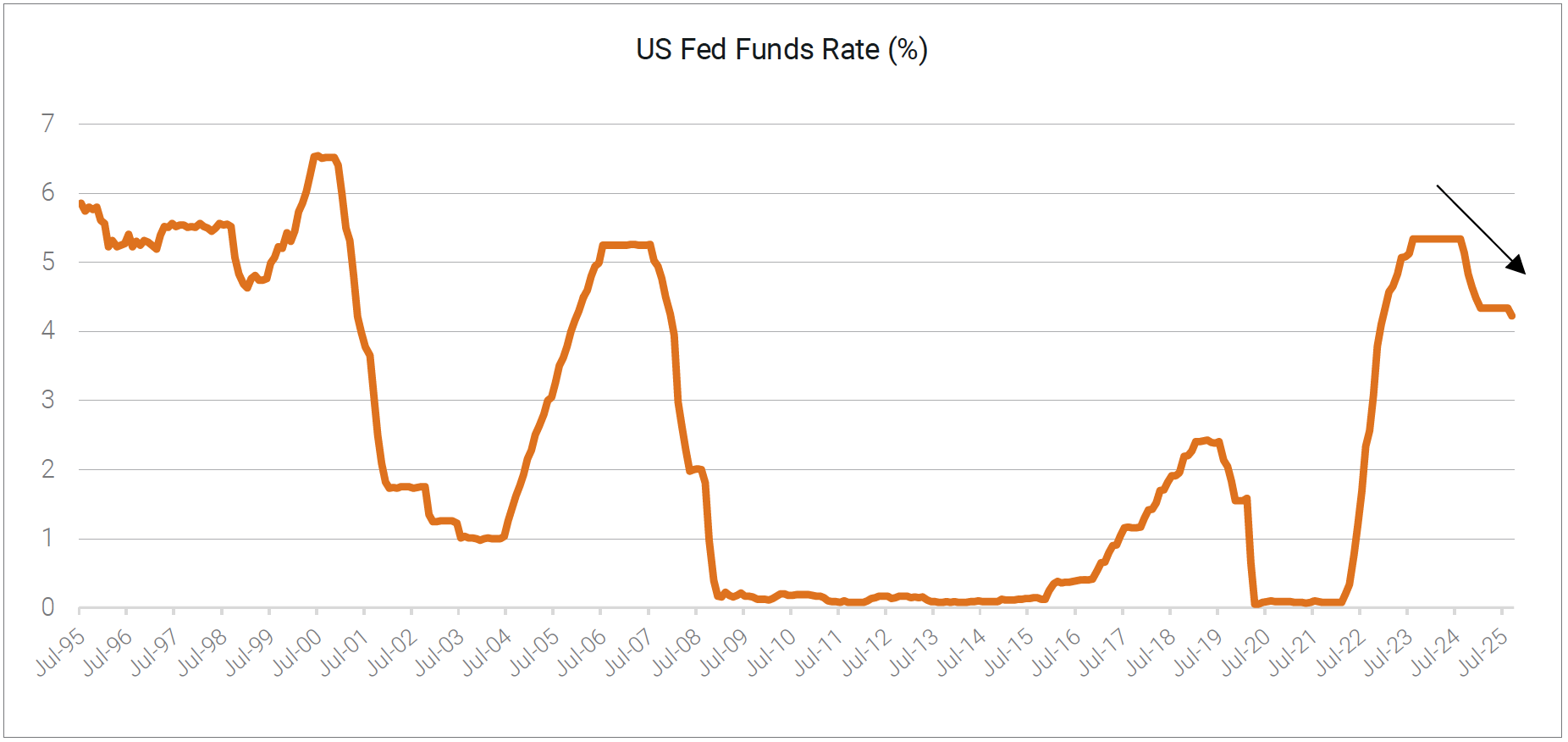

A different interest rate cycle

During the late 1990s the US Federal Reserve (along with other developed countries) was increasing interest rates. And while we have argued that has supported the US economy recently via the interest income channel, extremely low government debt in 1999 meant there was little benefit from such a policy.

This time around the US central bank has an easing bias which (at least from a sentiment perspective) leans more supportive of equity multiples and pricing.

Source: US federal Reserve, Quay Global Investors.

Source: US federal Reserve, Quay Global Investors.

Concluding thoughts

The recent performance of the equity market (particularly US equities) is historically unusual and somewhat disconnected to near term profits. For investors that are worried about this disconnect it is natural to try and find parallels to previous cycles. The most relevant being the late 1990s tech boom / bust.

However, there are some important differences this time. Household balance sheets are in excellent health. Federal governments continue to pro-actively run deficits which support incomes, and spending. And importantly, company profits are increasingly supported not only by the aforementioned deficit but also net investment (largely AI).

Where can it all go wrong? If the large net investment spend in AI fails to produce economic returns, this will result in negative net investment (previous CAPEX written down / off) blunting profits and unwinding exuberant expectations. Until then, the party may well continue.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. The commentary in this article in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] https://www.livewiremarkets.com/wires/it-feels-exactly-like-1999-paul-tudor-jones-sees-one-last-run-before-the-mania-ends